The stated theme of QBConnect 2018 was “anything is possible”. I tend not to be a believer in the life philosophy of infinite possibilities. I don’t think it possible that I could break the world 100m sprint record held by Usain Bolt in the process of winning the 100m Olympic final. At 41 I’m too old to start on this momentous life goal. I wasn’t genetically endowed with a sprinter’s body, an elongated gate nor a mass of fast twitch fibres. Aspiring to such a lofty goal would be ludicrous (at my age especially), and assured of failure. So in summing up the Negative teams argument, if I can’t aspire to break Usain’s 100m world record and win the 100m gold medal, anything is NOT actually possible…

So I thought I would create my own theme for the event.

One word that ties together the common elements of the event to better encapsulate my experience and core takeaways. That word is:

LEGACY

Ultimately I am stealing from the presentation on day three given by the legend that is Paul Dunn.

Perhaps it was the power of what Paul had to say that made this word impossible for me to shake off as I thought about what I learned from QBConnect 2018. But grab me it did and so here is Legacy – my 2018 review of QBConnect that no-one else will write:

Personal Legacies

2018 is Intuit’s year of transition in it’s executive team:

Most notably: Brad Smith

This was a very emotional farewell for Brad Smith who is transitioning to the role of Intuit Chair (rather than CEO and Chair). Brad appears destined for politics. He is a much loved leader, inspirational orator, family values loving demigod with a NASDAQ track record few could compare themselves with. He has been at the helm of Intuit during a massive period of change over his 11 year tenure. One in which equivalent incumbents like MYOB and Sage have fallen from grace, Intuit have stared down the potential disruption from Xero, Wave, Freshbooks et al and come out the back end stronger than ever, with a better worldwide position than ever before.

As an outsider looking in, Brad’s legacy appears great. From culture to performance, innovation to market engagement. They truly appear to be a company that genuinely lives its values. No doubt Scott Cook’s legacy remains deep in the Intuit DNA (particularly the product focused culture), but few could argue the enormity of Brad’s legacy. Check out the share price for Intuit over Brad’s tenure. Basically 10X – not bad…

Sasan Goodarzi

Brad will be succeeded by Sasan Goodarzi. Sasan was the obvious winner of the divisional swap, winner succeeds Brad competition, with Dan Wernikoff, dating back to May 2016. One could argue Goodarzi was handed the proverbial “goose that laid the golden egg” when given the upswinging small business division whilst Wernikoff landed the mature, consumer tax division. Nonetheless Goodarzi was the obvious choice and now sets about building his own legacy.

I have been fortune enough to spend time with Sasan over the past few years. I sense a man who understands the cards he’s been dealt. A certain, earned arrogance that comes with being the biggest fish in the sea (with respect to being CEO and Intuit the company vs the rest). A battle hardened competitor, with the mix of street and book smarts that whilst showing utter respect for he predecessor, isn’t trying to be his clone. He’s not a product of humble, small town West Virginian upbringing. He’s not the man of a thousand quotes. He is his own man and will live his own legacy over the years to come.

I was privileged enough to get a one-on-one with Goodarzi and when I asked the cliched question on his legacy vs Brad’s, the couple of takeaways I left with were:

- Bold choices – a confidence in decision making that will perhaps grow under Goodarzi’s leadership. For example, perhaps we’ll see a greater willingness to acquire than simply build innovation (going to love this one, given Xero’s recent debt raise and key acquisitions);

- A clear understanding of the role product has in building an economic moat and the need to move increasingly faster on innovation to compete harder;

Alex Chriss

Alex succeeds Sasan as GM of Small Business division. I LOVE Alex’s path to this senior executive role. Alex is a product guy at his core. In fact he is a Platform guy. Check out his LinkedIn role history. Yes he’s spent time in Sales, and “partner management” (perhaps the traditional paths to exec), but more recently he was Chief Product Officer. The legacy we can expect Alex to live? An absolute focus on delivering a genuine platform. Not a new mission for Alex, but one in which his power to deliver has been growing, since a decade ago taking on the Partner Platform role. He has already taken a cloud 1.0 product in QBo, which Intuit launched in 2001, and worked on re-engineering it into a genuine, open, modern platform (no doubt in part in reaction to the Xero threat). He has a ways to go (see below on technical legacy) and he appears up to the challenge.

