For the second year in a row, I started the year with my crack at being a futurist, by publishing my predictions for the Biztech/AccountingTech industry for the year ahead. Unlike most other people who make bold predictions, again I am happy to hold myself to account and check-in on how I am going at the halfway point. I’m happy to proclaim my 2017 edition has already surpassed the accuracy of my predictions for 2016, and we’re only halfway through…

So here goes, my mid-year update with my current “gut-feel” probability of occurring in 2016, reviewing my predictions with the benefit of 6 months hindsight:

Prediction 1. Xero to announce 1 million subscribers with their FY2017 results

(YE March 31 2017). So last year I predicted this would happen by December 31, without sitting down and truly doing the maths. A year on, gut has been replaced by maths, with my models projecting it to be VERY close. If they keep the 1H17 growth rate (which was supported by NZ and Au financial year end accelerations), they’ll hit 1m, on March 22, but one can suspect they might slow in the 2H – the question is can the UK and the rest of the world make up for any post financial year slow down in the antipodes? I’m saying yes!

How am I tracking?

I am pretty pleased with this one. On March 30, Xero announced it had surpassed 1 million active subscriptions. 10/10

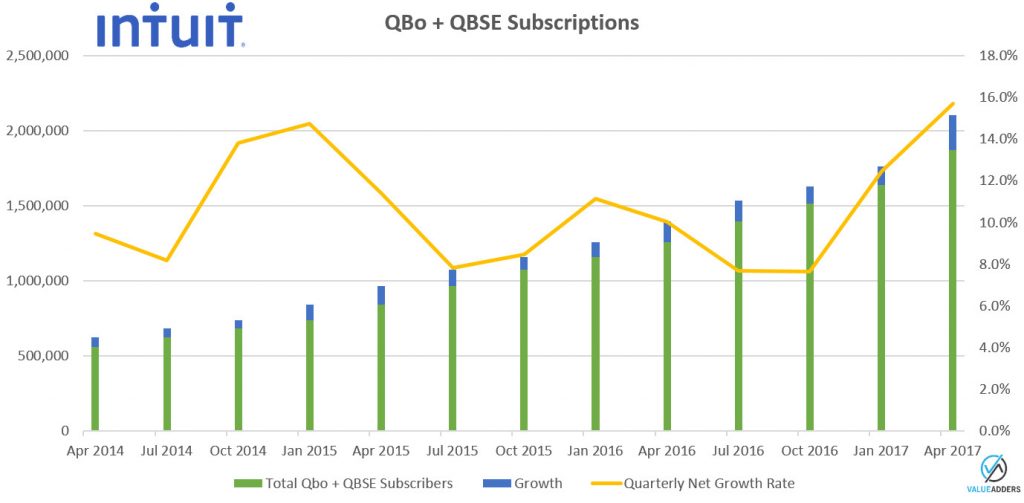

Prediction 2. Intuit to announce 2 million QBo “ecosystem” subscribers with the FY2017 results

(YR July 31 2017). Intuit themselves are forecasting 2-2.2m subs, so I’m cheating a little here. My maths says closer to 2m than 2.2m. Noting this includes QuickBooks Online and Self-Employed subs (for which the latter is a WIP, with (I expect) significant churn, low comparative margin and low Customer LifeTime Value). I’m guessing the target for the Australian team might be ~75,000 subs by July 31 (an uplift of ~50% YoY).

How am I tracking?

On this one, I was WAY off. Yes Intuit will exceed 2m subs at July 31, but you didn’t have to be a futurist to predict that. The reality is Intuit blew me away by announcing 2.22m subscriptions at the end of Quarter 3. As the chart shows, this included a significant acceleration in subs, that I didn’t predict. 0/10

3. Bain to exit MYOB

MYOB is currently 57.7% owned by private equity firm Bain Capital. They’ve pretty much already doubled their money on the acquisition from Archer in August 2011. I personally can’t see significant growth opportunity for MYOB, with Xero consistently beating them on growth in their core market and now Intuit getting very serious in market as well. I’m sure Bain recognise this and will sell, likely (in my mind) to institutions rather than another Telstra2 style tranche. For me, by mid-year, but we’ll see.

