Assessment of listed (International) AuNZ SMB Accounting Tech

In Part I of Getting SaaSy, I assessed the ASX and NZSE listed SMB accounting tech players competing in the Australian and New Zealand market. For purposes of comparison and relevance, in this installment I’ve assessed the two major international players Intuit and Sage, plus, by popular demand I’ve had a look at Netsuite, whilst not really targeting AuNZ SMBs, they are the longest standing accounting tech SaaS cloud player in the world.

I’ve finished by tabulating the key numbers in Australian dollars, across all the assessed companies, which makes for interesting reading indeed.

International Listed Competitors

Intuit

Overview

The dominant US and thus worldwide player. Big head start in SMB cloud accounting launching QBo in 2004. Massive lead with ~1.3m subscriptions and growing 100k/quarter, faster than anyone (though Xero regularly highlight a % are churn from QB desktop).

Highly innovative company. Used as an example by Eric Ries in his book “The Lean Startup”, for how large companies can be innovative and lead the disruption curve.

Exist in the Australian market:

- Because an agreement to acquire Reckon (the logical course of action), didn’t eventuate (rumours have it due to personalities on both sides of the table).

- As a source I shall not name once so subtly put it, “to be a pimple on Xero’s backside in their home market” (which makes their absence from NZ funny…)

If you haven’t read the article by Brian Halligan (CEO of HubSpot) on “Why aren’t there more Intuits?” – please finish reading this then come back and follow this link. It’s a great read on the challenge of scaling SMB software tech companies and recognition of Intuit’s achievement over the past 30+ years. Also, for the pessimists, serves as a warning to Xero’s ability to keep growing at scale.

The Numbers

~1.3m QBo subscribers worldwide with ~30k subscribers in Australia (in my books that puts them behind Xero and MYOB and ahead of Saasu, Reckon and Sage for pure cloud SaaS subscribers), though how many of these were effectively given away with prices like $4.99 being dominate early..?

More than 8,000 employees with 80 odd Australian based staff (some of whom came from the Invitbox acquisition and work on the US TurboTax product).

Listed on the NASDAQ. By far the biggest with a market cap around Au$35b on revenue of Au$5.5b (giving a market cap to revenue ratio of 6.65). -1% YoY revenue growth FY15 with a dividend of 1.11%. Masses of long-term debt – $3.5b on a debt to revenue ratio of 1.21 and debt to equity of 194%.

Market

The world. Aggressive international expansion, beyond English speaking countries including markets such as Brazil, India, Asia and France.

Direct strategy in Australia running parallel to channel. In the fight with Reckon, Sage, Saasu and Xero for partners (accountants and bookkeepers primarily). Reckon’s channel appears the easy target as they “grew up” on QuickBooks/Intuit products.

Product Strategy (AuNZ)

QBo only though awaiting news on their new “self-employed” product in Australia. TuboTax is a significant product stream in the US, with some Dev in Australia, but not sold here.

No real presence in NZ, though the “International” version of QBo is used/sold into NZ.

Partnered with fast growing Australian “payroll disruptor” KeyPay to offer payroll, after initial partnership with DBit (I recall the name WebPayroll) went south – see comments on SageOne payroll…

Ecosystem

Apps.com – the leading ecosystem for mine. Now offering developers access to QBo framework to build single-sign on, “native” add-ons – I think a seriously smart play. It took them a decade to catch on to the platform rather than application play (QBo went a decade without published APIs), but they certainly caught up quickly.

Fintech

Partnered with OnDeck to offer QuickBooks financing, which signals clear Fintech strategy.

PayPal/credit card “Pay Now” built into invoicing platform – obvious, easy, “clip-the-ticket” Fintech.

Big Data and Machine Learning/Ai

In the best place at this point, to aggregate MASSIVE SMB data worldwide and lead the Big Data and Ai push.

It appears that there is some machine learning within the bank rec, which is pretty cool to see in action I have to say. Still immature but gives great insight into where we are heading with auto-coding of transactions WITHOUT having to set-up your own coding rules. For those not familiar with bank feeds and coding, it’s THE game-changer for cloud accounting tech compared to desktop. Based on the learning engine, QBo allocates transactions for approval saving enormous time in data entry for small business.

Sage

Overview

The dominant UK player with worldwide footprint. Historically cloud deniers and highly acquisitive (after you finish reading this piece, see my previous article on Sage – The Waking Giant for more details), seemingly getting their act together under CEO Stephen Kelly.

