At the start of 2016 I boldly put my pride and reputation as a budding futurist on the line by penning my article: 16 predictions for 2016 for the AuNZ biztech industry.

Before sitting down to write my 17 predictions for 2017, its only fair that review how I went with this year’s attempt!

Before I do, I remind the reader of how hard predicting the future truly is. Peter Drucker famously made reference to this:

Things I got completely right

4. Intuit to benefit from the Reckon uncertainty.

“Big marketing dollars and sharp pricing *could* see Intuit take full advantage of the uncertainty around Reckon, sweeping up their channel and clients en masse using the QuickBooks branding and positioning them as the clear 3rd player in the Australian SME Fintech space.”

Tick: Intuit Australia has made significant inroads this year into Reckon’s channel (and beyond). Recently announcing 53,000 subscribers in Australia, QuickBooks Online subs now exceed the combined total of ReckonOne plus the Reckon Hosted “cloud” solutions making Intuit, by my reckoning (pun intended), the 3rd largest cloud accounting player in the Australian market..

7. MYOB to acquire mid-market desktop player

“I expect at least one long-term “legacy” accounting player to be absorbed by mid-year.”

Greentree was acquired by MYOB for $27m – announced to the market on August 1.

8. MYOB will launch a new Payroll service

“… a new MYOB Cloud Payroll solution is obvious. I’ll go further to predict a true Software-As-A-Service offering, blurring tech and service, by including a premium solution providing full outsourcing of the payroll function (taking on the likes of ADP).”

Quoting James Scollay, MYOB’s GM of SME solutions, published on Computerworld 5/2/2016:

“To complement the new Essentials Payroll, Scollay says MYOB is introducing a new payroll intermediary service, MYOB PayAgent.

Scollay says the service will allow Kiwis to nominate MYOB as their payroll provider enabling them to outsource payments to staff and PAYE as well as their IRD reporting obligations.”

15. The beginning of the end for the ABA file format

“I predict 2016 will be the beginning of the end for the ABA file with, modern, seamless, secure alternatives arriving inside cloud accounting and payroll systems.”

Xero in particular have made a number of announcements this year, including: A partnership with NAB

“Xero has announced its cloud-based accounting software will now connect directly with NAB’s Application Programming Interface (API) to simplify and automate a number of tasks for small businesses.”

16. 2016, the year of accounts payable automation.

“I think 2016 is when accounts payable automation goes mainstream”

Whilst Intuit are sitting on their hands with their InvitBox acquisition, players like ReceiptBank, Entryless have grown in popularity. BUT, far more importantly, in the AuNZ markets, most SME accounting software vendors (Cloud & Desktop) have now partnered with Xtracta, to embed AP automation into the standard workflow inside their systems (effectively bypassing the need for 3rd party solutions in the future).

For those not familiar with Xtracta, in this use-case, it is an API driven, AI powered, AP Automation solution – effectively an AIaaS for stripping and defining data from images (how is that for a string of acronyms only those in the know will understand: in plain English a super cool service software developers can use to strip and define data from supplier invoices and expense receipts)

The evolving switch from ecosystem add-on to core payables system feature effectively confirms my prediction.

Things I got wrong, but maybe only for timing

Happy to admit I got these wrong, but I think its only the advancing calendar that beat me. These might make my 17 for 17 list yet:

1. $RKN (Reckon Ltd) will not be listed, in its current form, by the end of 2016.

So I was wrong, Reckon will still exist as a listed entity as at midnight on December 31 2016 and the company structure very much still reflects that which entered the 2016 year.

The market entered the year with hope of a trade sale (the share price peaks at $2.49 in January), but when it was off the agenda, well, you can see the share price chart for the year:

I still predict a break-up and sale will occur, in due course (maybe during 2017?), as the way to maximise shareholder value.

2. ReckonOne to be absorbed/decommissioned.

Tied to point 1. IF there is a trade sale of Reckon or its SME division, this is probably still a likely outcome.

