Cloud Accounting – May 2017

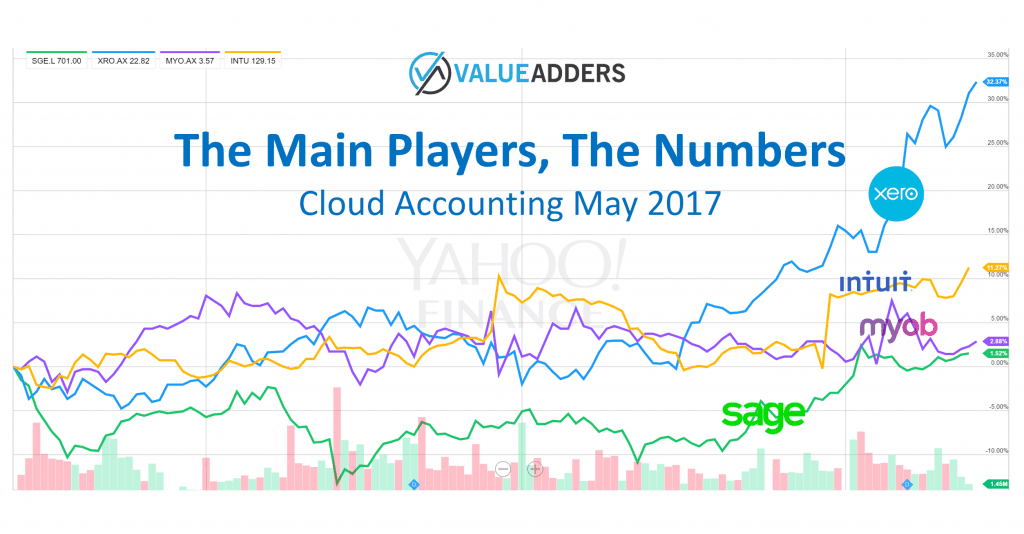

May has been a BIG month for us Cloud Accounting nerds (and investors), with Sage, Xero and Intuit all reporting. Given the opportunity, I’ve had a high level look at the 3 results (+ MYOBs from Feb for comparison) and performed some analysis. #Interesting

Sage 1H17 Results

Sage reported solid results on May 3, notably (for purposes of comparison):

- Total revenue up 22.7% YoY to £840m (AUD$1.459b) for the half year

- Software subscription (desktop and cloud) growth of 30.5% YoY

- “Organic” operating profit margin at 25.2% down 0.4% on SPLY

- Profit before tax up 41.1% to £180m (~AUD $312m)

- Sage One annual recurring revenue (ARR) increased by 88% to £22m (~AUD $38m)

- Current market cap: £7.57B (AUD$13.15B)

My Comments

As JKF once remarked, “a rising tide lifts all boats” – do we attribute Sage’s solid results simply to an industry booming? I think there’s no question the shift of the industry from one-off purchase to subscription, from desktop to cloud is powering Sage forward. But I would also suggest Sage are getting their act together under CEO Stephen Kelly. With the results they announced: “52 product launches planned in FY17”. This combined with senior management changes happening across the business (including the retirement of Alan Osrin in Australia), the business is reinventing itself – I’m not sold on the “leap-frogging” spin, but tagging along for the ride they are!