“Customer for life” strategy with masses of separate code bases worldwide (from Handisoft to Accpac, Pastel to X3 and Micropay to WageEzy in Australia for example). A new cloud/mobile first focus and putting a lot of eggs into the Salesforce platform play, SageLive.

The Numbers

~13,000 employees worldwide. Listed on the FTSE with a Market Cap equivalent to nearly Au$13b on annual revenue of $2.7b (market cap to revenue of ~4.7). 6% YoY revenue growth with a dividend of 2.49%. Long-term debt of Au$1.1b on a non-current debt to revenue ratio of 0.42 and Debt to Equity of 70%. The largest Goodwill and Intangible Assets balance sheet account, probably indicative of their historical acquisitiveness.

Market

The world. Entry level to enterprise. Client-side and accountant-side.

Channel strategy by product. SageOne seems to be a new channel to market with hope of leveraging the established Handisoft accountant user-base, plus compete with Intuit, SaaSu, Xero etc to get accountants and bookkeepers on board.

Cloud Product Strategy (AuNZ)

- SageOne – entry level “bookkeeping software” – S in SMB. Has bank feeds. Utilises Sky Payroll – which interesting, an ASIC search shows links to D-Bit and redirects from www.webpayroll.com.au – which was Intuits original partner for Payroll in Australia, as I recall it. I assume the reasons for the Intuit bust up didn’t worry Sage in their due diligence?!

- SageLive – coming soon. Mobile-first, built on Salesforce, by my reading mid-market play, perhaps ultimately a replacement in AuNZ for lower end of Accpac (Line 300 – with X3 replacing the upper end of Accpac), but seemingly “all-things-to-all-people” view inside Sage. Why Salesforce? Easy – they recognise accounting tech platforms + Ecosystems are taking over the world, not applications. They were late to market, so a short-cut was to use the world’s leading business tech platform that brings an ecosystem with it!

- X3 – upper mid to enterprise solution, I’m am told is quite deep and powerful.

- Sage Payroll – I’m happy to be corrected, but MicroPay & WageEasy are still desktop applications (though hosted versions are available). I would expect a SaaS/true Cloud Payroll at some point…? As mentioned above, have engaged a third party for SageOne Payroll.

- Advisor Apps – Handisoft is desktop bound, a couple of technology generations behind (in process of SQL upgrade) – cloud strategy? SageView and SageImpact offer immature glimpses of where they are heading for advisors.

Similar view of the world to MYOB – multiple, unrelated products across the gambit of the business accounting tech space.

Ecosystem

By product. Limited on SageOne (https://www.sageone.com.au/apps/). Salesforce’s leading ecosystem (https://appexchange.salesforce.com/) for SageLive.

Fintech

Classify themselves as occupying the golden triangle – Accounting, Payroll and Payments – the latter clearly defining Fintech as core to future strategy.

Big Data and Machine Learning/Ai

? Masses separate data/code-bases will make for interesting strategy. SageView has Big Data written all over it.

Special mention – Netsuite

Overview

Netsuite have pioneered online accounting since being founded in 1998. Originally called NetLedger, at one point the product was renamed “Oracle Small Business Suite” (owing to Larry Ellison’s significant investment/ownership) before settling on the name Netsuite.

Originally exclusively distributed in Australia via NetReturn, a name many might remember from the days when MYOB were involved with a stake of around 35%. The story has it that Netsuite renegotiated the exclusivity clause out of NetReturn’s agreement by the mid-noughties in order to come to Australia direct, which saw NetReturn reassigned as a non-exclusive partner. Within a couple of years Netsuite acquired NetReturn and MYOB exited with other investors (all of which ultimately led to MYOB investing in and distributing Acumatica in direct competition to Netsuite).

With a specific focus upstream of the SMB space Netsuite sees its sweet spot in businesses with 20+ employees – which accounts for less than 3% of Australia’s 2,121,235 businesses (which equates to a target market of ~63,000)!

The Numbers

~4,600 employees worldwide. Listed on the NASDAQ with a Market Cap equivalent to over Au$7b on annual revenue of almost ~Au$1b (market cap to revenue of ~7X). Incredible 33% YoY revenue growth considering they’re nearly a 20 year old company – in fact they have achieved 37% growth per year over the past decade! No dividend, which is common in the US where a dividend is almost seen as a concession that the company isn’t better with investing the cash than the shareholders. Long-term debt of Au$420m on a non-current debt to revenue ratio of 0.42 (basically same as Sage) and Debt to Equity of 93%. Goodwill and Intangible Assets balance sheet account ~Au$470m.

10,000+ companies running 30,000+ subsidiaries and entities across 100+ countries.