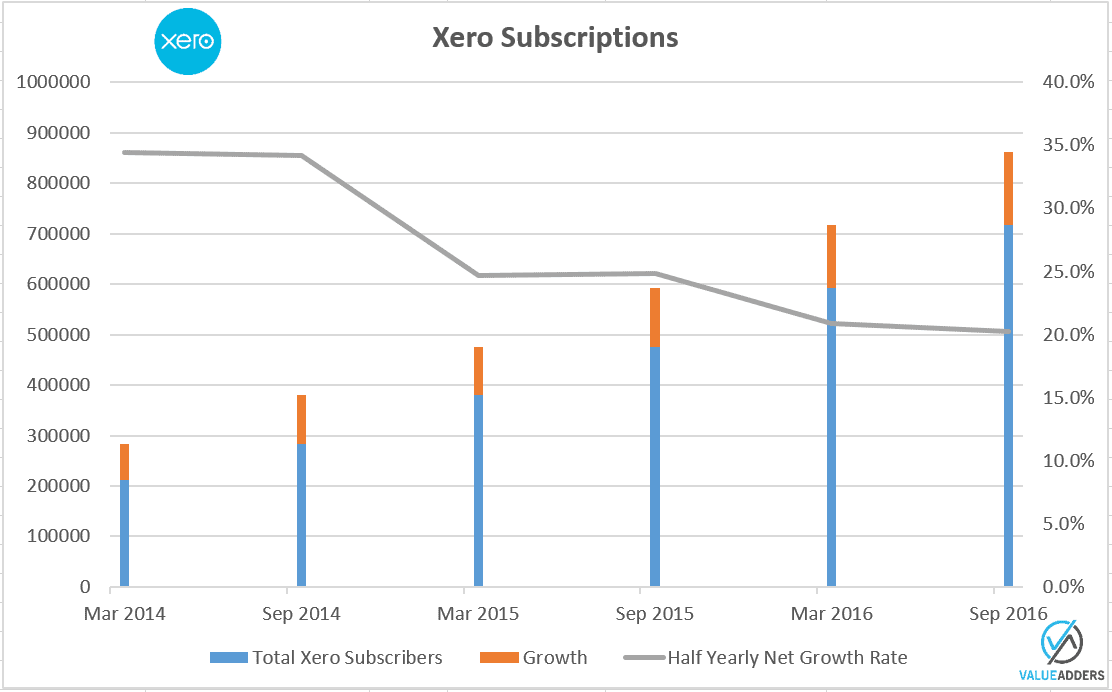

3. Xero to crack 1 million subscribers before 2017.

Unless there’s been a remarkable acceleration this quarter in net acquisition, I got this wrong. But only by a few months. On the run-rate and subs number published for the 6 months to September 30, Xero will have 935,297 subs by midnight December 31 and should crack 1m on March 22, 2017.

5. SageOne will struggle but SageLive will find a market.

I was right on the SageOne front: Sage announced 12,000 subs in Australia for SageOne for the year ended September 30 – by my calculation this puts them well behind Xero, MYOB, Intuit, Reckon and Saasu.

I think I was a little early on SageLive. Looks like its still a WIP (they annouced 600 subs as at September 30, with 400 added in the 90 days previous), but I am a fan of CRM/ERP on the common platform and by all reports FinancialForce is going strong as the first Salesforce based ERP play, so the opportunity remains for Sage to do well with SageLive

6. MYOB Advanced (Acumatica) to grow rapidly.

The feedback from the market is MYOB Advanced, like SageLive, is still a WIP.

I was fortunate enough through the year to go to Russia to meet the team behind Acumatica and deep dive into the platform. I am convinced, its a serious solution and has the opportunity to radically change the disparate mid-to-enterprise market across Australia and New Zealand and as I originally predicted, grow rapidly. With Oracles acquisition of Netsuite this year, I believe the opportunity is probably only growing.

BUT the general feedback from the market is that MYOB Advanced as a product AND the channel partners implementing it, are a WIP. Finding a happy testimonial client is difficult and that speaks volumes.

Some observations/opinions:

- Maybe its more mid-to-enterprise than small-to-mid market?

