On the 16th of November it was announced that MYOB (subject to regulatory approval) had acquired the assets of Reckon’s Accountant’s Practice division for $180m. Over the past month, I’ve spoken to more people about the deal, than I care to count. Rarely at my instigation I might add. It seems everyone wants to talk about it! From people close to Reckon to big ticket clients, former staff, current staff and the average man on the street. I was even provided the opportunity of a private audience with senior MYOB execs in a no-holds-barred session in which they laid-bare their core strategies.

I’ve distilled my own thoughts, stolen some from others and now have my opinions and theory of what is to come. Here goes:

My general thoughts on MYOB

Despite their detractors, MYOB have actually made a pretty good fist of a dire situation over the past decade, from a shareholder’s return-on-investment perspective. With their market dominance in the Australian & New Zealand now well and truly usurped by a plucky start-up (or is that up-start?) in Xero (who one can never forget is funded in no small part by MYOB’s former chief and co-founder, Craig Winkler), they have still been able to deliver both their Private Equity owners a significant ROI. And they remain the largest player by revenue and genuinely (though some may disagree) “still in the game” in AuNZ accounting tech. All this has occurred despite being responsible for a mind-boggling array of separate, desktop code-bases and the en mass conversion of the installed base and channel (primarily to Xero).

My general thoughts on Reckon

Not agreeing to terms with Intuit some years back, allegedly through egos on both sides of the negotiating table, has to be, in my opinion, one of the greatest strategic blunders in technology land (for the two companies on both sides of the Pacific mind you), of the last decade. Only for Reckon to then be hit by Microsoft killing off Silverlight and severely delaying their entry into the genuine, cloud accounting market, which had many preparing the obituary for ticker code RKN.

But one can’t help but think the Rabie family has done a pretty good job of protecting it’s own financial asset and as a by-product, that of the other shareholders, with what has transpired in 2017. The key theme has been the “sum of the parts is worth more than the market values the whole”.

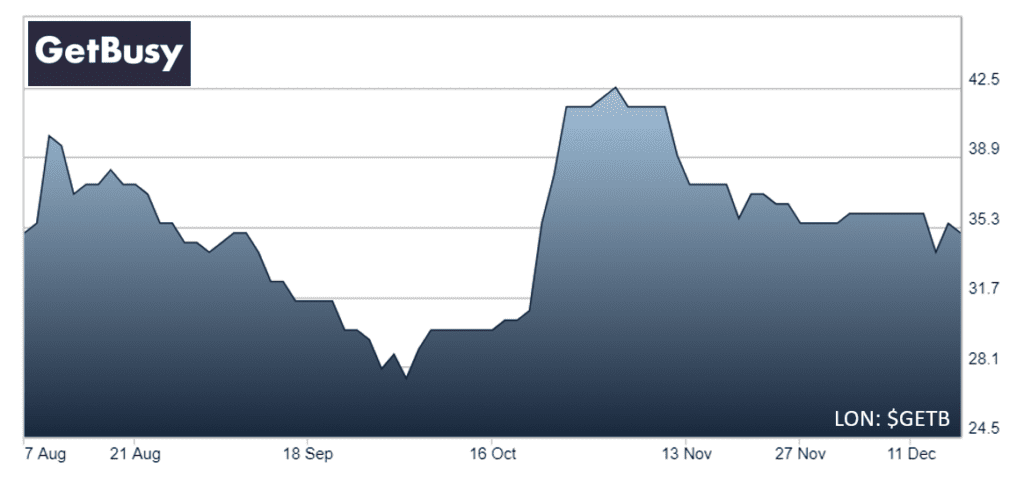

First, the only genuinely growing division was sold off to the secondary UK market the AIM, with the £13.6m listing of the document management (SmartVault and Virtual Cabinet) division under the name GetBusy.

Now they are selling off of the Accountant’s division to MYOB for $180m.

Given the current share-price as at December 19, effectively equals (slightly exceeds) the share-price as at January 1 ($1.54), sans GetBusy, the relative gains for shareholders in 2017 equals the value of GetBusy… current Market Cap £17.56 (~$30.6m AUD or around 17% return on the year, BEFORE regulatory approval of the division sale to MYOB). Not a bad year for a severely hamstrung company sliding backward into market obscurity…

On the deal

- Rabie is a great negotiator. He just got $180m, for a bit more than half a company, which at the time had a total Market Cap of $120m!