Xero FY17 Results

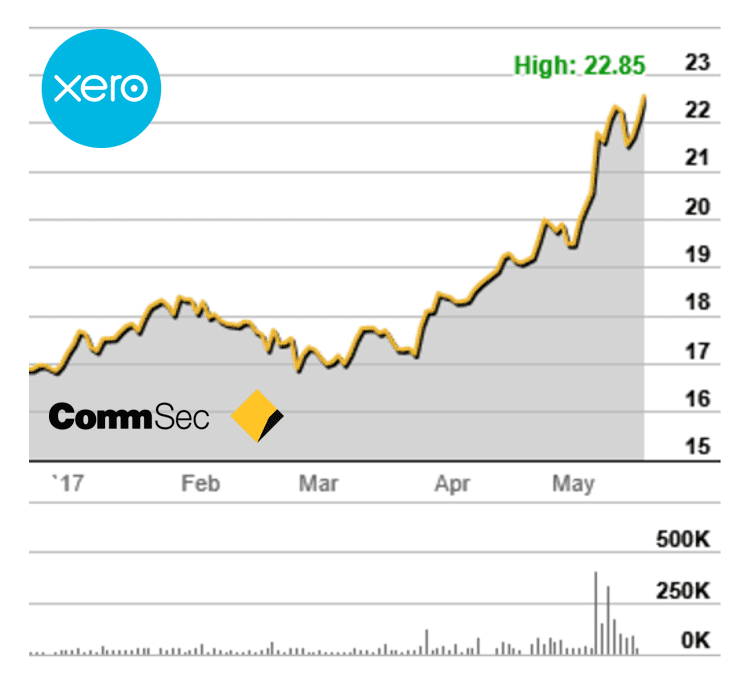

On May 11 came the much anticipated release of Xero’s full year results. With a stellar jump in the share price, now hitting 12 month highs, the market has given its approval.

The mention of ca$h flow breakeven in the 2H was a surprise to most and I think has been a big part of the share price taking off.

Whilst I am one to brag, I just thought I should remind my readers of a tweet I sent in mid-March, predicting this…

For what it’s worth: with 1m customer announcement approaching, cash flow break even in the ballpark, booming industry, I say BUY $XRO #long

— Matt Paff (@mattpaff) March 16, 2017

Breaking down the numbers:

- Total revenue for the full year up 51% YoY on constant currency to NZ$295m (AUD$277m)

- 1,035,000 subscriptions up 44% YoY

- Annualised Recurring Monthly Revenues (ACMR) at NZ$360m (AUD$338m)

- “Whistle clean” balance sheet with NO DEBT, only $52m in capitalised dev and $1.64m in “non-tangibles”

- Current market cap: AUD$3.11B

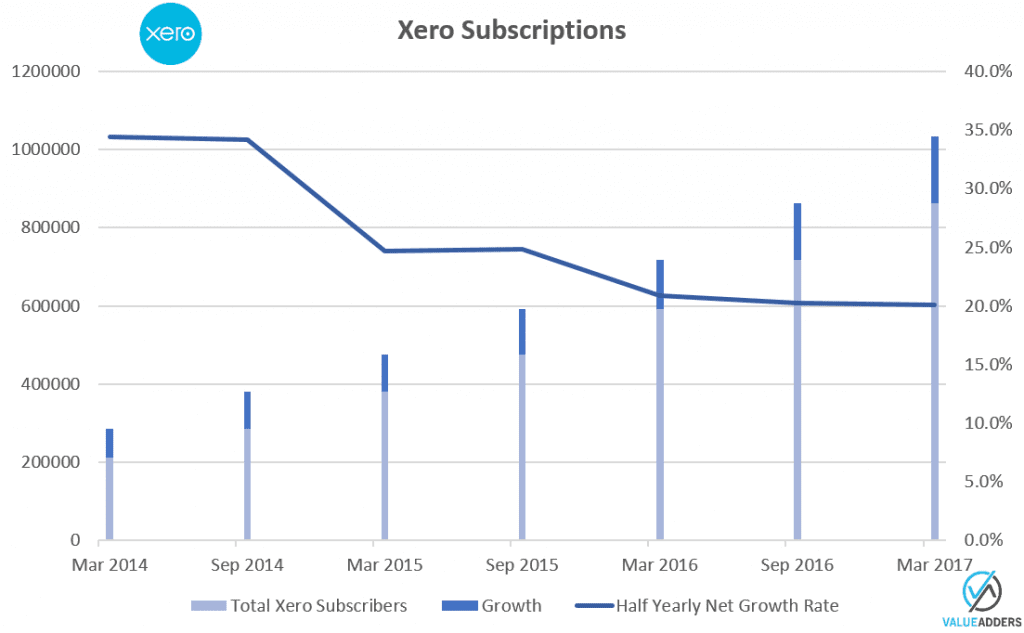

The growth curve still looks pretty good with 500,000 customers added in the last 2 years:

But the percentage half-year growth has plateaued and is interesting to contrast with Intuit in particular (below) – though I note Q3 is consistently Intuit’s best quarter with tax season in the US, whilst Xero’s 1H appears its best.

