For those following along at home, you may recall a post I wrote in July last year on the unusual share price movement of MYOB listed Value Added Reseller (VAR) Enprise (NZE: ENS) titled “Are MYOB getting screwed in their desire to go direct?“.

Here it is:

Either way, maybe have a quick read because it seems there have been some recent developments and my article appears quite prophetic (and dare I say impactful) upon reflection…

What happened last year?

Check out the chart that accompanied the article:

Now look at the updated graphic:

I guess a few people read my article last year… sorry shareholders. 😏

What now?

So my article finishes with what I saw as the likely outcome:

Here’s 2 scenario’s that could play out:

MYOB don’t buy Enprise, because the numbers don’t add up any more and they remain one of the few offical MYOB Enterprise partners; OR

Let’s play PE hardball…. MYOB announces a cut to enterprise partner margin and an aggressive shift to direct first strategy, drives the share price of Enprise down and picks it up later than planned, but for a truckload cheaper, leaving those buying up in recent months screwed…

Normally in a battle between retail investors and Private Equity, I’d always bet on PE…

Sooo, update time…

I’m hearing from multiple sources, some VERY interesting developments in the MYOB Enterprise division go-to-market over the last couple of months. Can you possibly guess what they are?? I could…

The margin on MYOB Exo has been cut significantly

My understanding is top partners (like Enprise) reaped healthy commissions on sales and Annual License Fees (ALF). This margin has recently been heavily reduced!! “Revenue from software and licences” constituted 24% of revenues in the last half (ENS 1H22 report). I would hazard a guess that MYOB Exo makes up at least 75% of this revenue line… Interesting… not just to the impacts and motives by MYOB, but… the lack of announcement to the market by Enprise that such a major revenue stream is going to be impacted… at the same time, the share price has bounced UP 30% resulting in an NZ RegCo. query… 🤯🤦

On another key point, I hear that MYOB are really disencentivising conversions from Exo to Advanced. With margin focused on new logos, Enprise and other Exo heavy partners are snookered…. they are in fact almost better off getting into bed with Microsoft or NetSuite or Odoo etc and converting as many Exo sites as they can, rather than the logical “upgrade” to Advanced. Perhaps some at MYOB/KKR over-estimate the clients’ loyalty to the MYOB brand over the VAR…

MYOB are showing all indications of an aggressive shift towards direct

With more VAR acquisitions (Aztech, Endevour, Star etc), a significant margin reduction and even communications of a change in tack to the wider channel, all indications are MYOB are moving to a direct first strategy… those VARs that are already onboard the mothership, got the first mover advantage, high growth partners – put up or shut up, bad luck the rest… Again, Enprise would be aware of this and yet… no announcement to the NZE…

What Next?

It is becoming more obvious that KKR are headed to the finish line (an exit via a float perhaps). Buying revenue by acquiring the channel. Increasing recurring revenue by cutting margin. A focus on new logos over revenue retention… etc

At some point, at some price, I feel MYOB will need to buy Enprise. Enprise comprise too large a percentage of the MYOB Enterprise division for the relationship to turn too sour and be left to die… What if Enprise pivoted to Microsoft Dynamics or NetSuite or Odoo and aggressively started converting the Exo base? MYOB cannot want a fight like that.

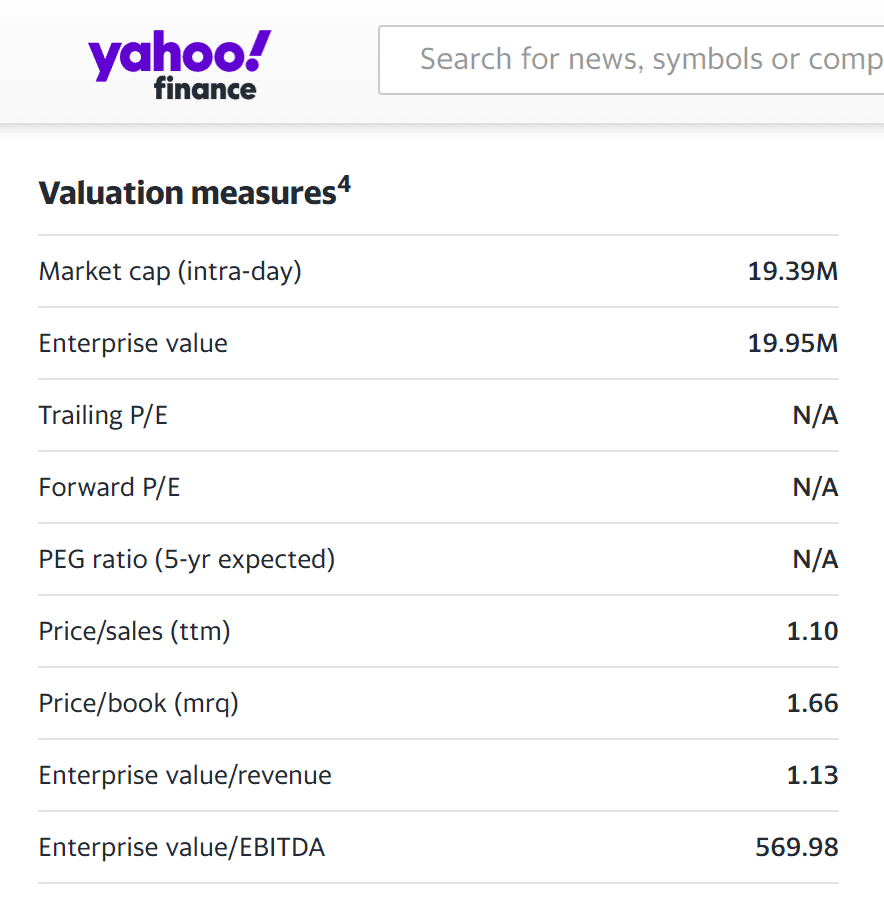

And so when I see a 38% bounce (89c 13/3/22 – $1.23 4/5/22) in Enprise’s share price given the company’s outlook deterioration, I have to conclude a deal in the works? But what is MYOB / KKR going to be willing to pay? Currently market cap. of ~NZ$20 on revenues multiples nearing 1 (1.13X before commission cuts considered)… but EDITDA multiples nearing 600… 🤢🤮

Lets just put a positive spin on it and say ~$20m makes a lot more sense than $60m+ did when I wrote the article last July!!

Here’s my prediction: within the next 2 months, MYOB make a formal offer to buy Enprise for no more than NZ$20m, which the board recommends shareholders accept.

This would mean my July 2021 article, looks to have made up for my lack of “Paff’s Predictions” in 2022.

For more on ERP, Cloud Accounting, Payroll and HR tech follow on:

Follow our LinkedIn: https://www.linkedin.com/company/value-adders/

Twitter: https://twitter.com/mattpaff and https://twitter.com/valueadders

Our blog: https://valueadders.com.au/articles

Like on Facebook: https://www.facebook.com/valueadders/

Follow on Medium: https://medium.com/@mattpaff