And why the likes of Intuit, Sage, Xero and MYOB are investing so much to make it happen

A couple of recent interactions have led me to believe that the broader market doesn’t fully appreciate the potential for the accounting technology industry. My intention over a series of articles, is to highlight my view of where the industry is headed and why I and many others are so excited to be part of what is unfolding.

In this article I am going to focus on the Accounting Financial (Services) Technology (#Fintech) opportunity. To do this, I’ll look at a common measure for “Software-As-A-Service” (SAAS) businesses: CLTV – Customer Lifetime Value (otherwise known as LTV for Lifetime Value) and use it to explain why I think the accounting fintech opportunity is so BIG.

As the name suggests, CLTV is the average total revenue per client across the period subscribe to the solution.

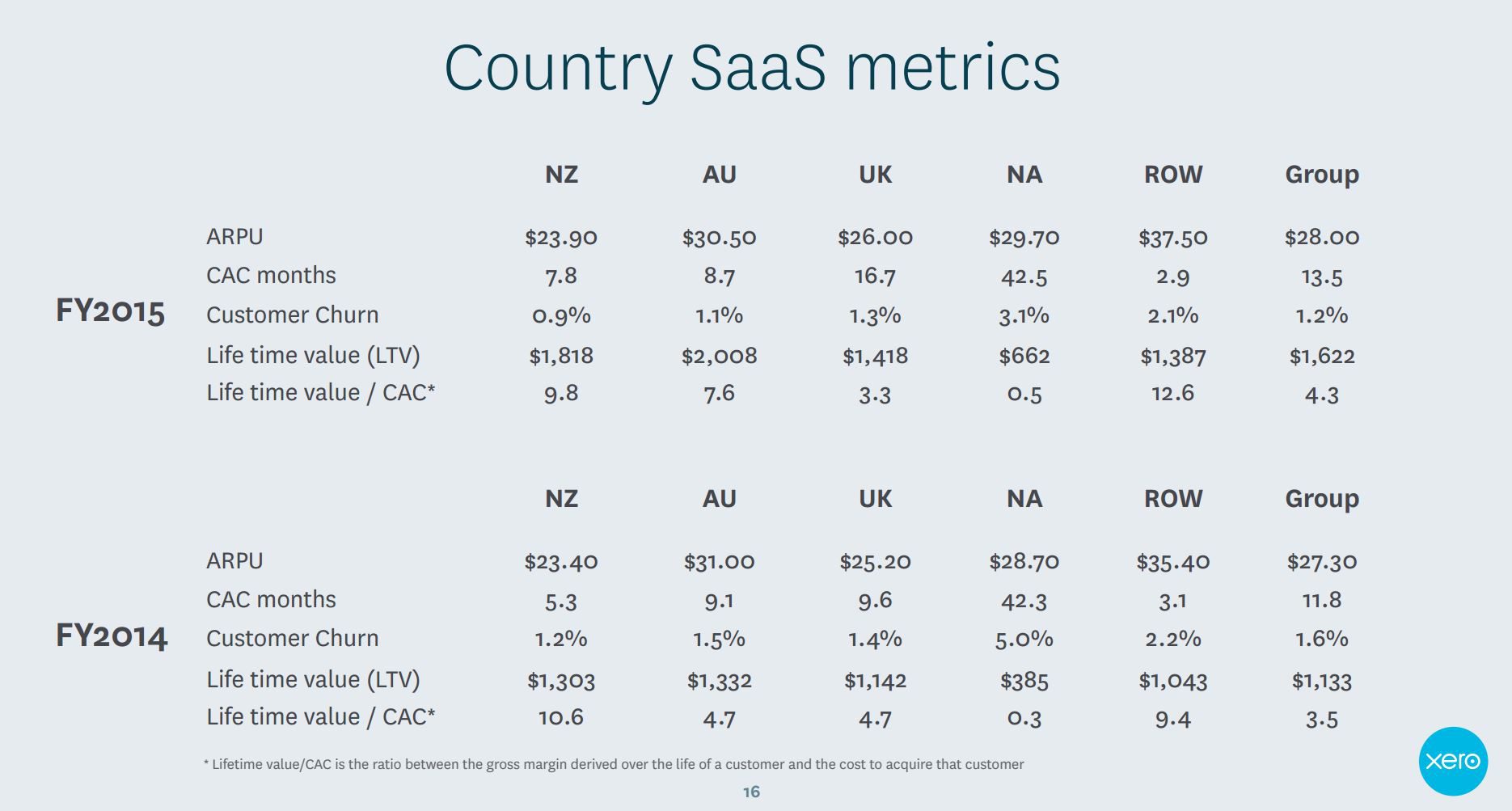

What most people get, is that CLTV within the accounting technology space, is growing with the move to online systems, simply by changing from one-off purchase to a subscription model. BUT a key point, which it seems many do not yet appreciate, is that current CLTVs (e.g. Xero quoted NZ$1,622 and growing for FY2015) are in no way reflective of future CLTVs as the industry continues to grow and evolve. And here’s why:

- The customer mix to-date, does not reflect the future customer mix.

