Yesterday’s announcement of MYOB’s acquisition of ERP provider Greentree, won’t be the end of MYOB’s buying spree, according to their CFO Richard Moore. Moore, courtesy of Yolanda Redrup’s AFR article, states:

we do have a list of potential acquisition targets and we’ll keep reviewing that list in the coming months

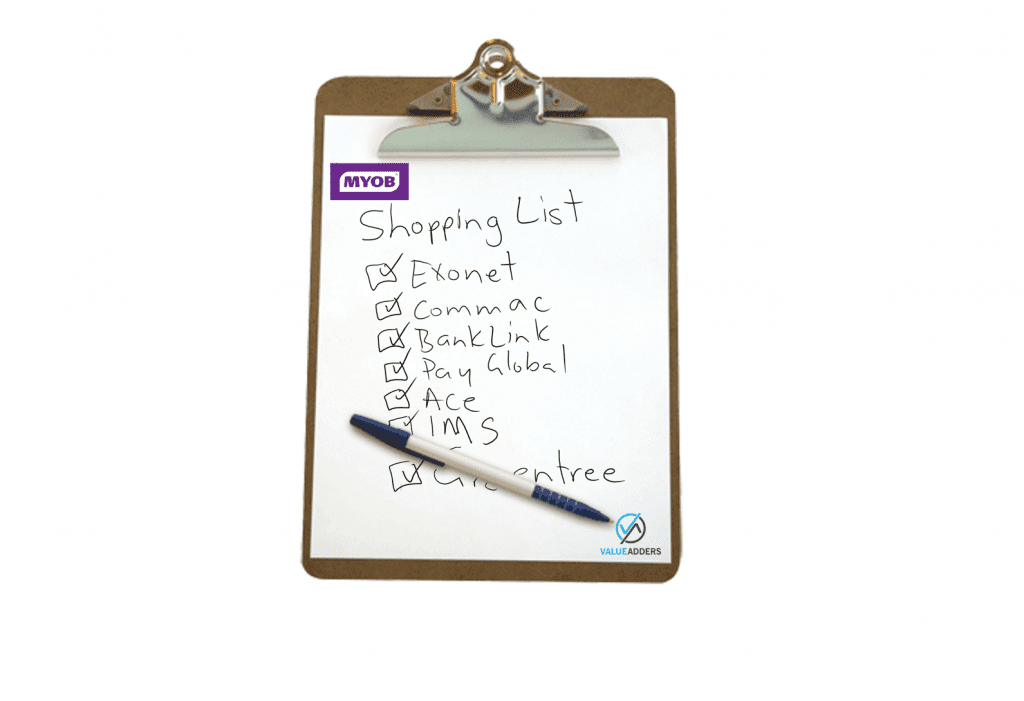

This got me thinking, who else might be on that list? Based on what we know in the public arena, throw in some gut-feel and some muck-raking, here’s my guess at the MYOB shopping list:

I Reckon…

With an ailing share-price, disgruntled shareholders and an unusual price driven cloud focus with ReckonOne, Reckon might be a more realistic price-point acquisition target for MYOB than 6 month’s ago when rumours were around of a done deal. They still have a large base and channel…

Losing their Sass

Saasu have really been upstaged by Xero in recent years, maybe the owners *might* just take some money and run? Unlikely. Recent rumours of more capital raising, a worldwide focus (outside of MYOBs stated market) and the fact they would have rejected substantial offers before, probably makes Saasu long-odds for a MYOB buy-out.

“Up-market” focus

MYOB have stated they are eyeing the mid-market. One might see this as either:

- as a defence against Xero who are beating them in their historical core, small business & practice management market; AND/OR

- in an expansion of their Total Addressable Market (TAM) – which they have capped by limiting strategically to Australia and New Zealand (what becomes of the international Greentree/Pay Global clients I wonder?)

Whatever the reason, the mid-market is primed for disruption/consolidation, by a major player (or the disparate parties coming together themselves for a roll-up). The “beyond entry-level” space is highly disjointed, and full of small developers with generally ageing technology stacks, who will struggle to transition through to pure-cloud and compete with the connected systems of the future.

