Preamble

When Decartes penned his treatise “Cogito ergo sum“, all that he could conclude from critically testing all that he believed to be true was “I think therefore I am”. His very existence was the only thing he could definitively know beyond doubt, all other beliefs could be argued against, ultimately they were opinions or perceptions, not indisputable facts.

A number of people who I met for the first at Xercon this year exclaimed something to the effect: “ah, Matt Paff, you’re that guy who posts those controversial articles!”.

So, as I start to write my 2017 edition of “Xerocon – the review that no one else will write”, I state my intentions openly – I hope my reasoned opinion adds some value to the discussions and is worthy of the readers’ time and thought. Please, feel free to disagree. As Decartes concluded, its all just opinion and perspective anyway!

Xerocon 2017

With my wife 8.5 months pregnant, I risked lifelong regret and jumped the plane at Xero’s invitation to my 4th Xercon: Xerocon South/SE Asia/Melbourne 2017.

It has been fascinating to see this event grow and grow. No doubt, Xero are very good at running slick events. As always, the “sold out” signs went up (I’m sure it would regardless the number BTW). Nonetheless it genuinely does get bigger and better year after year. The parties more numerous and sizeable. The hangovers…

In the interest of brevity, here are some of my thoughts on this year’s event and the direction Xero are headed.

Network beyond

My biggest problem with Xercon was there’s only one of me. Too many presentations to see. Too many people to meet and catch up with. Too little time. Apologies to those I didn’t get the chance to catch, but thanks to Xero for bringing it all together!

Xerocon 2016 was about “community”. Xerocon 2017 felt almost like a big city in comparison!

Barriers to entry are growing exponentially

If you consider Xero’s complete offering at the conclusion of Xerocon 2017, specifically in the Australian market (where I suggest Xero is the most mature with Payroll, Tax, financial web, Xero Connect etc), the ten years and hundreds of millions of dollars Xero have invested in product, ecosystem, brand and channel, starts to add up to a significant economic moat (to borrow a Warren Buffetism).

10 years ago, when Xero started, the conditions were prime for market entry. The barriers to entry to leverage Cloud, as a start-up against almost stagnant incumbents, burdened by legacy code-bases and with client-bases to service, were as low as they had been since the Windows evolution in the early ’90s or even the advent of the PC and SME accounting software in 1981.

(BTW sorry Rod, you were wrong in your keynote to say modern accounting technology started in 1983 with Lotus Notes – by then Attache Software (founded by Gary Blom, Geoff O’Reilly and John Portus) had already built a significant SME Accounting Tech business in Australia and with a big wad of VC cash had even relocated the business to the US (Ann Arbour, Michigan) before Scott Cook started Intuit – here’s some of the back story FYI).

Today though, if you want to be genuinely competitive in SME (Australian) Accounting tech, with any hope of disrupting the key player(s), I reckon you’ll need:

- A decent and comprehensive cloud accounting solution;

- Open APIs;

- A significant ecosystem of add-ons;

- A significant channel to market;

- An AI engine eliminating coding;

- Relationships with all the banks and other financial institutions;

- A Payroll offering;

- A Practice Management offering for bookkeepers and accountants;

- Tax filing;

- Workpapers;

- A smegload of ca$h to build your brand and product;

- A shipload of hope that there’s room in the market for another player (regardless how good your product is)…etc

Those tempted to post a comment that this is about to be eroded by block-chain technology, please be sure to explain, in detail and plain English HOW!? It is one thing to create an immutable audit trail and streamline the data collection process, it is something very different to build features and functions that help small businesses and their accountants/bookkeepers manage their customer, supplier and staff relationships whilst handling inventory and projects and meeting compliance obligations…IMHO.

Practice Management suite getting better

Xero are genuinely starting to deliver on the owning-the-aggregator strategy. To this point though, whilst Xero Tax has been well supported by its users, Xero Practice Manager (Workflow Max) has disappointed many for the features lost in swapping over from MYOB AE, Sage Handitax, Reckon APS etc.

Opening up the Xero HQ API and working closely with ecosystem partners to build messaging back into Xero HQ, is a great move. Sholto from Digital First has written a great detailed explanation on this if you would like to know more about the “Modular Practice Concept“.

A brand new API for @XeroHQ Visit #XeroHQ Village at #Xerocon to see how our launch partners are using it! ^RJ pic.twitter.com/ULzuGrGG3L

— XeroAPI (@XeroAPI) September 13, 2017

I’ll just pass a couple of comments:

- I get “choice”, but you could argue no one practice needs FUTRLI, Fathom and Spotlight. Three reporting tools, but one incorporations solution with NowInfinity, could be argued as incongruent.