- Perhaps some of the partners, familiar with/used to the rigidity/market positioning of Exo, are over-selling the flexibility of xRP (the underlying platform that runs MYOB Advance) and therefore struggling with the business process re-engineering and client education challenges that come with the implementation of an enterprise level system, at a much lower price point…

- Perhaps the product isn’t quite there yet – between the MYOB side of the dev (still missing Bank Feeds, BAS reporting limitations for multi-entity etc) and Acumatica ERP, there are a few “immaturities” still in the system. The roadmap I saw in Russia, certainly looks exciting for where they are taking the product though. Its going to be interesting to see how the timing of Acumatica versions are managed with MYOB Advanaced updates. The last time I looked, they seemed a little out-of-whack from a UI and featureset perspective.

14. NextMinute to arrive.

They haven’t matched Simpro, who recently announced a $40m investment in their growth (effectively validating my feeling on the job management space as a HUGE growth opportunity), but NextMinute have received some funding from Silicon Valley investors this year and made significant inroads in New Zealand, with a couple of big aggregation deals.

Being based in Australia, I can’t ignore the fact they don’t have much of a presence here yet, but I do think they have a more modern, technically superior product to most competitors on the market and with the right execution, should “arrive” here spring-boarding off the back of NZ success. Maybe this 2017 is the year?

Things I got completely wrong

Hey, unlike a younger me, I can admit when I got things wrong and these were just plain wrong:

11. $XRO (Xero) share price to crack AUD$30.

With a 2016 high of $19.74, I got this wrong. Rest assured, XRO will hit $30 (again, noting it hit a high of $42.96 in early 2014), but absolutely not in 2016. I wanted to fit this into my wrong but maybe only for timing category, but share trading is all about timing, so I can’t fudge it…

12. $MNW (Mint Payments) share price to take off.

Mint started the year at 9.2 cents. It peaked in late April at 13 cents (can I use this fact to say I was right? Afterall it did take off…before crashing down to earth…). At the AGM last month, things look strong:

BUT at close of trade December 19, it is languishing at 5.8 cents as their cash buffer looks set to exhaust and further capital raising looks likely before any chance of breakeven.

13. Common Ledger to be acquired.

“I think it needs to live inside a practice management system (like Sync Direct and APS). Walters Kluwer, MYOB and Sage would all seem logical buyers and are all acquisitive”

I wanted to put this one in the Wrong But Maybe Only Timing basket, but The Common Ledger guys have been in touch this year to tell me they’re not looking to sell…so we’ll record this one as me being completely wrong!

Things I might sit on the fence on

In hindsight, a couple of my predictions were subjective (lesson to any serious, budding futurists, make measurable, objective predictions). So I might sit on the fence on the outcome of these two.

9. Employment Hero to explode.

Whilst Employment Hero has received some funding to have a crack at the UK, I’m not sure I can claim they “exploded” in 2016. What did happen in 2016 is the “poster child” for alternate revenue model for HR systems, Zenefits, imploded in the US, effectively losing their “unicorn” $1b valuation.

I think Employment Hero has done well, but the jury is still out on the benefits model these guys and FlareHR are bringing to the Australian market. Perhaps its market education? Perhaps its trust in monetising employees..? I’m still a fan of the model myself, but time will tell whether they “explode” or its a slow burn.

10. Walters Kluwer (aka CCH) to make some serious noise

“I think the leverage CCH will get out of their market leading position on content, plus a maturing, genuine cloud practice management offering, will shake up the market”

I think there is little doubt CCH IQ is innovative and gives them a point of difference in the market. iFirm is one of the more mature cloud practice management suites. I still don’t fully understand where agnostic practice management fits in the future with competitive offerings like Xero HQ, MYOB Dashboard and even QBoA..? Serious noise, maybe? Maybe not serious traction yet…

Conclusion

I’ll admit, my first crack at being a futurist wasn’t overly successful…Its a FAIL from me.

I’ve learnt some lessons from it though and am a year wiser now. Stay tuned for Paff’s 17 Predictions for 2017, early in the new year!

I’ll leave you with some inspiring quotes on failure:

_____

For more commentary by the author on Biztech:

Follow On Twitter: https://twitter.com/valueadders

Or LinkedIn: https://www.linkedin.com/company/value-adders

2 Comments