In May this year I was lucky enough to present at the Smithink Young Guns Conference on the Gold Coast. My topic, “Leading the firms’ to leverage cloud and new technologies”. In preparing the presentation into a structure that I hoped would be both impactful and memorable, I managed to codify my key points into what I call “The 7 C’s of Value Added services – the secret to en masse adoption of advisory”.

6 months on I reflect on the 7 C’s and note a lot of consensus of thought from many of the industry leaders, but also some contentious ideas that challenge some of the common thinking.

I share with you herein my thoughts and strongly encourage debate and additional input.

Introduction

The accounting industry is confronted by significant disruption to its traditional business model. Most recognise that we are either in the midst or on the cusp of perhaps the greatest period of change since Fr Luca Pacioli (inset) invented double entry accounting back in the early 16th century.

Key drivers of change are well documented, but include:

- Central government agencies (such as the Digital Transformation Office (DTO) and the ATO) pressing forward with significant efficiency improvements (such as Standard Business Reporting (SBR), SuperStream, Single Touch Payroll etc) and putting significant downward pressure on compliance fees into the future

- Globalisation of services – we are seeing accounting services from countries like India and the Philippines at a fraction of the cost of labour (let alone standard professional service fees)

- A maturing of the consumer – A tech. savvy generation of business owners and managers expect more from their technology and service providers than ever before, often at a fraction the cost.

- Convergent Evolution of industries – see my other post on this topic, but essentially as all B2B service providers evolve as a reaction to common environments of change, we are seeing traditional barriers to entry fall and a rise of “all-encompassing B2B professional services companies”. Ultimately increasing both the market opportunity AND competitive forces across the breadth of B2B professional service industries.

- The “Digital Disturb” aka Technology Driven Disruption – new, typically online systems, driving significant efficiency gains, simplification, integration and the elimination of low value, automatable tasks.

Most professionals acknowledge that change is necessary and see a shift to recurrent, advisory services and the adoption of technology (rather than resistance to) as a key direction necessary for growth and even survival.

But there are some key blockers making the transition difficult for most. The top few I see are:

- For many, it is hard to imagine and prepare for a future with less compliance and without billable hours, when you are presently drowning in almost as much billable compliance work as you can handle. Realising a need to change and actually acting a 2 hurdles many find easy to simply put off.

- Technology being seen as a key driver, but remaining “out of the comfort zone” of many traditional accountants.

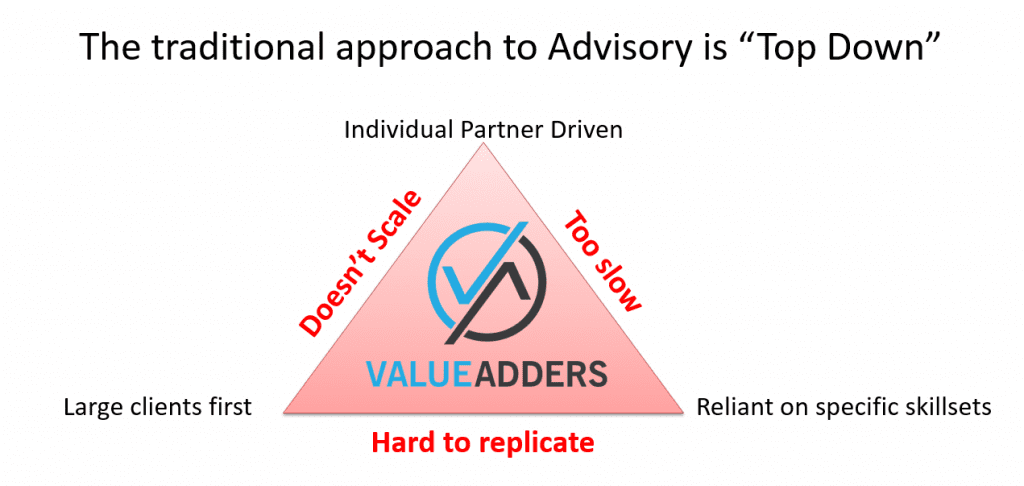

- Many firms take a traditional “Top Down” approach to change management, seeing the need and drivers for change being:

- Driven by partners down;

- Focused on specific skillsets (like succession planning or tax minimisation strategies);

- Targeted at larger clients first.

This model:

- Doesn’t scale;

- Is hard to replicate;

- Is too slow to take advantage of the opportunity that exists NOW.

So I propose a model that flips traditional thinking on its head:

- Driven bottom up;

- By tech savvy “young guns” (staff);

- Targeted at the majority of clients and prospective clients.

And I have codified this strategy into the 7 C’s.

