The end of May marked the third installment of the Australian QuickBooks Connect (QB Connect) event. This was the first year Intuit took their big show to Melbourne, in fact it was the first year the event traveled away from Sydney.

Over three days (Developer day Wednesday 29/5, Main Day Thursday and Bookkeepers, Accountants & Advisors’ day Friday), as always, Intuit ran a very slick event. As a regular of the major US edition in San Jose, Australia has for my mind, reflected a “little sister” event compared to what is dished out in California. But I must say, QB Connect Au 2019 was the year little sister grew up! I found the whole event slick, on point and well put together.

But let me backtrack… it wouldn’t be a Matt Paff review without a genuine critique of the event itself, the content and the associated announcements. Here were my main high- and low-lights:

Event Speakers/Content

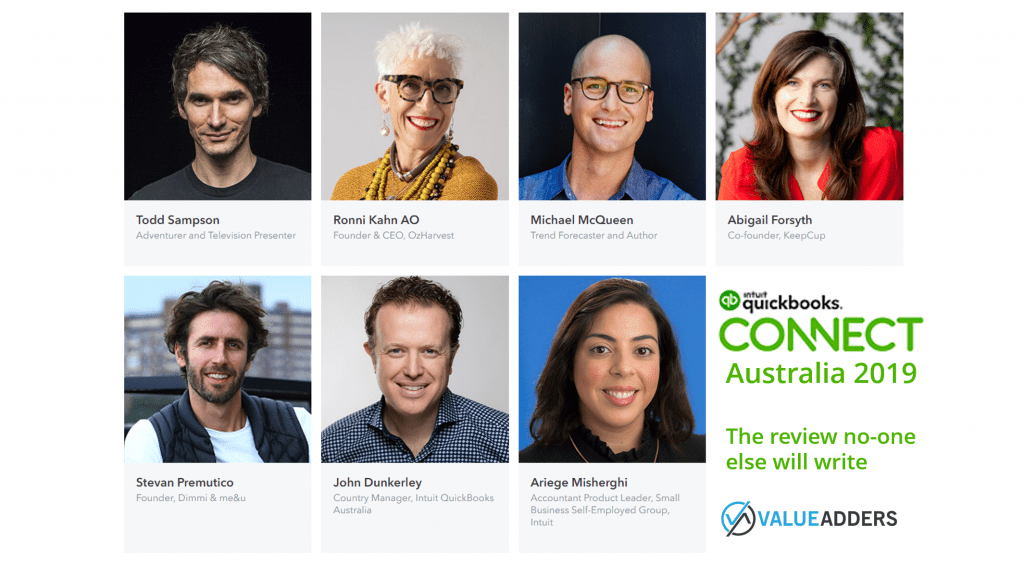

First class! Noticeably Aussie. “Beautifully gender diverse” (as so elegantly put by Inbal Rodnay Steinberg). A great mix of celebrity, industry, and company (Intuit) presentations and panels.

Exhibition Area

The vendors I spoke to, talked positively about the quality and quantity of new prospects they met. The delegates spoke to a confusing amount of reporting apps, but otherwise felt the key verticals were covered.

Seriously… ���#QBConnect pic.twitter.com/jzZxu5FDbZ

— RBS_Australia (@RBS_Australia) May 30, 2019

The Delegates

QB Connect seems to attract a noticeably different audience to Xerocon. A mix of former Reckon partners, “rusted on” “dyed in the wool” MYOB partners who resisted the blue temptation or merely dabbled, and dare I say price conscious agnostics… This makes for a slightly older average delegate age, perhaps earlier in their journey to the cloud and automation and more bookkeeper heavy event (when compared to Xerocon).

This makes the QB Live announcement (see below) so interesting. On one hand, the Intuit Australia channel may be more likely to see QB Live as a competitive offering. On the other, they also might be more likely to want to offer their services to Intuit as an hourly rate to stablise and grow their own revenue.

The Announcements – For Clients

QB Live coming to Australia

So QB Live is not new, its been in the US, tested, debated, proven over the past few months. A lot of people knew QB Live would probably be part of the QB Connect Au announcements.

