We get contacted a lot about what is the best accounting / bookkeeping software to use in Australian businesses. The standard consultant and right answer is always “it depends”. It depends on so many things:

- What industry you’re in?

- What business goals you have (an exit, growth, status quo etc)?

- Who is going to drive the system and what experience/skills do they have?

- How big is the company?

- What problems are you trying to solve?

- Do you have an existing system and what is it?

- Does your bookkeeper or external accountant have a preference?

- Do you need mobility in your business around data entry and reporting?

- …and the list goes on

Realistically, whilst the list of “it depends” questions can be very long, different answers still end up with the same recommended solutions, time and again.

This is especially the case when your turn-over is less than $3m and you have less than 20 employees (the majority of companies in Australia). Above that, I’d call you a mid-sized business, you’ll likely be confronted by the SMERP Dilemma, you should read this and then you should come and talk to us at Value Adders, to help guide you in your decision making.

But if you do fit into the small and micro-business majority demographic, and you’re interested in choosing the right software, then read on.

Reality check – most “will do”

First thing is first: most available retail bookkeeping/accounting software will do the/a job. Invoicing. Expenses. Projects. Estimates. Bank feeds…. There is some level of homogenisation.

In accounting terms, a Dr is a Debit and a Cr is a Credit and realistically any one of the top dozen most popular options will work for most small and micro businesses.

By our calculations, the top 12 most popular accounting / bookkeeping software in Australia are:

- Xero

- MYOB (Business & AccountRight – 2 convergent products).

- QuickBooks (Online or Self Employed)

- ReckonOne

- Freshbooks

- Rounded

- Saasu (now owned by Erly)

- ZohoBooks

- Hnry

- Thriday

- CashFlow Manager

- Q6

These mostly satisfy the baseline prerequisites I always advise when choosing business software for small and micro-businesses:

- To ensure the software will more likely be around 5 years from now, go for the browser and mobile-based options only (this includes all of the above);

- To ensure the software vendor will be around 5 years from now, go for well-known, established brand with a decent sized client base over the flashy and new (most of the top ten will likely be here 5 years from now);

I know at this point, some people will just be thinking, what’s the cheapest? And I’ll always say the lowest price is rarely the best value, knowing some people won’t hear me and will just look at the pricing, at which point:

- I used to say Wave – it is free, but apparently they have discontinued sign-ups outside of North America from December 30, 2020 – but it seems you can still sign up, without geo-blocking??

- If you have a small number of “contacts” (customers and suppliers), both ZohoBooks and Freshbooks can be cheap – else check out Saasu starting at $15/m.

- and if you need a payroll app for Single Touch Payroll, Payroller and Reckon STP app are free

Those wanting the best value and not just the cheapest, read-on.

The question is then what will be the best fit, over a period of time, delivering the fewest compromises and providing a genuine return on investment?

To help narrow in on an answer, I’ve unpicked the things I see as the key considerations:

Key considerations for choosing the best accounting software

1. Your Accountant’s / Bookkeeper’s software preference

I stress this relates to SMALL and micro businesses only (<20 staff, sub $3m turnover).

- Are you delighted with your existing external Accountant / Tax Agent?

- If yes, go and ask them what software they’d recommend/prefer you use.

- If no, the first place to start (almost in business let alone in choosing business software) is to work with a good external accountant. One that delights you, not just the one you know. The technology they use, *should* influence your decision whilst you are small.

- Hnry is interesting as they offer freelancers the “whole package” – software and tax accounting.

- Do you use or do you intend to use a bookkeeper that delights you?

- If yes, go and ask them what software they’d recommend. My view is, the bookkeeper’s opinion/preference (due to regularity of use and intimate knowledge of your business) trumps the accountant’s.

- If no, see question 1.

Invariably, I would suggest more accountant’s and bookkeepers these days will prefer Xero, followed by MYOB and QuickBooks Online.

If you’re accountant or bookkeeper is industry focused (such as creatives or trades), they may favour the lesser known products like Rounded or Freshbooks – but most will suggest one of the BIG 3.