1. Client-centric

Unfortunately I see too many firms focusing the evolution of their service offering on what is good for the firm first and then just expecting clients to fall in behind the strategy as a natural course of business and their relationship.

I am a firm believer in client-centric business models always ultimately winning out of self-centric ones. As Zig Ziglar famously states:

“You can have everything in life you want, if you will just help enough other people get what they want“

Start with the premise of “how can we help our customers get what they want”. Then build service offerings that deliver VALUE to your customer and charge fairly for the delivery of that VALUE.

Here’s my take on the services clients want:

2. Ca$h Flow focused

As Warren Buffet famously said:

Ca$h Flow “is to a business as oxygen is to an individual: never thought about when it is present, the only thing in mind when it is absent.”

My experience is the average business owner understands their Cash At Bank position clearly, but discuss P&L or Balance Sheet and often their eyes glaze over. So talk in the language that your customer understands (or as I distinctly recall @Ken Robinson describing being customer-centric as “tuning in to your customer’s radio station”). This means, start transitioning clients (and your firm) to the advisory model, by focusing on helping your customers to improve their ca$h position – that is what the majority understand.

@Michael Ford from Castaway Forecasting Software recently described it to me like this: “discussions around Ca$h Flow is a stage 1, easy access point to advisory”. He stressed its not the complete journey to an Advisory firm, but agreed with me on the fact its a great starting point for en masse engagement with clients.

And I believe the number 1 place to start is by helping any customer who offers trading terms with their ca$h position, by helping them improve their debtor management. It is generally the fastest and easiest way for many businesses to “put cash into their bank accounts”, yet it is under-valued and misunderstood by most.

Whilst there are a number of debtor management technology products like Chaser and Debtor Daddy on the market, personally I LOVE Collect by the team at Web Ninja. The key is, unlike the other systems, with Collect it almost doesn’t matter what accounting software (Desktop or Cloud) your client has. Collect plugs-in in but a few moments and starts automatically emailing reminders to debtors to pay based on due dates straight away. It’s very basic, very simple, but just works – exactly what you need for adoption!

Take up of technology works best when a client can: “find out about it today, implement it today and start seeing benefit tomorrow”. This is what Collect promises. I’ve personally seen improvements in debtors of up-to 50% in the first month after implementation!

Combine this technology with some sort of “debtors boot-camp”, where your services for providing debtor management advice are wrapped up with the technology. For example: if the client sends statements with ageing bands (such as 30/60/90), get them to switch to Due and Overdue ageing only and they’ll see in the vicinity of a 15% improvement in debtors basically overnight!

Combine this technology with some sort of “debtors boot-camp”, where your services for providing debtor management advice are wrapped up with the technology. For example: if the client sends statements with ageing bands (such as 30/60/90), get them to switch to Due and Overdue ageing only and they’ll see in the vicinity of a 15% improvement in debtors basically overnight!

This work can and should be done by junior “product champions” (those staff most familiar with the various accounting packages (MYOB, Reckon, Xero, QBo etc)) and it should be reinforced by what I call the Value Adder Cycle (future article):

- Identifying and document the current state;

- Add VALUE through a combination of service and technology offerings;

- Review and emphasise the improvements and VALUE delivered;

- Identify the next opportunity to help the client; now repeat

3. Centralised Service Offerings

The key is blurring the lines between technology and service, like wrapping a debtors boot-camp up with the installation of Collect as described above. With modern accounting systems and the value-add markets around them now offering bank rec and accounts payable automation, providing clients a service to manage these on their behalf and stay perpetually up-to-date with their accounts is a service they want, but may not yet know is possible.

Payroll outsourcing is another obvious opportunity. Many small businesses don’t want the hassle of managing payroll or trust a staff member to know what everyone gets paid. With a significant existing trust relationship with SMBs around money and compliance, accountants have a service offering available to them begging to be delivered en masse. Furthermore, not on an hourly billing basis, but on a per employee basis and via a service not needing a partner to deliver.

4. Common Ledgers

There is enough literature on why common ledgers are the future of accounting for me to just say, take it as a given your firm must be on board. See MYOB, Reckon Sync Direct, Xero, Common Ledger etc if you are yet to be sold on the Common Ledger opportunity.

5. Consult on Analytics

Big data/Data Analytics is referred to some as “the next battleground for competitive advantage”. Big business can employ the staff and implement the technology to disseminate through an increasing amount of data on customers, products & services to predict and react quickly to trends.

Data analysis and plain English dissemination of data is a service requirement for SMBs that I predict will grow exponentially over the coming years. There are dozens of analytical tools such as Spotlight Reporting, Crunchboards, Fathom, Castaway Forecasting etc that are offering accounting firms the technological platform for the delivery of consultation around analytics.

