Last week I was lucky enough to be in San Jose to attend Intuit’s second annual QuickBooks Connect. Only in America could you attend a technology conference headlined by Oprah, with the doyen of the accounting software industry, Scott Cook modestly chatting with THE guru of modern technology development Eric Ries, in one of 15 (yes fifteen) simultaneous stream sessions.

I thought I would sit down and share my takeaways and highlights from a very eye-opening event for me, before I head to #SleeterCon next week and learn some more.

Preface

This doesn’t need a heading, but may need to be said for those slow on the uptake – the world is Online. Desktop (the majority of Intuit’s existing business), got very little mention. You’d be forgiven for thinking QBo is all they offer and have offered for some time.

Intuit Are BIG

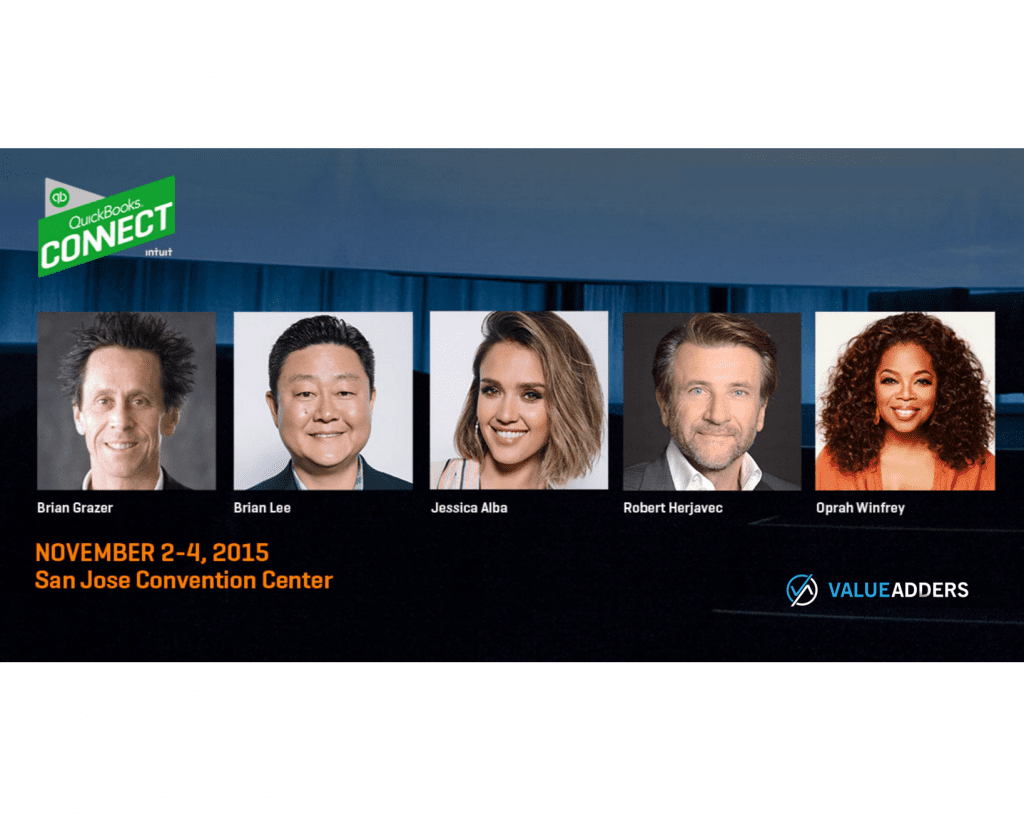

I always knew Intuit were BIG, but this event absolutely reinforced the fact for me. It starts with the presenter line-up: Oprah; Eric Ries; Jessica Alba & Brian Lee; Brian Grazer; Robert Herjavic not to mention the Intuit executive like Scott Cook and Brad Smith and of course the celebrity aussies: @Clayton Oates and @Wayne Schmidt – Intuit showed they have pulling power (and obviously the ca$h).

Then they start quoting numbers like:

- 5,000 attendees to only their second QB Connect!

- 1,100,000 subscribers on QBo.