- The book value of the net assets of the Accountant Practice Management Business at 31 October 2017 was $38 million.

- MYOB flinched first, that’s a big number and assumes significant stickiness and cross-sell to get a decent return.

- Perhaps there was a second bidder pushing up the price and the urgency… Sage perhaps, looking at another channel for their long-awaited Salesforce solution?

The numbers from a Reckon perspective

- $180m cash from the deal

- Current market cap $176m (anyone else see an anomaly there?)

- The market values the rest of the business as a negative asset value, really? Have you seen the EBITDA numbers of the business division?

- OK there is *some* risk of the ACCC blocking the deal, but really, that is unlikely IMO…?

- OK Reckon has ~$52m worth of debt, but even if they pay off 100% of the debt (I wouldn’t) that still values the rest of the company at only ~$50m with no debt and a VERY attractive EBITDA…and the ability to gain more cash on the sale of the Legal Practice division..!

- #STRONGBUY $RKN

I need more convincing you say? Take a look at what is left. The business division + legal elements of the practice management division.

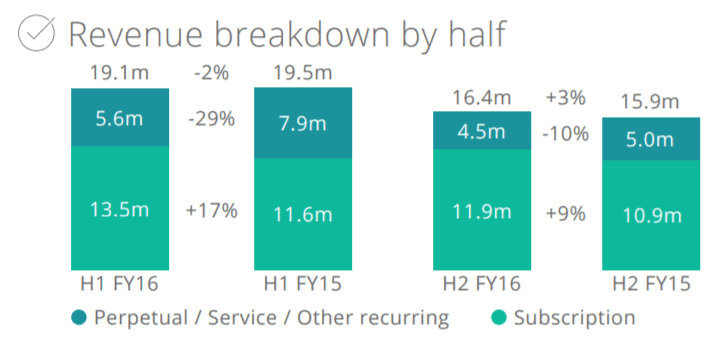

Based on 1H17 c.f. 1H16 results for just the business division:

And the FY16 results:

So…with some rounding $RKN will be left with:

- north of $35m in revenue business

- On projected EBITDA north of $15m

Those familiar with the BCG Matrix, this is the pure definition of a ca$h cow if I ever did see it! She ain’t a dog yet!

In short, what is left would make a highly profitable, very attractive, private business IMO. I don’t see how or why they would continue to remain listed and impair EBITDA with ASX compliance costs.

Whilst the market communication is “ReckonOne rah rah rah, lets ante-up with the injection of cash…”, I suspect the truth will in fact be quite different.

With a long tail in technology subscriptions, I suspect Messrs Rabie, Wilkinson et al, are thinking “let’s find a buyer for the legal practice stuff, delist this thing and make a truckload as this old QuickBooks thing dies a long, slow death…ReckonOne, meh…”. Take it from one with fair experience in old accounting & payroll tech companies, it can be a highly profitable past-time squeezing the lemon (“sweating the asset”) on a rusted-on user base.

I suspect what will happen is a special dividend will be announced. Shortly thereafter will come a management buy-out offer to shareholders. Effectively the money raised from the various sell-offs, via a special dividend, will deliver the remaining assets to key shareholders as a private company that will more than fund a easy transition into a healthy retirement. And they get to play with GetBusy as their growth investment vehicle!

What comes of the new MYOB Practice Management division?

As an avid rugby league fan (born and raised in regional (northern) NSW, it’s injected into you at birth, like AFL in Victoria), I can’t help but think of the Northern Eagles when I consider what comes of a combined APS/MYOB Practice Management business.

But before I get into that, let’s consider the elements that make perfect business sense:

- Reckon has no cloud strategy for APS. They are too small and too late to have one. MYOB Dashboard and what they are building with MyAdvisor etc would be a logical pathway for APS customers to transition to the Cloud.

- Whilst $180m sounds a lot, MYOB will make their money back, quickly:

- Word has it Reckon had very little account management and as such, minimal product cross-sell. MYOB have the existing business structure to grow ARPU in the Reckon accounts AND cross-sell products like Reckon docs into the MYOB base.