- Revenue sources to-date, do not fully reflect future revenue sources.

Customer Mix

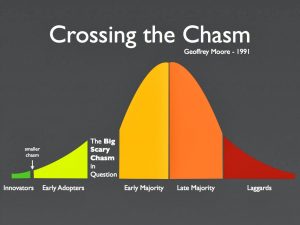

Across the world we are seeing online accounting adoption really starting to grow, with more regions “Crossing the Chasm” from early adopters to early majority.

Crossing the Chasm, Geoffrey Moore

Important to note the fact that up until this point in time, the ratio of start-up businesses using Cloud Accounting, is disproportionally higher than the broader economy. There are a few key reasons:

- immature cloud solutions historically lacked functionality and weren’t a 1-for-1 replacement for desktop offerings. Established businesses wed to certain functionality within their existing desktop systems, found it harder to justify changing than a new company without existing expectations.

- Similarly, businesses with no attachment to existing desktop systems, don’t suffer from the “sunk-cost fallacy” – “we’ve invested too much in the existing system to change”.

- Desire to retain extensive data history vs having no data history makes adoption easier for new businesses.

So with more new businesses on the platforms, CLTV is impacted as start-ups typically:

- Have a higher failure rate – which contributes to higher customer churn (another key SAAS measure)

- Are smaller and therefore more likely to pay for lower price point offerings and have fewer company files

My contention is CLTV will start to rise sharply as the customer mix using online accounting solutions more reflects the broader market. Xero’s figures below show this with both lower churn figures in higher penetrated markets & growing CLTV. You can see NZ (by far the region with the highest cloud accounting adoption) has the lowest churn and significant growth in CLTV FY14 vs FY15 as they crossed the chasm and the early majority jumped on board.

Xero Investor Update April 2015

The fact is, these systems are now usurping the functionality of desktop systems (particularly when ecosystems are considered) so barriers to exit from existing desktop products are diminishing as the value proposition for online grows and grows. Also consider how the early adopter businesses are growing and moving up the price points and expanding their number of data files.

All this points to expected growth in CLTV from higher and longer subscriptions.

We’re talking Fintech, not just accounting tech!

Current revenues are primarily generated through subscriptions, hence the wide use of the ACMR (Annualised Committed Monthly Revenues) as a measure of growth and success. But the key point is subscription is by no means the only, possibly nor even the largest source of future revenues per customer.

Let me highlight the fact that:

- Intuit and MYOB have relationships with Ondeck

- MYOB have a relationship with Mint Payments for mobile SME payment collection

- Xero have formed direct relationships with Banks (starting with NAB).

- Stand-alone Payroll and Benefits companies like Zenefits (a multi-billion dollar valuation start-up), give their software away for free to get the brokerage fees on financial services such as Workers Compensation Insurance. Financial services, which the accounting tech companies can similarly leverage either through the accounting platform or the attached payroll systems.

The future of accounting tech is significant revenues being generated through the provision of Financial Services. Those financial services can be extremely wide and varied in nature, from loans to payments, from insurance to simply “group buying power” of practically any product or service.

As an example, let’s just look at SME loans, recognised widely as an area for significant growth and disruption of existing solutions. The accounting platform is THE perfect access point to SME loans, for several reasons:

- Situationally Relevant, Complimentary Offering: In any sales environment, providing solutions when problems are “front-of-mind” shortens the decision making process. And if the user experience is well designed, the sales cycle can be dramatically reduced. With online and mobile access seeing more decision makers using online accounting platforms to stay abreast of company performance, offering ways for those decision makers to fund business aspirations and reduce expenses in the same place, is logical.

- Leveraging Existing Trust Relationship: Accountants & Bookkeepers are THE trusted advisors to SMEs and this will only grow as the service offering they provide evolves. As accounting technology vendors continue to grow their relationships with these aggregators, they leverage the trust relationship the partner has to create an easy point of access.

- Competitive Pricing through Risk Management: with direct access to “the numbers”, business loan lending risk can be managed like never before, both at the time of approving the loan and on an ongoing portfolio risk management basis. This leads to lower levels of default which in turn allows for more competitive pricing and/or higher margins.

How big is this opportunity? Talk is Intuit forecast a 9% annual return on the billion dollar Quickbooks Financing fund serviced by Ondeck.

SME Loans alone WILL mean a dramatic rise in CLTV for smart Online accounting vendors with the size and scope to leverage the opportunity. Add in a multitude of other Financial Services like clipping the ticket on payments, insurance etc and you start to appreciate the CLTV opportunity.

Augment a sky-rocketing CLTV with ballooning client numbers as more and more business move online for their accounting tech, and the sky is the limit for the opportunity!

___

For more commentary by the author on Accounting & Payroll fintech:

- LinkedIn: https://au.linkedin.com/in/mattpaff

- Twitter: https://twitter.com/mattpaff

1 Comment