My Comments

The Xero story is an impressive one. Whilst there have been a raft of “accounting tech” start-ups trying to chip away at the incumbents, only Xero can genuinely claim success at this point. Worldwide, the main incumbents have awoken and with deep pockets and deep, mature channels to market, they are competing fiercely.

For me the barriers to entry for accounting tech were never lower than the last decade. From hence forth, the new barriers to entry (establishing a product, a channel, an ecosystem, winning customers, collecting data, leveraging data/AI…etc) will rise exponentially. Which positions Xero extremely well, with a clean balance sheet, more than a million customers, an established channel, an established brand, a solid (almost) single product/code-base, I can only see continued success. As a 10 year old company, market leadership outside the US, they are no longer the challenger, they themselves have become an incumbent.

Intuit Q3 FY17 Results

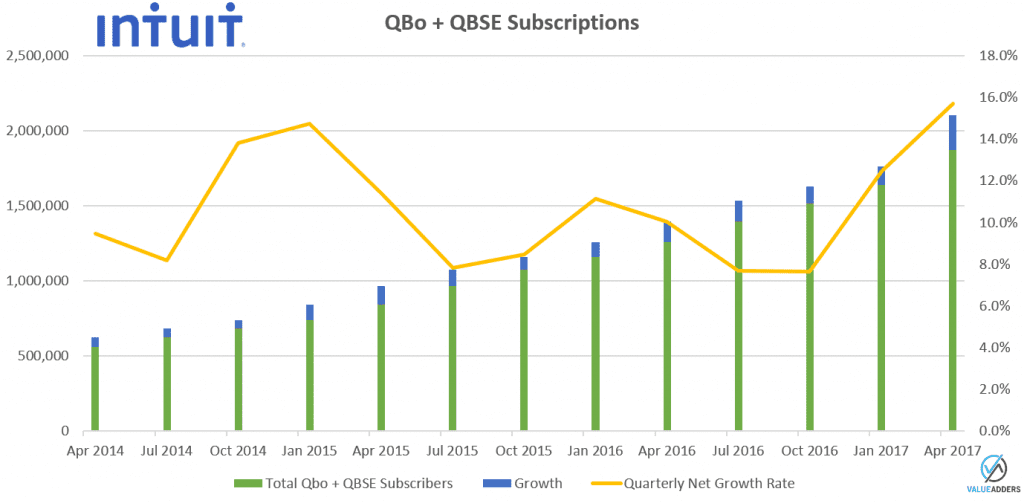

Wow, see you later 2 million, how quickly will they hit 3 million QBo + QBSE subscribers? This morning Intuit announced:

- Disappointing personal tax results (turbo tax)

- OK ProConnect results

- Stellar small business/QBo + QBSE results, adding an incredible 349,000 subscriptions in the quarter!

Breaking down the numbers:

- Total revenue (for the biggest quarter of the year) US$2.541b (AUD$3.41b) up 10% YoY

- 2,220,000 subscribers (QBo + QBSE), up 59% YoY

- QBo revenue up 13.6% to US$117m (AUD$157m) for the quarter

- My estimate of ACMR (for comparison to Xero) ~AUD$705m (representing a slightly lower ARPU, impacted by international pricing strategy AND QBSE being lumped with QBo)

- Current market cap US$33.62B (AUD$45.13B)

My Comments

Intuit are using their long-established market position, brand and cash generation capabilities to play the long-game on small business cloud accounting… and they are winning (off the back of US dominance).

The numbers are more than impressive, BUT if I were to raise an eyebrow, it is how much of what we are seeing is bringing forward future numbers, and at some point will there will a correction, through churn?