SaaS Metrics

If you’re looking for the guru of SaaS metrics I recommend this Tomasz Tunguz – this is a great article he wrote on Netsuite and some of its SaaS Metrics over time. They are quite an amazing example of SaaS success.

Nonetheless, they don’t seem to open to publishing SaaS stats. I’ve tried my best at calculating what I can from what is in the public domain + estimating based on some known stats from JCurve. All care no responsibility here:

Annualised Committed Monthly Revenue (ACMR) – ~Au$800m

Active Subscriptions – ~10,000 (companies running 30,000+ subsidiaries and entities across 100+ countries)

Average Revenue per User (ARPU) monthly – ~Au$6,600 at company level – you see, a very different league to the SMB players discussed before.

Customer Acquisition Cost (CAC) – ? With Sales & Marketing expense 45-50% of revenue, you’d have to think CAC is large compared to the others I have analysed BUT still a fraction of CLTV!

Customer LifeTime Value (CLTV) – unbelievable, but my estimate is >Au$600k/company

Churn – used to be renowned for horrific churn but continued growth suggests very much under control. If JCurve can be used as a benchmark, you’d have to think churn is around 10% or better.

Market

The world. Mid-market to enterprise.

Direct and channel strategy, with professional services making up 20% of revenue.

Whilst there are no practice management or tax tools for advisors, Netsuite off an Accountants’ program with free access to client data, discounts on training plus referral “benefits”.

Product Strategy (AuNZ)

- JCurve – Netsuite “lite” available via JCurve under a distribution agreement, targeting businesses under 20 employees.

- Netsuite – 20+ employee businesses. Key competitors MYOB Advanced, SAPB1, FinancialForce

Ecosystem

Significant and seamless via https://suiteapp.com/.

Fintech

With a mid-to-enterprise focus, Fintech perhaps isn’t as integral to the ERP offering as SMB..? I see Fintech in the accounting tech space focusing on access to volumes of SMBs, which Netsuite isn’t trying to do.

Big Data and Machine Learning/Ai

I think ERP players have a lot to learn from SMB Cloud accounting tech. I can’t comment much on Netsuite’s Big Data/Ai play, but on a whole, I feel ERP land including Netsuite can learn a lot from SMB cloud accounting tech in Bank Reconciliation and AP automation – as a window to the future of accounting tech.

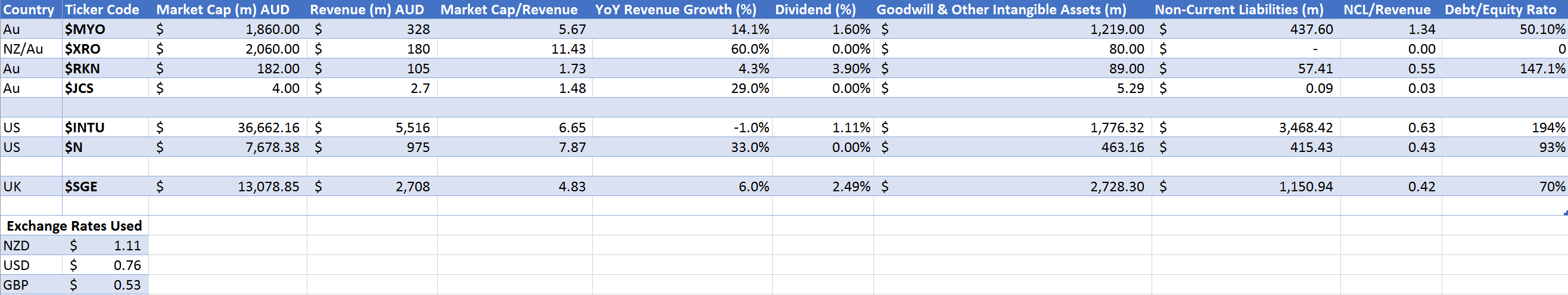

All Players, The Key Numbers

Now I have covered them off, its good to look at the key numbers all in one place.

Note: the numbers are constantly changing (Xero’s share price was up 6% on Monday, after sustained selling over recent months).

Note also: Some of the numbers are “educated calculations” rather than published numbers, but for the purposes of comparison, these are accurate enough.

Prices in AUD as at market close 5/4/2016 ($XRO up nearly 6.5% yesterday)

___

For more commentary by the author on Accounting & Payroll tech:

- LinkedIn Company: https://www.linkedin.com/company/value-adders

- Twitter Company: https://twitter.com/ValueAdders

- Me on Twitter: https://twitter.com/mattpaff

- and now on Medium: https://medium.com/@mattpaff