- Conversely, I get it, you have to start somewhere with new ecosystems. Starting with arguably the 8 most common, complementary offerings to Xero in the Practice Management space, makes sense.

So all-in-all I have to give this announcement a thumbs up. When I look from the lens of Imagine Accounting (the firm I sit on the advisory board of), it further validates their recent decision to move from MYOB AE to XPM. Further reinforced by the big announcement that followed (and follows here).

iKnow its a good idea, but competitors strange bedfellows do make

The Practice Management landscape in Australia has had limited players. Dominated since 2004 by the big 3 incumbents (dare I call them the encumbereds):

- MYOB (who “merged” with Sol6 in 2004);

- Reckon (who made a very smart acquisition of APS also in 2004)

- Sage (who acquired Softline and as a result its Handi PM solutions in 2003)

Accounting firms across Australia, particularly those of any size, sold on the idea of cloud, really have had limited options as far as modern, cloud Practice Management solutions.

Whilst a couple of new players (like Karbon and Jetpack Workflow) are starting to appear and make waves, and Sage keep promising their Salesforce based solution “is close”, just two have dominated in the last few years:

- CCH Wolters Kluwer acquired Acclipse and its iFirm solution in 2012.

- Xero acquired Workflow Max in 2012 as well.

CCH have focused on monetising the practice, not the clients (they even originally had iBizz, a cloud based, bank feeds driven SME solution, which they practically gave away). Xero have focused on monetising the client, not the practice (charging for client files/solutions, not the practice management offerings).

Both have evolved their strategies in recent years, but without question, cloud aware accounting firms have made buying decisions that at least considered (or should have considered) both offerings.

CCH’s competitive advantage has been content. As the publishers of the “Master Tax Guide” that is found in most firms, the building out of digital content with iKnow (the digitised version of the guide) and combining that with iFirm and CCH iQ has created a key point of difference in the marketplace.

CCH iKnow’s exciting collaboration with @Xero Tax announced at #Xerocon today! 🎉 pic.twitter.com/eG2EbxJXmM

— Wolters Kluwer AU (@cchaustralia) September 13, 2017

So when it was announced at Xerocon that Xero and CCH had done a deal to integrate Xero Tax and CCH iKnow, my initial reactions were:

- Ah, where there’s smoke there’s fire. That inside word I got in May about Xero acquiring iFirm wasn’t without some merit!

OK a couple of sources now…

X

➕

iFThe latter originally “A” Bonnie Tyler song#accountingawardsau https://t.co/u5V3a3A7JS

— Matt Paff (@mattpaff) May 26, 2017

- Really CCH?! You just gave away your key competitive advantage!

- Wow, that’s a seriously good deal for Xero!

Upon reflection, it is interesting to note the deal is non-exclusive. So I assume we’ll see iKnow integrations with the likes of MYOB AE, Reckon APS etc.

Is this a case of retreating to your strengths by CCH? Is this the beginning of the end for iFirm? Is CCH conceding that their strength isn’t practice management, like they conceded SME software by abandoning iBizz? Rumours have abound in recent times that iFirm has had some performance challenges. Perhaps owning market dominance with content via iKnow and the likes of CCH Learning is a better strategy than trying to compete in the competitive, now hard to monetise, PM space?

For a moment, I thought I was at #BomaCon

Boma, a new Mail Chimp-esque marketing platform, has done an amazing job to partner with Xero. The amount of advertising across the conference during keynotes, must have been a massive leg-up. It gives Xero an opportunity to market at arm’s length. Providing content in platform, for Xero HQ Boma users to enter a world of professional, proactive marketing, effortlessly. The reality is, many accountants and bookkeepers are unfamiliar with or uncomfortable in this space, making it easy is a great strategy for Xero to continue to grow.

My fear, homogenisation. If everyone is putting out the same, Xero-styled content, where is your own brand value/point of difference?

Xero & Intuit diverging

If there is one big takeaway from Xerocon 2017, it appears to me that the strategies of the two big players, Xero and Intuit, are diverging.

Intuit appears to to be very focused on the Small & Micro Business definition of the acronym SMB. Justifying their pricing and product strategies (that has seen them build a new product “Quick Books Self Employed”), on the growing #GigEconomy opportunity. Win marketshare first, monestise second appears the core strategy.