How am I tracking?

One part of me wants to claim this as a 10/10. Indeed Bain sold down 1/3rd of its holdings “to a range of institutional and sophisticated investors” announced on February 24. BUT I did use the word EXIT, so one could argue selling 1/3rd isn’t exactly exiting…yet. Still, I think I was on the money perhaps the rest of the year might prove me fully correct. 7/10

4. Reckon not to be listed (in its current form), by year end

OK so this is a copy and paste from last year. Like many, I expected the involvement of Macquarie in late 2015 meant Reckon were preparing to be sold off – by my prediction, through a break-up and trade sale of a division or divisions.

The reality is, the same environment exists:

- Growth will be tough for Reckon going it alone, henceforth

- If Intuit were serious about Australia, even a hostile take-over makes more sense than continuing to burn $20m+ per year trying to re-establish a brand Reckon had already built for them…

- MYOB have shown an appetite for growth by acquisition…

- as has Sage who might see APS + Handtax as a solid base to launch their new Salesforce offering to whilst sweating the asset…

- Greatsoft from South Africa are a growth focused Cloud practice management software company and eyeing off Australia, perhaps an APS division might look good under their control, given their headstart on cloud in this space?

All in all, I personally think some sort of sale of Reckon would maximise the return for its shareholders in the coming year – and there appears some likely options.

How am I tracking?

On the 17th of March Reckon announced its intent to split business and list the document management division on the UK AIM exchange. More details were released right on end of year. I think I can claim this one! 10/10

5. Significant senior management changes at Sage Australia

I have liked what I have witnessed of Sage’s “saviour” CEO Stephen Kelly. I can only assume he is surrounding himself with smart people who can help him execute on his strategy to reinvent Sage as a technology company (historically they were an acquisitions business).

Sage Australia have a MAJOR credibility (and hence brand) issue. They were the out-and-out cloud deniers. They were the definition of company silos (their many divisions rarely talked, let alone collaborated). Now they claim to be a united company, all about the Cloud. “Leap-frogging”… The market is having a significant issue buying what they are selling.

Sometimes to change the culture you’ve gotta change the people

I don’t believe the same “old heads” that guided Sage Australia into the position it was in post Softline and beyond, can reinvent themselves and the brand to be a competitive force, diametrically opposed to what they once stood for. And I can’t fathom that the UK head office, under Stephen Kelly’s leadership wouldn’t agree with me.

And this one isn’t just from the “what would I do” school of gut feel. The mounting facts support the likelihood. The Sage Group reported 3,000 new employees in FY16, yet kept their headcount steady ~13,000. That is, there was staff churn of around 23% worldwide in FY16! Then late in December, AccountantsDaily published this.

I think its a strategic necessity. The stats suggest staff are churning. The reports are this is now entering the leadership ranks. If it quacks like a duck…

How am I tracking?

On April 10, Accountants Daily published an article announcing the impending retirement of Sage Managing Director in Australia Alan Osrin. Boom! 10/10

6. Machine Learning really starts to disrupt the Accounting & Bookkeeping Industries

Sage have already released their bot Pegg.

Intuit showed off their new and improved auto-coding of banking transactions (already released) and “QB Bot” (for release this year) at QB Connect late last year.

Xero showcased their removal of coding (by auto-coding of customer and supplier entries) as well as their Xero bot via Facebook chat and Amazon Alexa at XeroCon 2016, for release this year.

Whilst it is not official, it is in the public domain…Ben Ross (former head of Product and Platform at MYOB), has what appears to be some sort of joint venture with MYOB (note his LinkedIn account states “Entreprenuer in Residence” and note the logo colouring) with myadvisor.ai.