- Also rumour has it the redundancies have already started at Reckon ahead of the deal, meaning MYOB don’t get heat on asset stripping post acquisition and the ultimate EBITDA impact will be higher (and therefore the actual multiple they paid lower) than has been reported to the market.

- With few options in the enterprise end of Practice Management in recent times (I emphasise this IS changing), APS and MYOB have largely predated (as in the past tense of predation NOT to pre-date/come before – ah English, what a language!) on one-and-other. With a common path to MYOB Dashboard, perhaps the net-zero-sum game of swapping from outdated tech to outdated tech, ceases.

Now, let’s look at this through the lens of the Northern Eagles. For those not familiar, let me summarise it like this:

- The Northern Eagles were formed in the post Super League era (there were 2 rugby league competitions in Australia in the late 90’s) through the merger of the North Sydney Bears and the Manly Sea Eagles in 2000.

- Historically bitter rivals (think Carlton and Collingwood in the AFL), the two clubs opted for money and survival over potential obscurity.

- The merger failed for many reasons (North Sydney disappeared from top line rugby league when Manly took over the licence), not least of which, fans of both clubs were actually despisers of the other. The new combined entity was hard for the fans to love, because the fans who were either Capulets or Montagues (think Romeo and Juliet) just couldn’t handle the internal conflict the new entity created.

So to my point. I think Accounting firms have a brand association with either APS or MYOB, invariably they have had a bad experience with the other. The companies have predated on each other, as I have already emphasised. Clients may like APS in part because it is not MYOB. They like MYOB AE in part, because it is not Reckon APS… So what comes of the client base under the merged entity? Another Northern Eagles? Particularly from a Reckon APS customer perspective? Are Reckon customers like the North Sydney Bears fans, who are for the most part, now lost to rugby league..?

Final word

The ACCC should NOT stand in the way of this deal (those old enough will recall that the Sol6 / Ceedata / MYOB acquisitions were not blocked – this creates no more of a monopoly than that did). On reflection, whilst there will be challenges for both MYOB and the broader, accounting firm practice management market, I think this deal is a win/win/win for all:

- The likes of Xero, Karbon, Greatsoft, Jetpack Workflow, Sage etc are all licking their lips at the carcass they see this acquisition exposing, where fed up customers opt out, due to dissatisfaction or the “Northern Eagles Effect”, even if it means lost functionality in the near-term;

- MYOB and its shareholders win as the purchase will pay for itself – there is a long-tail in technology revenue – the question is not if but how long will it take to reap the ROI? 5 years tops I expect.

- Reckon shareholders win as the value realised is a massive leap on the market’s valuation of the whole.

The final, and most important and debated topic is, the customer:

- APS customers I believe win as they now know what the future holds. Certainty (or closer to certainty) is better than the uncertainty they have faced of late. They can now stay or leave, clear as to their options (limited they may currently be).

- MYOB AE and AO customers win, as the additional revenue *should* accelerate the cloud evolution of the MYOB practice management suite (even if some resources are needed to write the APS data converter). And APS has been effectively taken off the table as a viable alternative.

- If you disagree with either of the two above opinions, then the alternative is that the customer still wins, as they get to leave purgatory. They can now make a decision to exit (MYOB & APS), comfortable in the fact the risk of exit is now lesser than the risk of status quo…

PS in case you missed it, I think Reckon $RKN shares are currently significantly under-valued given my belief the ACCC blocking the deal is unlikely and the pure numbers on what is left (regardless of churn), don’t really add up to how the market has valued it…

PPS Yes I have put my money where my mouth is – I’ll disclose that I have recently invested in $RKN

PPPS This advice is general and in no way can be construed as investment advice… 🙂

___

Follow me on the socials for more commentary on #CloudAccounting #Biztech

Follow On Twitter: https://twitter.com/mattpaff

Check out my blog: https://valueadders.com.au/articles

Follow on Medium: https://medium.com/@mattpaff

Thanks for the article I enjoyed reading it! Do you still think it is unlikely the ACCC will block the deal now that they announced concerns?

Vince, apologies, only just picked up this comment (my SPAM filter wasn’t up and running and I am only now getting on top of real vs SPAM comments).

Today’s news shows that the ACCC’s final opinion is irrelevant. MYOB have backed out of the deal, game over…