Data analysis and plain English dissemination of data is a service requirement for SMBs that I predict will grow exponentially over the coming years. There are dozens of analytical tools such as Spotlight Reporting, Crunchboards, Fathom, Castaway Forecasting etc that are offering accounting firms the technological platform for the delivery of consultation around analytics.

Again, it is not just about the technology but also the service with which it is bundled. Recurring monthly fee engagement with monthly management reporting meetings is a common, major growth area crying out for accountants to leverage.

The average SMB already sees their accountant as “the numbers people”. It is a logical extension to advisory services to consult on analytics.

6. Chunkification – technology beyond core accounting

@Doug Sleeter describes Chunkification as:

“Splitting up separate parts of the overall business management systems into discrete parts.”

Intuit quote that the average Quickbooks user has 18 other apps they use alongside their applications. It’s a large, disjointed, confusing world outside core accounting.

The opportunity for Accounting firms is to be the trusted advisor for Value-Add technologies, helping to source, implement and maintain specific vertical or horizontal functionality. All the major players (bar maybe Reckon), have woken up to the benefits of add-on partners and heavily promote their ecosystems. The problem is, as time goes on and more and more similar products pop up, which ones are any good?

This very question, sings out opportunity. I suggest, pick a winner in the key verticals/horizontals that your firm want to work with, know your limitations and source expertise when a clients’ needs exceed your ability to help.

For example:

- Debtor automation – Web Ninja Collect for mine is the clear winner with broad integrations, not limited to Cloud. Others like Debtor Daddy, Chaser etc are good, if ALL your clients are on Xero or other Cloud solutions.

- Job Management – I’m a massive fan of Next Minute, the new kids on the block. Of the long-term players, Simpro seems to dominate.

- Point-Of-Sale – not my specialty but from what I know, POS systems depend on industry. The local café – Revel (owned by Intuit) stands out for mine. Vend has big wraps and Kounta seems to be gaining traction through MYOBs investment.

- Accounts Payable Automation – add-ons like Receipt Bank are obvious, but more and more I see the future being based on Gen 2, Artificial Intelligence systems like Xtracta being natively embedded in the purchasing work flows of the client’s accounting systems. Yet again our kiwi neighbours lead the world in this space, with the majority of NZ developed accounting systems having this (including the likes of Infusion and Greentree – but funnily enough, not the most well known one).

7. Cloudification

Like climate change, the argument over the cloud has been run and won. In Australia (16%) and ahead of us in New Zealand (over 30%), we are now past the tipping point in “the Law Of Diffusion Of Innovation” (best explained by @Simon Sinek in his famous TEDx Talk on “Start with the Why”) with the adoption of Cloud business platforms.

Its pretty widely accepted that moving clients en masse to the cloud for their accounting systems helps roll out other recurrent advisory services (as described above). The challenge is Time and the Value proposition. Let me explain.

MYOB in selling their recent float, claimed in the vicinity of 700,000 customers in AuNZ who use their products but don’t have a recurrent contract with MYOB. That’s 700,000 customers who “purchased” MYOB with their GST vouchers back in 2000, or bought it from Harvey Norman at some point, but have not taken out a support/upgrades contract with MYOB to maintain the product.

Add to this the number of Reckon clients who purchased their desktop Quickbooks product over the years, in a similar position.

This represents a SIGNIFICANT number of businesses:

- Who do not pay recurring for their business software today;

- Who quite often run multiple data files (including family trusts, SMSFs etc) at no extra cost;

- Who may often be skeptical of security in the cloud;

- Who (here’s the critical point) have to be convinced of the value and security of moving to the cloud and having to pay recurring, by dataset!

My contention is that relying on converting all clients to Cloud accounting systems in order to nurture an Advisory relationship, is likely to be a slow, challenging strategy if that is stage 1 in your “firm of the future” plan. I would suggest Cloudifying clients in chunks. Start where the clients biggest business need is:

- A tradie who needs NextMinute for Job Management;

- A wholesale customer who needs a Web Ninja webstore or their Collect product for debtors automation;

- A retail customer who needs a new POS system;

The “add-on” (moreover the vertical or horizontal chunk) is a far easier Value proposition in a lot of cases. Starting with this is often the first step on the journey to Cloudification and adoption of your advisory services.

Closing

I finish with an old chestnut – many accounting firms need to “eat their own dog food” before pushing advisory outward. Have you already transformed your practice? What are the firm’s debtor days? Are you utilising technology? Do you engage in your own recurring business improvement process?

So therein lies my 7 C’s. Please feel free to disagree or add your 2 cents. My ideas are always “point in time” thoughts and I am more-than-willing to evolve with solid input from others.

This article and more are also published on my LinkedIn profile: https://au.linkedin.com/in/mattpaff