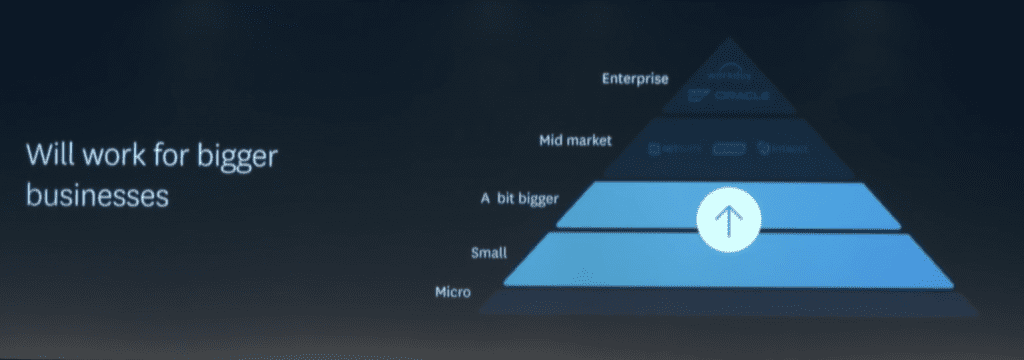

Xero seem to be hellbent on the Small & Medium Business definition of SMB. From a premium pricing strategy (outside the US), to CEO Rod calling out the “mid market” at Xerocon 2016, to delivering operational, modulised, per user solutions with Expenses and Projects at Xerocon 2017.

Rod Drury calling out the mid-market strategy at Xerocon 2016

Intuit appear focused on growing subscription numbers alone (noting QBo ecosystem Subs and Revenue are not growing at equal pace). Xero appear focused on simultaneously growing ARPU (Average Revenue Per User) and CLTV (Customer LifeTime Value) – which they publish openly, seemingly unlike any competitor.

The risks Xero are running: slowing growth; and not being competitive in the micro business space. Micro businesses become small businesses and ultimately forgetting micro makes acquisition of small businesses more difficult. Adding features to meet mid-market demand is also offset by what I call the “features/simplicity paradox” – the more features you add, the harder it is to make it intuitive and user friendly for unsophisticated users.

The risk Intuit are running is: the micro business space may prove difficult to get a return on investment. A lower propensity to pay. A higher churn. Lower barriers to entry. More open to competition from the big 5 US tech companies (Google, Facebook, Amazon, Microsoft and Apple).

What would I do? I like the “upstream” play. The continued ignorance of the mid-market players (e.g. NetSuite) to core SMB usability and functionality like bank feeds, makes them primed for competition from the SMB players. My maths says NetSuite have a CLTV of ~$800k, compared with Xero currently ~$2k. Moving the needle, even by a little, towards the NetSuite number, has massive bottom line benefits for Xero. But if I were Chris Teeling and Rod Drury and driving Xero’s strategy, I’d also revisit their micro business offering. Keep to one platform play, but build out a mobile first, light-weight offering, that offers a growth path by adding modules over time.

The changing ecosystem

The app marketplace of Xero may be growing beyond 600 “ecosystem partners”, BUT interestingly the number showing up at Xerocon is diminishing, despite the rapidly growing audience.

In 2016 there were 91 exhibitors for ~2,300 attendees to inspect. And whilst delegates grew around a third to over 3,000 in 2017, exhibitors shrank by more than 20% YoY. In my 2016 review I raised concerns as to the direction Xero had taken with its “ecosystem”. And whilst I believe they have learned from their mistakes, on raw numbers, one could argue, it has had an impact.

It is true, amongst early “ecosystem partners”, genuine commercialisation strategies were sometimes non-existent. There were more than one that simply hoped for the day Rod came knocking (like he had with PayCycle and Workflow Max) and they wouldn’t have to work out how to build a proper, profitable business. What we are witnessing might well be a commercial reality check for “add-ons”. It could also be ecosystem partners deciding they already have a full prospect database..?

But the announcements of Expenses and Projects, says a few things to the ecosystem:

- Xero are more inclined to build not buy now; and

- Unless you’re willing to spend big and innovate hard, stay out of the horizontals (those solution with broad industry appeal);

I was asked by an investment fund during a chat at Xerocon:

- Was the ecosystem a competitive advantage? My answer: yes against most, not against Intuit as most “partners” in this space integrate with both;

- What are the risks to Xero continuing to grow? My answer: if they get the ecosystem strategy wrong (as they did last year for a period when they looked to charge for API usage), they will lose a key advocate and will slow their growth, particularly if Intuit continue to embrace the same ecosystem and build a genuine platform.