- 209,000 accountants on QBo.

- 1,500 (or 1,400 depending on which presentation you quote from the conference) ecosystem partners via apps.com.

They are BIG! And it is a very important point to appreciate that Intuit have significant market dominance in the world’s largest economy a market that is not only HUGE, but is patriotic and celebrates it’s tall poppies.

The fact is, Intuit are the “reining Kings” of the SMB accounting software in the world. As the original Apprentice – Bill Rancic (who was effectively the MC) said at one point:

Facts Tell, Stories Sell

And the big numbers are the inarguable facts.

Intuit have earned their title though (30 years of) evolution. In his book “The Lean Startup”, Eric Ries uses them as an example of a large (7.700 employees) established company that has responded to the modern world by adopting the “startup-like”, Lean, Agile tendencies. They have been able to reinvent themselves and leverage their position to absolutely lead the world in the new era of #Fintech, rather than allowing their “legacy” to be an excuse to stagnate (like so many in the industry have fallen afoul).

The US has HUGE growth opportunity

I could never get my head around Intuit’s quoted market share. I’ve read stats as varied as 80-95% in US SMB accounting software space (see links like this and this), when they claim an also widely variable client base somewhere between 3.5m-7m customers worldwide. But there are close to 30m SMBs in the US alone…the numbers didn’t add up!??

I finally understand!! At the conference, Intuit quoted 29m SMBs in the US. Their assertion is the US SMB market is HUGELY under-penetrated by retail accounting software. Manual systems (including MS Excel and Word) rein supreme.

EVERYONE agrees that this has to change (the penetration rate MUST and will go up), which makes the US even more attractive than I realised and explains the investor appetite for the likes of Xero, Wave etc and Sage’s weird Salesforce based SageLive play – purely to get a seat at the US SMB table.

This makes you wonder when the Bain majority owned MYOB and its “ANZ Only” strategy will run its course and they look for a slice of the US pie, like Reckon have recently signaled they intend! Yes 50% of 2m businesses in Australia is a lot (if they manage to retain/convert that many to recurrent, paying customers, which many will doubt), but that’s only 3% in US market share terms…! And there’s an AccountEdge footprint/relationship surely they could leverage…? Tim?

#Fintech Platforms are replacing Accounting Software

Regardless of whether it was Rod Drury, someone from Intuit or whoever that started the discussion, accounting software as a category is dying and being replaced by major “Financial Technology Platforms”.

From a “Fintech” perspective: Intuit have joined with OnDeck in a $100m fund to offer integrated financing, direct from the “accounting” system. Xero have formed similar relationship with NAB in Australia. Its not only about offering access to funds where and when needed, but about the loan provider managing the risk profile through transparent “real-time” data. And seriously, watch-this-space, there is just SO far this integrated financial web could go!

From a platform perspective: These companies (I think undoubtedly led by Xero and now embraced by Intuit and MYOB), have woken up to the fact that the likes of Facebook, Salesforce, even Apple with the iOS, have all been successful because they offered a platform that developers could plug into and develop upon, en masse. Its no longer about monolithic, everything to everyone technology, its about open systems and a genuine focus on not just the User eXpeience but also the Developer eXperience, with whole teams dedicated to helping and encouraging symbiotic development. Which leads me to my next observation:

Intuit have caught up on the need to embrace their Ecosystem

For a company that pretty much had to retro-fit an open API framework to a mature product in QBo (a decade after the fact), Intuit have cottoned on and caught-up on understanding what Rod Drury and the Xero team knew very much earlier – “Embrace Your Ecosystem”.

At this point I will highlight that the exhibition hall at XeroCon 2015 in Melbourne had probably 2-3 times more exhibitors than QBConnect 2015. And about 50% of the QBConnect exhibitors were at both. And perhaps a similar, slightly smaller percentage were Australian or Kiwi companies (a lot of the rest were Canadians).