Ariege Misherghi

Ariege has stepped up to replace Rich Preece as the head of Accountants Division, and practically the new face of QBConnect! The legacy I expect Ariege to live? More gender diversity in senior exec roles at Intuit? Perhaps a deeper, global, cultural awareness? A focus on product for Accountants? Who knows, but based on her confident owning of the QBConnect stage I look forward to seeing her influence and legacy grow.

The legacy international operations structure has been done away with

Not necessarily an announcement of QBConnect, but one which was obvious whilst there. International operations at Intuit were recently restructured with the various heads of country reduced to 3 senior roles and the rest restructured to report via a new “Rest of World” division. For the first time ever the US gets a head in Rich Preece. Canada, obviously the next battleground in the international SME Cloud Accounting battleground retains Geoff Cates and its standing as a core market. All other countries now report into a new Rest of World structure under Dominic Allon in the UK. Country managers like Nicolette in Australia, no longer report directly into HQ in Mountain View, but into Dom in the UK.

When I quizzed Goodarzi on the restructure, he spoke in terms of McKinsey’s Three Horizons of Growth framework. The US is obvious the world’s biggest Cloud Accounting technology marketplace, with significant runway and Intuit hold a massive market leadership position. Of course this remains a key focus…more important to Intuit than Australia – not to say Australia doesn’t remain strategically important.

Dealing with technical Legacy

I don’t think it is unfair for me to highlight the distinct lack of output in new features/major new releases at QB Connect 2018…

To be brutal, the key items presented at QBConnect 2018 (main day) were identical to QBConnect 2017.

- Smart Money

- Smart Decisions

- Smart Connections

There was little to no new feature announcements for QuickBooks.

The big announcements were:

- Faster Payments – Accounts Receivable and Payroll (neither available in Australia) and really what can only be a “wow factor” in the US, a country with perhaps the most archaic banking system in the western world… FYI existing banking systems in Australia and around the world already offer same day, even real-time clearance on payments. Sure big news and a significant moat in the US. Meh… for the rest of us.

- QB Capital, whilst it still blows my mind (see below), was announced last year;

- QB Assistant, Sasan practically gave the same demo as last year;

- Smart Connections – connecting customers and suppliers, QB Customers to staff… but where and what the heckfire is it?? Same as last year – discussed, not shown, not really explained…??;

Perhaps the hint as to Intuit’s gap year on new features was the quote from Brad Smith in the “Anything Is Possible” inspirational quotes of QBConnect’s past and present handout:

Intuit are at their peak. Now is the time to fix the underlying foibles of the platform.

My one-on-one chat with Alex Chriss gave me the insights that reaffirmed my thinking on this. This has been a year to get the underlying house in order, so Intuit can accelerate in 2019. A bit like Xero slowed to transition to AWS, Intuit have slowed to do likewise (I’m telling you, Amazon is taking over the world, seriously). Re-engineering the underlying architecture of the platform that is now 17 years old to a micro-services architecture, leveraging all that AWS and other services have to offer, one which allows internationalisation through configuration, more than raw-coding. A year in which to refine their AI and ML. A year to build out, and “eat their own dog food” with the new GraphQL API.

From an innovation/new feature announcement perspective, there were only a few minor updates to QuickBooks Online Accountant. This was disappointing as I was hoping/nigh on expecting some big announcements around API and in-platform development vis-a-vis Salesforce Force.com or NetSuite SuiteApp.

But as someone who fully appreciates the challenges of legacy code, I get the need for a gap year such as this. I will just be expecting big things in 2019 – I’m watching Alex!

QuickBooks Online is now a legacy brand

Its subtle, but I noticed all reference to QuickBooks Online was simply QuickBooks. See the new logo vs the old:

Old

New

A clear sign Cloud /Online is now a given – dare I say, we have officially entered Cloud Accounting 2.0 phase [quoting Mr David Leary]. Cloud is so much a given in 2018, its no longer needs reference.