This is an inevitable evolution for the industry. Here’s me in June 2018 asking the CEOs of Intuit and Xero Australia when they would start offering Bookkeeping/Accounting services:

Watch out @mattpaff has the mic? #hardcorequestions #SGMS18 pic.twitter.com/2vo1CJKSBQ

— Lielette Calleja (@LieletteCalleja) June 28, 2018

That night I was booed by some. Scoffed at for the ridiculousness of the question. Someone even tried to take the microphone off me… but, if anyone had seen the runaway success for TurboTax Live in the US (where Intuit bundle “ask a tax advisor” service with their personal tax product), they knew QB Live was inevitable.

TurboTax Live is, from all reports, Intuit’s fast growing new product ever! Since launching in November 2017, Intuit have amassed 4,000 (Pro) advisors working with them to deliver the service! And from a business perspective, TurboTax Live:

- Grows ARPU & LTV (average revenue per user & LifeTime Value);

- Reduces churn (needing advice was the #1 reason people would change from self-lodgement to visiting an accountant);

- Grows Intuit’s Serviceable Available Market (SAM) and Serviceable Obtainable Market (SOM) as they take business from the $20b/year tax professional industry.

All things that investors love to hear! Intuit’s need to do this is even more apparent when one considers the rise of the “Intuit disruptors” in the US already bundling software with bookkeeping, like:

So personally when I see QB Live announced I think, oh well, that was inevitable. For others, busy in their daily lives as bookkeepers, not joining the Intuit earnings calls or researching trends as closely as I do, this was THE MAJOR announcement of the event, perhaps the first time they were hearing about it. The lack of cheering when announced, suggested this will take time to absorb.

As alluded to above, the QB Connect audience are perhaps most directly affected. They will either perceive this as:

- A threat to their own businesses – how do we compete with the behemoth?

- An opportunity to work directly for Intuit and supplement their income with stable, steady work (QB Connect is contracted out to Pro Advisors); OR

- Not much – it will never compete with the personal service I offer, it’ll mop up the businesses who are price conscious or not appreciative of our service value.

Receipt Capture

I can’t tell you the number of “tips” I’ve received about Intuit buying ReceiptBank since Xero acquired Hubdoc. I have never believed the rumour as I always suspected Intuit would build rather than buy. And with the announcement of Receipt Capture, the rumours can now be put to bed:

Intuit following Xero into native versions of @ReceiptBank with receipt capture and bill automation@divinecassie #QBConnect pic.twitter.com/OzpZYTaaUW

— Matt Paff (@mattpaff) May 29, 2019

Though, whilst the announcement seemed big, the reality of the of the on-stand demo vs product market fit has me astonished how early this announcement seems to have come… So here’s what has me perplexed:

- Rather than just add OCR to the existing expense capture in QBo (which allows you to snap a photo and manually enter the expense details), they have built an entirely new process and menu… OK

- So you snap the photo in the app and that’s it, it then creates a “bank feeds like” receipts feed in your QBo, meaning, for a small business, they have actually added a step into the process and I can’t just enter the expense and move on like I can with the existing Expense capture. I have to snap the receipt on my phone app, then log into a browser to complete the coding and allocation… What tha?! What happened to mobile first Dev. guys???

- Also they talked about emailing your receipts to receipts@quickbooks.com… so I ask: How will intuit know what dataset it goes to..? You register your SENDERS email address… what if I have multiple datasets and one email… ah…. How about if I have multiple staff – does each staff member have to register?? … ah, its one per company… What Tha?!

- So why not, do like every other OCR vendor does, and reverse it. Create a @quickbooks.com email address per company (eg 189546@quickbooks.com) and let people send their bills/receipts to there knowing which company it belongs to – they can even give this address directly to their suppliers to send the bills directly to QBo… ah… seriously, What Tha??!