My take on AI, the more data a company can analyse, the better their bot has the potential to be. Case in point New Zealand. Xero can know what is happening in the NZ economy, in almost real-time, better than even the NZ IRD (who only get GST data bi-monthly). With about 1/3rd of businesses using Xero there, transacting, you would think, with the other 2/3rds of businesses in the country, it is no longer about random sampling, its about “all of population analysis”. With the right categorisation. With the right algorithms, Xero won’t take long to be better at coding transactions or giving better advice on cash flow etc for New Zealand businesses, than most people.

As mere mortals, our limited frame of reference and ability to analyse based on finite spheres of education and experience, simply cannot compete with the ability for algorithms to perform the same task.

And here’s my point, 2017 is the year that the naysayers and those with their heads in the sand still busy with basic BAS compliance, bank rec’s and data entry, will start to see real-life consequences of technology on their old business models.

“Cloud Accounting” was NEVER going to be just about a deployment model people. The Cloud is data aggregation and what you do with it!

How am I tracking?

In retrospect, this is a little too subjective for my liking. I could say I was right, but its not for me to say, each individual bookkeeper and accountant will have an opinion on this. For my sins of “airy fairiness”, I’ll mark this one down as a fail. 0/10.

7. The rise of Governance consulting

In 2016 I completed the Australian Institute of Company Directors (AICD) Company Directors Course. During the course I had an epiphany. Governance seems a logical evolution for accounting professionals. Not just trying to come down into technology and operational “advisory services” (that bots will ultimately automate), but shifting up into recurrent governance oversight consulting and helping organisations in key areas such as strategy, compliance and risk management.

There will likely be at least one BIG common law case in Australia in 2017 (7-Eleven and/or Dreamworld perhaps?), plus the handing down of the “Royal Commission into Institutional Responses to Child Sexual Abuse” that will evolve the obligation of governance on directors and increase awareness of the need for directors to fulfil their duties of oversight (beyond those imposed by the Centro case in 2011).

There’s also a rising tide of business owning baby boomers approaching retirement with little to no succession plans. Clear governance of strategy, growth and risk seems a logical way to separate the individual from the entity and drive up sale multiples. Its seems a logical service offering that accounting professionals can deliver.

Accounting professionals hold a significant position of trust with their clients. They are respected for their knowledge of compliance when it comes to business obligations. Governance is an aligned, value-add to the existing relationship between client and accounting professional. It offers absolute recurrent engagement opportunity. I’m so convinced, I’ve joined GovernRight, the world’s leading Good Governance technology platform, to make sure I’m on top of the tidal-wave! InMail me if you’d like to know more!

How am I tracking?

Again, I risked “airy fairy” subjective outcome here (lesson for 2018, keep it measurable and objective), but I genuinely am seeing a big uplift in the Governance consulting space. And I feel its been confirmed by the rise and rise of the AICD and Governance Institute, as well as GovernRight where I spend most of my time. And this Robert Half Salary Survey that was published earlier this year also highlights that “Australians working in corporate governance sector are amongst those most likely to enjoy double digital wage growth in 2017″ (i.e. against an environment of flat wages growth, the rise of demand for Governance consulting is driving double digit wages growth in the sector). I’ll mark myself down for subjectivity but up on the back of the Robert Half survey: 7/10.

8. More of the same from NetSuite

In 2016 one of Larry Ellison’s businesses bought another. That is Oracle bought NetSuite. Larry made a cool $3.5b in ca$h on the way through. What to expect of the kind of new ownership?

I don’t expect much will change. There’s a big gap between what the likes of Xero are doing at entry level and where NetSuite are growing and taking their product and service offerings. Whilst they claim to be targeting SMEs, they are really pushing upward. They clearly don’t get small business as they continue to ignore banking or any sort of development of a decent bank reconcilation solution. They already push smaller businesses to JCurve. And now JCurve are out selling full NetSuite…

Competitively they are priced above MYOB Advanced and even the likes of Microsoft Dynamics Enterprise (formerly AX). I see Oracle continuing the strategy, focusing sales efforts in the mid-to-enterprise marketspace. Hopefully Oracle do a better job with NetSuite then they did with Micros POS. Either way, I don’t see much changing in 2017.

How am I tracking?