With the OEM agreement with Acumatica creating the MYOB Advanced product, MYOB have a great product and huge opportunity to seriously compete with Netsuite and the Salesforce ecosystem in the mid-market into the future.

With the OEM agreement with Acumatica creating the MYOB Advanced product, MYOB have a great product and huge opportunity to seriously compete with Netsuite and the Salesforce ecosystem in the mid-market into the future.

Mopping up another existing player would give MYOB:

- EBITDA growth, so Bain can exit at a premium

- Easy access to upgrade target clients for MYOB Advanced

- An expanded channel to “resource up” the go-to-market and grow the MYOB Advanced/People run-rate

So who are some of the mid-market players most likely:

- Pronto – a bigger version of Greentree perhaps?

- Attache – the less I say, probably the better (not because of any insider trading knowledge but more because of the people I might offend…), but nonetheless they are one of the bigger players in the space, have a great recurring revenue business, some great staff and channel…

- Sybiz – have been acquired before (Softline –> Sage). Now owned by management.

- Advanced Business Manager – same product, I mean channel as Sybiz…

- Arrow – Have been on a path of evolution with Arrow, Arrow SQL and now Tencia… Once solid client base and channel, not the player they once were (like most of the others on this list).

- Micronet – have their own “Acumatica” with a white-labelled cloud offering Harmoniq (out of Ireland I think, as well as their traditional Micronet product).

- Jiwa – decent, but small SQL db “disruptor” (if we can call the SQL phase 15 years ago disruption). Picked up some decent channel partners along the way.

- Triumph – again, fairly small, but mid-market…

- JCurve – listed, Netsuite reseller – valuation multiple already at a premium due to listing, Netsuite/MYOB not exactly friendly after NetReturn fiasco and limited value in MYOB acquisition – ruling it out.

They love Kiwis

Greentree marks the sixth NZ acquisition for MYOB in recent years after Commac, BankLink, Pay Global, Ace and IMS.

Go back further and there’s NZA and you could ALMOST argue Exonet was also Kiwi – it began in NZ before Sol6 bought them and of the private owners who bought and sold it from and to MYOB, Bruce is certainly still an All Blacks supporter…

This makes the likelihood of more kiwi acquisitions highly probable.

- Accredo – solid market-market player, primarily in NZ, established channel, configurable product making the channel well-suited to Acumatica…

- Infusion – though I suspect the history between MYOB and Infusion *might* rule this out (a little IP issue dating back to MYOB’s acquisition of NZA), they are a solid south island NZ business with some nice verticals.

- MoneyWorks – bigger than many realise, may not be “mid-market” but still a kiwi with decent client base and ageing technology.

They love Payroll companies

Potentially with the new MYOB People offering in mind, MYOB have been very Payroll focused with their acquisitions. With Sage owning Micropay and WageEasy, there aren’t too many stand-alone payroll providers with sizeable client bases out there. My possibles and probables list would include:

- HR3 – sizeable payroll player. If they were NZ based you’d say after Commac, Ace, Pay Global and IMS they were absolutely a high priority target…

- Datacom – big NZ payroll player. Diversity beyond software and size (they are big) might rule them out.

- AussiePay – more an outsource provider than a software developer, but I suspect this aligns with MYOB’s vision for MYOB People

As you can see, there are plenty of acquisition opportunities for MYOB left. We can rest assured that Greentree is not the last announcement this side of a possible Bain exit late in 2016. The attitude of the directors of the respective targets will be the ultimate determining factor in who is next.

Have I missed someone? Feel free to contribute further names to the list via a comment.

___

For more commentary by the author on Accounting & Payroll tech:

- LinkedIn Company: https://www.linkedin.com/company/value-adders

- Twitter Company: https://twitter.com/ValueAdders

- Me on Twitter: https://twitter.com/mattpaff

- and now, me on Medium: https://medium.com/@mattpaff