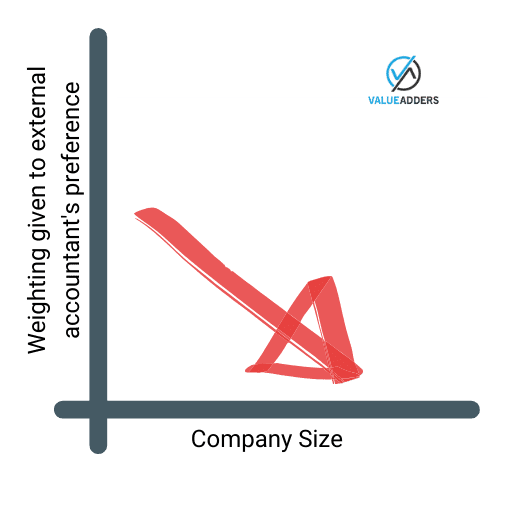

I am obliged to emphasise once again that I personally find the value of external accountant and bookkeepers preferences on business systems, as inversely proportional to company size.

2. Integration with operational software

The bookkeeping software is often not the key operational tool these days. If you’re in retail or hospitality, you need a Point Of Sale System like Square, Lightspeed or Hike.

If you are a tradie, whilst you can probably get away with just using the bookkeeping apps on their own (particularly the mobile friendly QuickBooks, Xero and Freshbooks), you might consider tradie specific apps like ServiceM8, Tradify, NextMinute and Simpro

If you’re a yoga studio or gym you need apps like Mindbody to book your appointments and manage your classes. I could go on…

My point is that the accounting/bookkeeping software is less important than the key operational software. This means the key value of the bookkeeping software is its ability to integrate with these operational tools and the number of options that these integrations make available.

Xero wins hands down in Australia in this regard. Followed by QuickBooks (who’s add-ons suffer from different connections per region and so often good apps only connect with the US QBo). Then MYOB.

Whilst most offer integrations to best-of-breed 3rd party operational tools, Zoho probably deserves a special mention, with ZohoBooks being one small part of a comprehensive suite of products the company bundles under the ZohoOne offering. From accounting to reporting, inventory management to email marketing, CRM to project management and beyond… ZohoOne is marketed as “The Holistic Approach To Business Software”. It is impressive at the price point.

3. Best accounting software mobile apps

10 years ago the concept of allocating bank statement transactions such as customer payments on a mobile device would have sounded ridiculous to me. Now, its where I do most of my bookkeeping. I personal value the mobile capability of an app highly and think it shows a company who understands and keeps up with the technology and customer demands.

On this score I rate QuickBooks (Online) slightly ahead of Xero, as far as comprehensive solutions on a mobile. ZohoBooks also scores well with a comprehensive mobile solution. Meanwhile small Australian player Rounded aren’t as comprehensive with their mobile solution, but rate very highly in the app stores for user satisfaction.

MYOB’s offering on mobile is disjointed and weak compared to its competitors.

4. Accounting Software Automation

If the last few years have been about the trend to mobile, then I believe beyond 2024 is about automated workflows and Artificial Intelligence (AI).

The best systems offer functionality such as:

- Automated debtor reminders (Xero, MYOB Essentials, ZohoBooks);

- Recurring transactions such as invoices, bills and journal entries (QuickBooks Online, Xero, ZohoBooks)

- Auto-coding of banking transactions – evolving from customer defined rules to suggestions driven by big data and AI (QuickBooks, MYOB, Xero)

- Automation of bill/expense entries, from pdf or image to entered and coded (Xero, MYOB, QuickBooks and ZohoBooks)

All told, it takes large datasets and significant resources to build automation engines that work effectively.

Automation is the economic moat or barrier to competition where global players have a massive competitive advantage. We are already seeing the likes of Intuit (QuickBooks), Xero and Zoho deliver in this area and I can only see them accelerating away from smaller players because of their size, access to data and significant human capital to build such things.

5. Integrated Payroll

Single-touch payroll is a requirement for any business with employees. If you have staff, you need a modern payroll software to give you compliance and ease of process. If you’ve set-up as a company, chances you’ll be paying yourself as an employee and need a payroll system.