In short: Xero as well as the AuNZ apps industry (no doubt cause and effect related) lead the world in the #Fintech ecosystem space. But for how long? I spoke to numerous US companies who were “just launching”, what appear mature products. And then you have Americans like Joshua Reeve from Gusto (who probably define the ecosystem opportunity as both an add-on and primary tool), who absolutely blows me away every time I see him speak, with his passion, insight and vision – I think the companies from “down-under” have some major competition ahead and they need to be fast enough to grab “a seat at the table”.

Highlighting the immaturity of the Apps.com ecosystem, there are supposedly 1,500 apps on apps.com, the absolute vast majority saw no value in getting in front of 5,000 Intuit staff, Pro Advisors, Press, Users etc at QBConnect?? I don’t get it other than to guess they don’t get it yet?

Anyway, back to my point, outwardly Intuit state that:

- The average Quickbooks user has 18 other apps they use in their business.

- QBo users with apps.com integrated apps are “stickier” than those without.

- 14% (up from 9% 12 months previous) of QBo users have added apps.com apps.

They had Avi Golan (VP and GM, Intuit Developer Group) talk at length about their desire to grow and improve their “ecosystem”. They had heads of DX and GMs of Developer Relations selling their absolute love of add-on partners through role plays.

And they offer their market position and 1.1m QBo subscribers and growing fast as a HUGE carrot.

Its why Xero are having to learn to love partners who were once devoutly monogamous but through economic commonsense now MUST embrace Intuit (and MYOB) and thus those former monogamous partners, must quell their previously inane Twitter dribble espousing the virtues of Xero as they know not to upset the new hands that also feed them). Be I digress… was that a rant?! Sorry.

The fact is, the sheer size of Intuit and the market opportunity they offer developers, means all serious ecosystem apps must join apps.com. And Intuit want to embrace them.

What’s good for the customer & the channel is good for Intuit

Like Facebook realising that in order to grow their user base they have to think macro and grow the number of internet users (hence internet.org), Intuit have cottoned-on to the link between SMB survival rates and their success.

It’s obvious when you look at it: improving the survival rate of SMBs decreases Intuit’s churn rate and increases the Average Lifetime Value of an acquired user. They sell it as altruistic, do we care if it is also self-satisfying?

You see it in the presentations of the key executive:

- Improving the survival rate of SMBs by 5% equals 5m more jobs in the US

- SMBs who utilise the services of an external accountant/advisor have an 89% better chance of survival than those that do not

Not coincidentally, this sets the role of the aggregator/channel partner at the core of Intuit’s strategy.

Then Intuit talk about how they’re helping SMBs by giving one an ad during the SuperBowl.

Then they have their Own It Community – a peer to peer platform for sharing and sourcing business advice.

Time will tell how effective they can be, both from a economic impact and pure ROI perspective (serious macro improvement costs money, ask any politician). But, no doubt, improving Churn and Lifetime Value numbers are what the investors care about in the SAAS world!

Oprah is awe inspiring

She made a believer out of me! What an inspiring women. So articulate. So “in touch”. So loved by So many. Oprah’s session in which she quoted Goethe & Zukav and spoke openly about her journey as a brand (and a person) and the virtue of Intent. It was very well timed for me in my journey and quite motivational.

In Closing

Intuit is not Sage nor MYOB. If they were asleep at the wheel admiring their own Desktop success, they woke up long before they ran off the road that led to Online. In fact, they lead the world in the Online SMB #fintech (I can’t type that without a hashtag) space, which is getting more and more crowded with established players (like Sage, MYOB, Reckon etc) getting their collective acts together and agile new players like Xero, Wave, Freshbooks, ZohoBooks etc all tying to grab a share.

In the US, I feel their tall poppy status will help them (unlike MYOB in Australia). But ultimately the market is hugely under-penetrated, and there is enormous room for competitors.

Add-ons, Value Add technologies, Ecosystem Apps – whatever term you use, the time is now to get your seat at the table. I think barriers to entry are as low as they will get and acting decisively and effectively sooner rather than later is a must. This poses the issue of internationalisation of technology vs building out functionality, but those that act quickly and get the mix right, will be given an opportunity for success like never before.

Onward to SleeterCon!

#growth #excitingtimes #Ilovethisindustry

1 Comment