- Either this product has not been tested in market at all, or the person on the stand who was demoing the product had no idea about the product he was demoing… Someone from Intuit correct me here? Please…

Mileage (Kilometreage) tracking

Finally makes it’s way out of QB Self Employed (SE) into QBo.

The Announcements – For Pro Advisors

There is NO doubt, Intuit have held to Rich Preece’s commitment 18 month’s ago at QBConnect San Jose, to invest heavily in Practice Management (QBo Accountant – QBoA). We have seen steady progress ever since, but QB Connect Melbourne is when Intuit leapt ahead of MYOB & Sage in my mind, to come close to offering a genuine practice management in the cloud (for small firms and Bookkeepers)!

Tax pre-Preparation

QBoA now offers a central location for preparing a client’s data for a tax return. Adjustments, corrections (not quite Xero’s find and recode, yet) etc from the QBoA portal, WITHOUT jumping into individual client files. #Nice!

LodgeiT Integration and Exclusivity

Once prepared, you then click the button to push the client’s data into LodgeiT for tax preparation and lodgement. Intuit now has an exclusive arrangement with Andrew Noble’s company to delivery genuine tax in the cloud… something the market has been demanding for a long time and something outside Xero, few incumbents have delivered! #GameOn

Boom! This just happened… #QBConnect @QuickBooksAU super excited to be working with the @LodgeIT team and driving tax automation for advisors! pic.twitter.com/POQCLbBNfU

— Matthew Pisarski (@intuit_matt) May 30, 2019

Bank Statement Fetch

No doubt responding to the Xero’s acquisition of Hubdoc, Intuit have now built in source document fetch for Bank Statements. THIS IS NOT bank feeds for those responding on Twitter about this new feature. This is embedding into client’s QBo dataset, the source documents to provide accountants with an audit of the client’s reconciled bank accounts.

Benchmarking

Not the first time I’ve seen this announced, but still cool. If there’s one thing having more online customers than anyone else gives you as a significant competitive advantage it has to be data. What you do with that data is where you get leverage. Benchmarking is coming to QBo and it has potential to be very cool. Allowing SMEs and their advisors to assess performance against similar businesses is powerful. I loved this idea when I saw it in Bstar a decade ago. The difference, Intuit has the data and it will get used!

The Interviews

I was lucky enough to score a press pass to QB Connect which gave me access to one-on-one interviews with John Dunkerley (acting Au Country head), Ariege Misherghi(Accountant segment business leader) and a pre-event pep talk with one of my favs Rich Preece (the face of QB Live).

JD

I think my questions for John were a little prickly, a tad cheeky. But hey, that’s my MO…

So, John was happy to tell me Single Touch Payroll is proving a real boost for Intuit in Australia, driving strong growth.

Inevitably this leaves me thinking… STP has been coming for some time. It didn’t take a genius to predict it would grow the cloud accounting & payroll market. Intuit in partnering with KeyPay in Australia, are giving away margin in that core space where growth is occurring (sub 5 employee businesses). Intuit cannot be making much margin/LTV per client (in fact I would guess their Marginal LifeTime Value vs Customer Acquisition Cost is nigh on zero, possibly negative…).

They also have the SAME payroll as Sage (who also partner with KeyPay in this space, embedding KeyPay in Sage Business Cloud Accounting, the product formerly known as SageOne) – so much for differentiation!

So its fair, is it not, for my questioning to be about KeyPay and where is Intuit with bringing its global payroll to Australia (an acquisition from 4.5 years ago called Acrede)? Intuit has openly discussed their plan to bring Acrede down under since the acquisition.

Q: Is the plan to still bring Acrede to Australia? A: KeyPay is a key partner…

Q: Would STP not have been the logical time to launch it here? Afterall, you’ve had 4.5 years to localise it…? A: STP has been good for us and KeyPay is a critical partner…

Q: Wouldn’t owning your own source code have made the economics of STP better for Intuit? A: We don’t offer a stand alone payroll [because you don’t have one…]

Q: Wouldn’t owning your own payroll not have made for a key point of difference at this critical point in the market evolution? A: Well we make decisions on building vs partnering all the time, like LodgeiT… KeyPay are a key strategic partner in this market…

I’ll accept these are not easy questions to answer publicly, particularly for an interim country manager, and so John I apologies for putting you on the spot, but I did not get a response that came close to addressing any of these important questions… so they remain, here on public record. 🙂

Ariege

Ariege Misherghi is the global lead of Accountant (and Bookkeeper) business at Intuit. She has taken the role having a deep resume in the product management space, no coincidence I suspect, at a time when Intuit are building and delivering a number of products for this segment after years of basically end-user only focus.