Let me explain:

- On the conference call this morning, it was mentioned that in the US, Quickbooks Desktop has been sold with a free subscription for QBo – are these subs being counted in the QBo subs? I assume they are. What’s the conversion rate going to be? I would expect a fair churn…

- In the international markets, like down under, I would expect a fair chunk of sales to be 10 files for $10 or 5 files for $5 to partners. These are sold “in advance” and the partners have time to find clients for those files… how many of these remain “empty”? When will those not “filled” client files, start returning? What impact does a heap of presales, have on slowing future sales?

Admittedly at this stage, these appear light weight concerns as growth continues to accelerate. But I will be watching carefully for signs of a churn-wall.

For Comparative Purposes: MYOB FY16

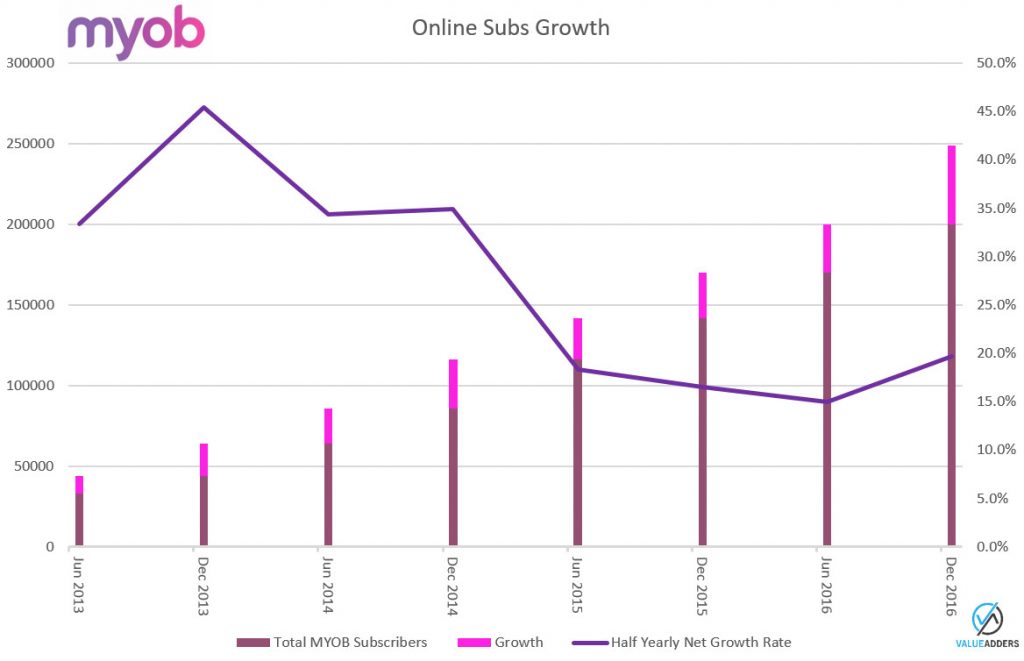

As the largest player in AuNZ (by revenue and companies using, not necessarily paying), I felt it worth comparing MYOB on their FY16 results from February:

- Revenue AUD$370m, up 13% YoY

- 585k SME Subscriptions

- 249k “Online” Subscriptions up 47% YoY

- SME ARPU up 7% to $406/year – translates to estimated ACMR of AUD$238m total, just over AUD$100m in the cloud

- Compared to Xero, dare I say an ugly balance sheet (in fairness pretty much aligned to Sage & Intuit) with Debt of $434.8m and AUD$1.21b in intangible assets & goodwill

- Market Cap: AUD$2.153b

My Comments

Have probably shifted their concerns from Xero to Intuit in recent times, as the big beast is absolutely coming to get them, with pricing strategies that would probably see Intuit fall afoul of the ACCC if they were in another industry (like airlines or agriculture).

On their track record and stated strategies, we’re probably due another acquisition soon.

I note an increase marketing spend of late, attempting to shift the brand from old to new.

The recent gapping in Market Cap between MYOB and Xero is long overdue IMO, not in criticism of MYOB, but in recognition that I personally would prefer to have my money on a worldwide success story than a local player, deep in the fight.

_____

For more commentary by the author on Biztech:

Follow On Twitter: https://twitter.com/mattpaff

Follow on Medium: https://medium.com/@mattpaff