What I’ve seen by way of product development and the continued ignorance of the entry level functionality, I feel I’m right on this front. Other than a logo change, I’m not seeing too much different from NetSuite. I’ll harp on it again, I don’t understand the how they don’t see the need for bank feeds and some level of banking transaction automation… talking to NetSuite staff off the record, in Australia at least, the inability to come close to the banking automation of the entry level systems is causing them issues with closing deals. And before anyone argues about cash vs accrual accounting, tell me again how manually entering and allocating customer payments in 2017 in a good thing for ANY business, let alone companies with significant debtors ledgers? 8/10

9. Single Touch Payroll will be delayed, again…

Hey, I’m a fan of the idea of Single Touch Payroll for Australia. A MASSIVE fan. It will drive significant efficiencies throughout the economy, particularly around the ease and enforcement of compliance. It is just that the ATO has a history of missing deadlines and delaying enforcement. Look how long it took for SuperStream to finally be delivered.

The original date for single-touch payroll was July 1 2016. Now it is July 1 2017 for the optional compliance from employers with 20+ employees and July 1 2018 for compulsory compliance for those employers. Ultimately it will be the technology providers that will need to drive compliance and adoption. There is something like 198 of those in Australia, each with their own development cycles and focuses. I have my doubts on the July 1 2017 timeline!

How am I tracking?

Just looking at the logs on the ATO Software Developer’s website, have there been any further delays on top of those known as at January 1 this year…? Kinda (there are a few elements missing and obligations changed on the original design), but it appears a limited release has gone live this week. Let’s see if the rest of the roll out dates are adhered to. I’m still betting no: 6/10

10. But the ATO will meet some deadlines: Simpler BAS and GST on Intangibles

The political (and budgetary) imperative on the delivery of these two initiatives will see them delivered.

Without meaning to get too political, forcing foreign entities (like Intuit who avoid all tax in Australia via billing from Singapore and LinkedIn via Ireland) with turnover above $75k to charge GST in the same way as local entities, is nothing more than logical. Enforcement will be difficult, but nonetheless if the “big boys” all comply, it will be significant. This has to be delivered on time, there’s not much for the ATO to do…?

Simpler BAS is a logical step. Few accurately complete the existing BAS worksheet anyway. Effective from July, but available to new entities from January 19, this simple compliance change should put further downward pressure on accounting and bookkeeping fees associated with BAS lodgement.

How am I tracking?

My mail is, stressing I am no qualified tax accountant, whilst low-valued goods until $1,000 was delayed, both Simpler Tax AND the “Netflix Tax” (aka GST on Intangibles) came into effect this week. 10/10

11. The New Payments Platform will be delayed

Its now 2017. Australia’s infrastructure underpinning payment processing is old and needs replacing. Why do payments take days to clear? Why does our payment processing operate on standard business hours when we live in a 24/7 world?

The good news is, we’re not just waiting for blockchains and crypto-currencies to disrupt the incumbents to fix things. The APCA has embarked on a project to deliver real-time payments. And they are due to deliver phase 4 by mid-year, with BPAY supposed to deliver the first “overlay service” 2nd half 2017.

I’m excited, but sceptical. I’ll go as far as to predict we won’t see anything of the New Payment Processing (NPP) system in the real-world in 2017.

How am I tracking?

I’ve not seen any recent announcements on this, but I suspect this may not happen this second half 2017 as planned. Let’s call it line ball: 5/10.