QuickBooks has partnered with EmploymentHero (formerly KeyPay) to bundle Payroll as part of their Australian QuickBooks Online solutions. EmploymentHero Payroll as an embedded “best-of-breed” probably wins on this front.

Xero‘s Payroll is not its absolute strength, but it is more than decent. MYOB have been improving their offerings in recent years.

Saasu, ReckonOne and Q6 all offer OK integrated Payroll solutions included or at a small additional cost.

6. Can you just Google it?

Not sure how to do something? What’s the quickest way to work it out. Just Google it…

I think giving weighting to a product based on the availability of online content for a wide range of How Tos, from wikis to community help, Facebook groups to Youtube… is a fair assessment point as it is the modern way people learn systems.

Logically the big players have more content online from themselves and their communities/partners. For mine, Xero is best in Australia for “just googling it”. QuickBooks Online has the most content but suffers from American dominant focus, where the product is slightly different. MYOB deserves an honourable mention for the volume of market specific content, though there are multiple versions and you can get lost in which product, which version etc.

7. Support

On customer feedback alone, Rounded probably scores the highest on support satisfaction. Its only fair to point out that customer support in software for small and micro businesses, is very difficult to scale well. I would suggest Rounded leads the way as they remain small and haven’t yet experienced the scaling problem and their key directors are still very hands-on in supporting their clients.

QuickBooks scores well for support in Australia, probably ahead of the other BIG players by offering phone, email and live chat support. MYOB offer phone and other forms of support to a high level (though my experience is not as timely as QuickBooks). Xero cops a bit flack for not offering phone support (see this thread for example), but not everyone wants phone support in 2024 and in general Xero do OK, given their size and their responsiveness to online queries.

8. Pricing

I’ve accused QuickBooks of price dumping in the Australian market before (big US player looking to muscle Xero in their home market). I think there has been a noticable shift away from this though in recent times. They have increased their prices, but still under-cut the Xero and MYOB price for equivalent offerings.

Reckon used to have very aggressive pricing on ReckonOne using a modular approach and an entry point at just $8/month – but we note this has changed a bit of late and the base entry point with customer invoicing now seems to be $20/m – still cheap, but not significantly cheaper.

Saasu is good value for what you get, starting at just $15/month.

Freshbooks and ZohoBooks seem great value too, but I really dislike how they use pricing per contact/customer, as even really small businesses can have loads of contacts.

I don’t think MYOB is the best accounting software as I believe they over price their solutions for comparative functionality, relying on the goodwill of their long-standing brand and rusted on, boomer client base.

Xero price relevant to their market-leadership and the premium offering they deliver. You’re unlikely to pick Xero on price alone, though I do believe it offers great value when all factors are considered.

9. Want Accounting or Banking with that?

In recent times we have seen a rise in bundled serves offerings. Products like Hnry, combining software with accounting and taxation support for micro-businesses.

Then there’s the banking apps that double as accounting technologies like Thriday and Papera. This is a trend I saw coming years ago – if you build accounting software around banking transactions (like Xero did in extending on what Banklink did 15 years before), where does the line between a bank account and accounting technology blur? First it was CountingUp in the UK in 2018 and now Thriday and Papera are banking on the same market trend down under.

Each has its market segment. Do I see them unseating Xero, QuickBooks or even MYOB any time soon? No. But if you want these extras, they do make logical sense as a bundled offering.

Conclusion – what is the best accounting software?

I could go on with many more factors to consider when choosing small and micro-business accounting software. The fact is the same names keep popping up.

I genuinely don’t think you can go too wrong choosing any of the top 10 products. If you’re planning to be in business for a while and to grow over time, then I suggest the major players like Xero and QuickBooks is where you should be looking. I think their products are already market leading and the future of automation should see them delivering even better solutions.

If you’re a freelancer, who works and bills on jobs and appreciate a nice aesthetic in your software with great local support, Rounded is a decent option.

If you just want to get your first invoice out and don’t want to spend much/any money yet, Freshbooks is not a bad solution at all.