Logically, QuickBooks Desktop now gets the suffix:

Watch out legacy business banks

I have been talking up business banking and the convergence with accounting technology for some time. This is no longer a Utopian future state, its here and now. In the UK we’ve seen the rise of CountingUp – a business bank account that is accounting software… And in the US we have seen the rise of the bank of Intuit.

QB Capital has a massive unfair advantage over all legacy lenders. It has the data and the situational relevance to promote loans to SMEs at a relatively low risk and high margin. The stats are amazing, have a read of this.

60 percent of QuickBooks Capital customers would likely not get a loan elsewhere, and 46 percent have never applied for a loan before

From the research I’ve done, business lending to SMEs in the US is something like a $300b industry. Intuit are growing the industry 2.5X overnight (given 60% would not otherwise have got a loan). The numbers are eye watering. I can’t see how the legacy lenders compete long term..? I will now rest my case on criticising Intuit for using a low subscription price to grow market share. Just think of the revenue banking will generate – who cares about subs…???

QB Payments & Payroll and same day clearances (which Intuit are effectively funding) surely dovetail nicely into Intuit offering business bank accounts as payments did for Tyro in Australia… They’ll have to fund all those loans somehow… Deposits are a cheap funding source… #WatchThisSpace

An event engaging the world

In the sphere of SME Cloud Accounting, Intuit are building an event with QBConnect that at this stage is unrivaled and for that fact is building a legacy for connecting the worldwide industry. It genuinely seems like THE world-event. With leaders, speakers and influencers from far and wide brought together (at Intuit’s expense) to socialise, philosphise and debate the industry trends.

This humble country kid from Australia, sharing a couple of international drinks with the legends Alison Ball (Canadian), Paul Dunn (Singaporean) and Paul Shrimpling (very British)

I genuinely think as an industry, regardless of which team you support (if any), QBConnect offers the opportunity to connect off the social channels, in real life, like no other. Here we can present, discuss, argue and grow our individual and collective knowledge and opinions. I think all in attendance are grateful to Intuit for such an opportunity!