On my way to the airport rocking my new @tsheets swag. Their swag is *always* the best, isn’t it? Show me your @tsheets swag all!#SwagYouActuallyWant #TurnsOutILikeTruckerHats #GoodbyeMelbourne #QBConnect pic.twitter.com/LG18HbFLf2

— Ariege Misherghi (@ariegem) June 1, 2019

On one hand, Ariege has a tonne of cool new features to excite the segment. QuickBooks Online Accountant has grown from simply a portal aggregating client access, to a genuine practice management platform equipped with kanban project management, task automation and tax preparation.

On the other, Intuit are launching QB Live, which could and will be seen as directly competing with her segment.

I think it no coincidence that her predecessor Rich Preece has become the face of QB Live – as Ariege’s predecessor he is well-known to and well-liked by accountants & bookkeepers. He’s very transparent and honest. And it helps, he’s quite handsome and has that Bond-like British accent to disarm you. Rich can cop the awkward questions and leave Ariege the glory of the product-led, winning favour with the segment. Afterall, all these practice management tools Intuit are launching are free!

So of interest from my interview with Ariege: what’s next? What from a product perspective, excites about the road ahead?

Her response: Advisory tools and Intuit helping accountants and bookkeepers monentise in the advisory space as Intuit automate the mundane, bookkeeping processes.

This inevitably leads me to ask: so, if Intuit are making certain features available in QBoA only, so Pro Advisors can monetise in that space, won’t power users rightly be upset at features being withheld? Afterall, the majority of QBo users are direct and NOT attached to an accountant or bookkeeper…

Ariege delivers a measured and reasoned response: Intuit’s research clearly identifies that SMEs want to work with a trusted advisor, someone who can interpret the numbers and reports to guide them on their journey. Offering advisors information to help give SMEs what they want, is not incongruent with a customer-driven strategy.

In Closing

QB Connect may only be 3 years young in Australia. It may attract a fraction of the attendance of Xerocon and even the MYOB Incite events, but if Intuit keep delivering at the scale of the 2019 edition of QB Connect Melbourne, this event will grow as an industry must-do, not just for the existing fans of Intuit, but for those interested in what else is happening in the segment.

And if Intuit can get the balance right with QB Live and the continued development of the QBoA practice management platform, Intuit will cause serious disruption to MYOB and Sage in the Bookkeeping and small practice end of the market. This will ultimately affect Xero.

I continue to be disappointed by Intuit’s efforts to locationalise the end product (QBo) for the Australian market and QB Connect 2019 did little to demonstrate a local commitment (outside LodgeiT integration for Pro Advisors). Admittedly the BAS/IAS area, in the last 12 months, has finally shown some signs of a genuine commitment to gain better market fit, but Accounts Payable continues to languish competitors, as does the KeyPay/Projects/Class/Location/GL interface (the fact there was a session on how to work around the clunkiness of costing between QBo and KeyPay, says this area needs work).

Anyway, all in all, its clear to see Intuit are playing the long game here in Australia. QB Connect is a serious event, from a serious player. It gets two thumbs up from me.

_______________________________

For more on Accounting, ERP, Payroll & HR tech:

Follow On Twitter: https://twitter.com/mattpaff and https://twitter.com/valueadders

Follow our Blog: https://valueadders.com.au/articles/

Follow our LinkedIn: https://www.linkedin.com/company/value-adders/

Like on Facebook: https://www.facebook.com/valueadders/

Follow on Medium: https://medium.com/@mattpaff