Looking for “one-throat-to-choke”, a broad toolkit of integrated solutions from one vendor, at a reasonable price, then checkout Zoho.

Want to support Australian manufacturing / companies? Xero is listed on the ASX but still thinks itself a Kiwi company (reporting and paying company tax in kiwiland). MYOB whilst based here, are now owned by KKR, a big international equity firm. This leaves Reckon, Saasu and Rounded as the genuine local players in the top 10.

___

[This article was last updated March 2024]

For more on Cloud Accounting, Payroll, HR tech and ERP Follow On:

This blog: https://valueadders.com.au/articles

Twitter: https://twitter.com/mattpaff and https://twitter.com/valueadders

Follow this Blog: https://valueadders.com.au/articles/

Follow our LinkedIn: https://www.linkedin.com/company/value-adders/

Like on Facebook: https://www.facebook.com/valueadders/

Follow on Medium: https://medium.com/@mattpaff

Or sign up for our email newsletter:

Hi

Whats the best app for say, professionals, wanting to track their assessable income and deductable expenses. I have lots of clients that dont want to budget but just capture tax related information to hand over to accountant at end of year

Cheers

Sam

Hi Sam

You haven’t given me much details, are we talking businesses with ABNs, or just employees?

If the latter, something like QuickBooks Self-Employed might be useful. It allows expense capture and separation of work expenses from personal credit cards/bank transactions.

Then there’s personal finance style products like: Pocketbook, Moneysoft and MyProsperity.

Cheers

Matt

Im after a programme that will allow my to keep track of both personal and self-employed business expenses, bank recs, gst etc. Don’t need to invoice or budget. Any thoughts

Hi Angela

Something like QuickBooks Self-Employed might be useful. It allows expense capture, bank feeds and separation of work expenses from personal credit cards/bank transactions.

Wave is free and could do the job.

ReckonOne is cheap and could probably do the job.

Or you can look at an expense management app like ReceiptBank.

I hope that helps.

Cheers

Matt

Hi Matt,

We are just setting up our small business. We have limited accounting knowledge and less accounting software knowledge! We will not need a payroll system just an account/invoice/billing system and expenses etc for tax returns. We also have minimal knowledge with BAS statements etc. Is there an accounting system that is easy and clear to use and also helpful in generating BAS statements?

I have read your above article and can see that each software package has its own advantages/disadvantages. I feel like support might be something we will need however I am happy to just have online support over phone support. I’m wondering if an Australian product is going to be better for us.

What do you think?

Hi Mardi

The reality is any one of the top ten listed can do the things you need. There is no wrong answer. I come back to the point – do you have an external or accountant or bookkeeper? Or will you be getting one? Their opinion is probably key to decision making.

I hope that helps!

Matt

Do you have an opinion about ‘Free accounting software’?

I assume you’re talking about these guys: https://www.freeaccountingsoftware.com.au/, now: https://www.basoff.com.au/, which is not actually free..?

I am aware of them but I don’t rate them in the top 10 is probably the best answer I can give.

I think Wave is a much better option in the free space… but remember, when you’re not paying for a product, YOU are the product…

Thank you.

I really appreciate your advice.

Hi Matt. I have been using cashflow manager for some time now. I have just changed over to an Apple Mac Book Pro and have discovered that cash flow requires Windows 10 to be downloaded with a split hardrive. Basically it would mean I would have to run Apple and Windows. Can you suggest any other accountancy program that would be using the apple platform only and might make life a little easier please ?. Paul

Paul

The answer is the fact that most of the products I’ve listed are platform independent, browser based solutions you can run on Mac, Windows, Android whatever.

No modern accounting technology worth its salt is written specifically for Mac or Windows anymore.

Cashflow Manager even offers a platform independent browser version I believe: https://www.cashflow-manager.com.au/cloud/

Else you can’t really go wrong with any mentioned in the article. Xero is by far and away the most popular product in Australia. Quuckbooks Online, the most popular globally.

I hope that helps?!

Matt

Hi Matt, Thank you very much for your advice, it is greatly appreciated. Paul