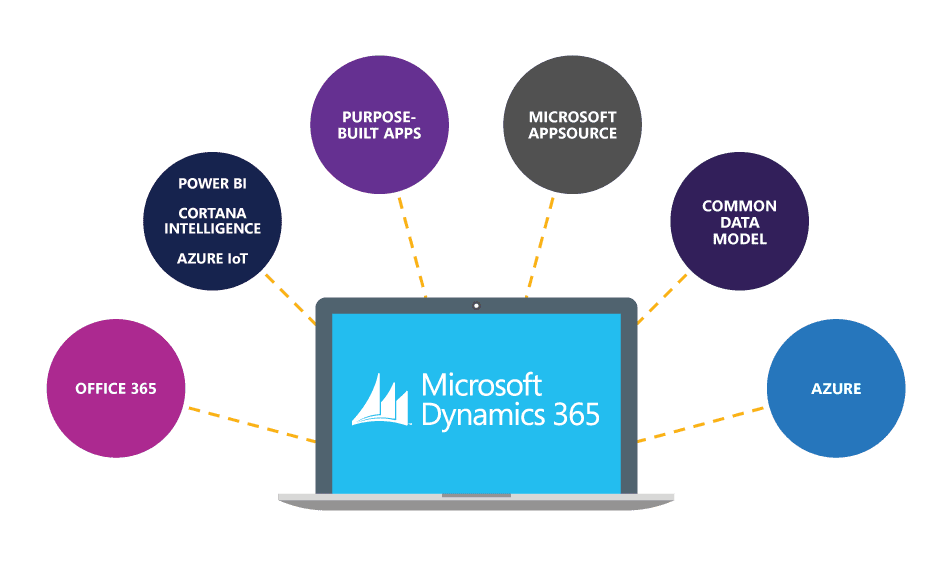

12. The new Microsoft Dynamics will do well in Australia

Microsoft, in my mind (certainly not Rich at KeyPay’s mind) is on the verge of a great resurgence. In the accounting tech space, they have announced the new Microsoft Dynamics suite, kinda/sorta converging their CRM and ERP offerings.

Dynamics Business (formerly Project Madeira) will offer a platform integrated tightly with Office, combining accounting and CRM for small business, competing with the likes of Intuit and Xero.

Dynamics Enterprise is the new converged AX and Microsoft CRM for mid to large businesses.

Throw in single sign-on for practically all business apps, Microsoft PowerBI, the new Microsoft Teams, even LinkedIn integration…wow, if they execute, I can see Microsoft Dynamics, running on fleets of Microsoft Surfaces, (maybe not connected to Microsoft phones) being a very compelling offering for businesses!

Their challenge will be the gap between Dynamics Business and Enterprise seems too large (maybe the guys at www.go-gravity.comwill fill the void?). And whilst they seem to want to bring Enterprise (aka AX) down-market, they’ll need a new channel as the existing partners will resist mid-market implementation price expectations…

How am I tracking?

Possibly I got ahead of my self on the “hype cycle”. Now thinking this won’t happen in 2017, but I hold firm it will happen. 2/10

13. Microsoft PowerBI to grow rapidly

I am regularly surprised by the lack of market awareness for Microsoft PowerBI. For me, its the best reporting components of Excel and Access, rethought for the modern world. Whilst there are a million and one competitors, the ease of use, familiarity to Microsoft UI, the sexiness of the visual delivery, the fact the desktop version is free…I just can’t see a scenario where PowerBI won’t dominate reporting and analytics for the masses in years to come. And 2017 is the year market awareness will grow!

How am I tracking?

I’m seeing PowerBI everywhere I go. From other software vendor conferences to social media to industry events. I’m marketing myself down for a hint of subjectiveness, but do genuinely believe this is happening. 7/10

14. vSure – my app to watch in 2017

If there is one word I associate with 2016 (apart from underdog), it is Populism. There is a growing tide of protectionism and anti-foreign worker sentiment. Pauline Hanson has 4 seats in our senate. Trump was elected. Brexit was successful. The Adani coal mine was approved, on the condition there were no 457 visas!

We are witnessing a growing attention on foreign workers and their “right to work” in Australia. The Migration Amendment Act 2013 enforces obligation on ALL employers to check the work rights of ALL their employees and contractors. And keep checking the work rights of any foreign workers, throughout their term of employment. Both the Department of Immigration and Border Protection (DIBP) AND Fairwork can audit your staff at any point in time to ensure ALL are not in breach of their visa conditions. Hefty on the spot fines apply to employers, directors and individuals where a breach is found – and we are not just talking intentional breaches. If you haven’t been running regular VEVO checks on your foreign workers then that may be considered not meeting your obligations and constitute a breach!