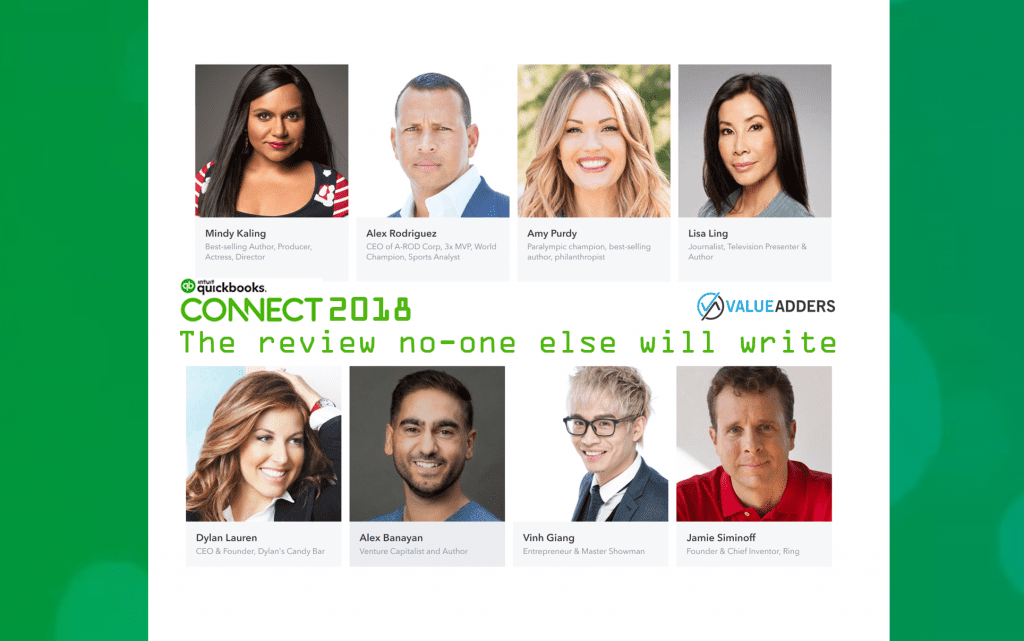

The celebrities and their shared legacies

Intuit are big on the celebrity speaker. From Oprah to Shaq, Tyra Banks to Michael Phelps and A ROD, QBConnect has for 5 years been consistently led with the keynotes from BIG personal brands sharing their stories of failures on the path to (or after) success. 2018 was true to form, with the common theme among the truly awe inspiring speakers with BIG legacies (such as Amy Purdy, A ROD, Mindy Kaling and Alex Banayan), a life journey that describes a seemingly real, attainable path to the seemingly unattainable heights of success.

HubDoc relegated to the deep, dark depths

Its surely not a coincidence that HubDoc received possibly the worst stand in the exhibition hall. As a product now owned by Intuit’s major competitor, I suspect this might be HubDocs last QBConnect. The announcement of HubDoc like Bank Statement fetch felt a direct reaction to Xero’s acquisition.

When I queried Goodarzi on when is an open platform NOT an open platform, his response was clear. It’s open until:

- You come after our customer;

- You come after our data;

- The inertia of competition takes over;

I suspect the latter will eventually apply to HubDoc (and TSheets in reverse).

Intuit’s mid-market Legacy

Shortly before QBConnect 2018, Intuit announced QuickBooks Online Advanced. QBConnect allowed me to dig into this announcement…

Intuit have some 140,000 active companies on their QuickBooks Desktop Premier. That’s domination of the US mid-market by my count. Now that’s a legacy client base! To this point, they have offered no Online equivalent. And to be frank, they still aren’t there yet either…

All I can take away from QB Advanced at this point is Fathom seem the logical next acquisition for Intuit…Apart from embedding Fathom as part of the $150/month licence cost, most features of the new “mid-market offering” are coming. Better user access permissions… coming. Better inventory controls… coming. Yadda yadda yadda…

As a person fascinated by the intersection of SME Cloud Accounting and ERP, I await genuine development in this space with great anticipation!

Paul Dunn’s legacy

I can’t comment on legacy with regards to QBConnect 2018, without mentioning the source and the legend that is Paul Dunn. Paul along with Ron Baker published “The Firm of The Future” book 15 years ago. The industry has been catching up ever since. Intuit have even built a brand and a contest out of Firm of the Future over the last 5 years – a decade after Paul and Ron!

Paul’s mission and presentation at QBCOnnect, is now living his legacy, using his tremendous influence and role as Chair, to grow B1G1 – Business for good founded by Masami Sato. Their mission is BIG, tackling the 17 Global Goals for a better world, one impact at a time! It’s hard not to see this as a movement, far bigger than Firm of The Future. Paul is again at the forefront, living an indelible legacy, one which WILL have long-term positive impact on the world.

Conclusion

- Intuit are a BIG company building a big moat on their way to market leadership in the SME cloud accounting space;

- 2018 appears a bit of a transition year, both in senior management and product releases. We appear to absolutely be entering Cloud Accounting 2.0 phase and I will for one will hold Intuit to account on accelerating its product development and feature releases in 2019, as 2018 felt, to be frank, quite sparse on front-end feature announcements;

- Sasan Goodarzi has MASSIVE shoes to fill as CEO, but with Brad remaining in the role of Chair, no doubt he will get plenty of guidance;

- I expect a bit of an acquisitions war to break out between Xero and Intuit, as both try to accelerate towards the future and continue to buy in innovation and talent;

- The banking future has arrived to SME cloud accounting tech;

Acknowledgement

Matt attended QBConnect 2018 as a guest of Intuit.

___

For more on Accounting, Payroll & HR tech:

Follow On Twitter: https://twitter.com/mattpaff and https://twitter.com/valueadders

Follow our Blog: https://valueadders.com.au/articles/

Follow our LinkedIn: https://www.linkedin.com/company/value-adders/

Like on Facebook: https://www.facebook.com/valueadders/

Follow on Medium: https://medium.com/@mattpaff