The commercial reality is the relationship with Xero and it’s ecosystem was always going to evolve as the edges and gaps that created opportunity for “add-ons” became areas of direct competition. I think Xero have learnt from their mistakes of last year and developments like the Xero HQ API with integrated messaging between apps is a real step forward (not quite my utopia of a genuine platform with Single Sign-On, standardised UI, but a step in the right direction nonetheless).

BUT the diminishing exhibitor numbers is a worry for mine. Xero need to find their mojo with the ecosystem again. I think they can, but it needs work and some TLC, not aggressive negotiations on top-line numbers or pay to use integrations… The next point plays to perhaps a growing awareness and transparency on where they will and won’t be playing in future.

Xero staying out of financial services

A BIG announcement during Xerocon was the confirmation of the strategy that unlike MYOB (with Ondeck, Paycorp and Mint Payments), Intuit (with Ondeck, AMEX etc) and Sage (with their “Golden Triangle” strategy), Xero are staying out of competing with the financial institution ecosystem, by avoiding loans and payments. I’m fascinated to watch how this plays out:

- Will the referral effect and end-user choice benefits garnered by remaining agnostic; help growth to the point it outweighs

- The revenue generated by monetising this space per the competitors.

As a surfer who likes the idea of catching lesser waves, away from competition with other surfers, rather than better waves I have to compete hard for, I like the point of difference from Xero. And given the size and tech budgets of some of the financial institutions, its probably a good strategy not to poke the big bears!

Respectful to Intuit (kind of) Not MYOB

I have noted previously, Rod Drury’s snarky Twitterades (my word, a portmanteau from Twitter Tirades) against every Intuit results announcements have not been becoming of him. I do note these have been noticeably tempered of late. To see Rod talk through his version of the history of Accounting Tech and pay respect to Scott Cook was surprisingly refreshing.

Lifelong learning

Genius. Just look at the ads for accounts and payroll staff in online job ads. Whether its a sensible employment criteria or not, knowledge of specific applications is often a core requirement. Imagine the impact of mobilising an entire generation of staff to one solution?

It worked well for Attache in Australia in the 80s and early 90s (ask anyone who did computer accounting at TAFE or university back then, I bet that most remember Attache). It has worked for MYOB ever since. Xero’s play is so much bigger and better than the previous attempts to own education and a generation of professionals. “Democratising” education is a massive play. Its a further eroding of MYOB’s established brand position in Australia. But its bigger than that. It’s a worldwide play. It’s a massive future barrier to competition. I believe it to be a currently unique, first-mover, big competitive advantage.

Lifelong learning is akin to the AFL investing in a 20 year play in Western Sydney. I think the impact is years from now, not immediately obvious. In a world of corporate (and political) short-sighted, short-termism, I LOVE, LOVE this play by Xero.

Size brings cultural challenges

My Xerocon 2017 day one experience was somewhat soured by an incident with a Xero employee. As Rob Stone put it, “sometimes good people do the wrong thing for the right reasons”

Rather than detail the misunderstanding in a public forum, I have spoken to the appropriate people at Xero. What I will say is that it is harder to have 2000+ employees on the same page, appreciating the same things and playing well with others. This will continue to be a challenge for Xero. Their culture is imperfect, as are most large companies. It needs leadership. It needs diversity of thought. It needs refreshment and constant attention. Despite my incident, I think they are doing a pretty good job at managing their transition from a small NZ company to a significant global player.

More to say, but few would read…

I recognise that this is already hitting social media length limits, so I’ll close with this. It is hard to argue with what Xero are doing and how they are doing it. Even the staid “but they don’t make a profit” argument is now effectively dead (not that it ever had any real life). Growth prospects in the UK, Asia, Africa and AuNZ is enough to be optimistic about further, significant capital growth. Even etching out 5% of the US market is like adding more than another Australian & New Zealand market – so forget the “can they unseat/compete with Intuit” question. They don’t need to. And you can quote me on this opinion:

This isn’t a winner takes all market!

P.S. Bubs waited… lifelong regret avoided

And just FYI, baby Henry waited for Dad to get home before arriving:

P.P.S. I’m looking forward to the Intuit comparative

Its going to be good to compare strategies with Intuit at their big event in San Jose in November. Keep an eye out for the QB Connect review in November!

Be sure to:

Follow me on Twitter: https://twitter.com/mattpaff

Follow on Medium: https://medium.com/@mattpaff

Bookmark this blog: https://valueadders.com.au/articles/