We are witnessing a growing attention on foreign workers and their “right to work” in Australia. The Migration Amendment Act 2013 enforces obligation on ALL employers to check the work rights of ALL their employees and contractors. And keep checking the work rights of any foreign workers, throughout their term of employment. Both the Department of Immigration and Border Protection (DIBP) AND Fairwork can audit your staff at any point in time to ensure ALL are not in breach of their visa conditions. Hefty on the spot fines apply to employers, directors and individuals where a breach is found – and we are not just talking intentional breaches. If you haven’t been running regular VEVO checks on your foreign workers then that may be considered not meeting your obligations and constitute a breach!

vSure is perfectly placed to address the emerging compliance issue for any organisation or software developer working with a volume of foreign workers. They have relative clean air from a competitive perspective and there are significant barriers to entry for competitors (the DIBP API sucks). The app and API is clean, simple and specific to purpose. Again, full disclosure, I am so convinced that vSure is about to take off, I’ve joined the company! InMail me if you’d like to know more!

How am I tracking?

Thanks to Peter Dutton, Malcolm Turnbull and the right wing of the liberal party, the protectionist, populist ending of the 457 scheme in Australia absolutely helped here. With businesses across Australia scrambling to get compliant with the obligation to take “reasonable steps, at reasonable times” to monitor employee work rights (ongoing, not just at time of recruitment – per the Migration Amendment (Reform of Employer Sanctions) Act 2013) vSure is experiencing unprecedented growth, up 100% last quarter. 10/10

15. The Accounting Business Expo to deliver a successful inaugural event

With most recognised vendors (barring Reckon only at this stage) committed to attending, it appears National Media’s foray into the successful UK Accountex model down-under with the Accounting Business Expo looks set for success.

The big question mark now is can they get the foot traffic required to keep the vendors happy and get them a return on their investment, so they’ll be back in 2018? I think the novelty of the new darling harbour venue, coupled with the fact vendor conferences like XeroCon and MYOB Incite seem to be proving a demand in the market, should see attendance into the thousands and I think, this will translate into a successful event all-around.

How am I tracking?

Unequivocally correct. All reports from the event have been positive and next year promises to be much. much bigger. Tick. 10/10

16. Xero to revisit their entry level offering

Intuit are going hard with QB Self-Employed and express a great argument when describing the future of work and the rise of the “gig economy” and supplementary income sources like: Uber driving; Airbnb and online sales. I’ve seen stats like 40-50% of people will have some sort of self-employed income in the not too distant future.

I know Xero have left this market previously, and re-entering this space would affect metrics like churn and LTV, but the argument seems strong to me and a simple, “self-employed” offering is probably something they should revisit. And I reckon they will, in 2017.

How am I tracking?

Not seen anything yet. As we’re halfway through, I’ll mark it as a line ball call: 5/10.

17. MYOB will make another “legacy” mid-market acquisition

Last year it was Greentree. MYOB have stated that they are open to further acquisitions. Its a great way to grow revenue without having to sell volumes of sites. Its a great way to push more asset into the balance sheet, with minimal short-term affect on expenses/COGS. Net affect looks good from a P&L perspective AND it helps them move up-stream, away from the heavy competition in the small business space.

All-in-all, a good strategy to help Bain exit at a nice premium. Here’s my previous article on who might be their targets:

Who else is on the #MYOB $MYO shopping list? I consider the #accounting & #payroll software companies most likelyhttps://t.co/qwBitREkju

— Matt Paff (@mattpaff) August 2, 2016

How am I tracking?

Whilst they did announce the acquisition of Paycorp in February, I can’t claim them to be “another legacy mid-market acquisition”. Helfway = 50/50 from here on in. 5/10.

Conclusion

So there goes, compared to last year’s effort, I’m pretty chuffed with this one. There’s a few more surprises ahead this year no doubt. I continue to eagerly spectate!

_____

For more commentary by the author on Biztech, Follow me on this platform OR:

Follow On Twitter: https://twitter.com/mattpaff

Follow on Medium: https://medium.com/@mattpaff