Last November I was lucky enough to be invited as guest of Intuit to it’s annual conference in San Jose, California. I had so much to write about the event and the key insights I garnered, I spread my review across two separate posts:

- QB Connect 2017: The Review No-one Else Will Write – Part I

- QB Connect 2017 – The Review No-one else Will Write Part 2

6 months on and the QB Connect event landed in Sydney for the second edition of the Australian conference. Armed with a “media pass”, I was fortunate to gain entry to the main day of the event and a one-on-one interview with Rich Preece, Intuit’s Global Accountant Segment Leader.

Its taken me a week to ponder what it is I might write, what thoughts I might share on the event. My challenge, this year as last, is framing my experience of the one day Sydney event relative to the almost week-long extravaganza that was my experience of the US edition.

Accounting tech is important & exciting

At QB Connect Sydney, Country Manager (and for the American readers VP) Nicolette Maury opened with a very personal recount of life growing up in her family’s restaurant. Small business is in her blood. Its a part of who she is.

Small business is also very important for the Australian economy.

All true. All engaging. Connecting with the audience. Genuine? You know I think it is, even though its the same script used in the US. Just with two different speakers Sasan Godarzi, EVP Small Business with his heartfelt personal story of SME upbringing and Brad Smith CEO/Chair and the importance of SMEs to the economy.

The reality is, I like Intuit’s relatively new slogan/mantra “Powering Prosperity”. Of shareholders. Of staff. Of Accountants, Bookkeepers and SMEs (in no particular order…).

As someone who has spent nearly 20 years in the accounting and payroll technology game, I appreciate the messaging. Accounting technology has the power to change lives. Its not boring. It can give kids more time with their parents. It can help businesses survive and thrive. It can help drive better business -> employers -> economies -> standards of living.

As someone I used to work with once said.

When someone asks you what you do, if you don’t want to talk to them, tell them you’re in accounting software.

If you want to have a chat, tell them you’re in the business improvement business…

Small businesses are important. Small business technology and those that support it, are critically important!

Intuit are big and for that they make no apologies

As Nicolette so eloquently put it:

“At @Intuit we have

more users,

more data and

more experience

than any of our competitors” @ngmaury#QBConnect— Matt Paff (@mattpaff) May 24, 2018

Intuit are big. They have deep pockets. And they are accumulating data. Tonnes of data. Many would argue, the data they (and others like Xero) are accumulating, has far more value than the subscription books they are amassing. AI and Machine Learning improve with data volume. Data + AI + ML = huge potential future value. Watch those barriers to entry/competition rise.

The headline announcements

The press release that accompanied the Sydney QB Connect 2018, contained 3 core announcements:

1. Accountants: QuickBooks Accountant Apps Program

This was announced at the US edition, 6 months hence. Admittedly then, it was obviously a hurried together program off the back of Xero’s equivalent announcement at Xercon a matter of weeks earlier. By the time May 2018 and QB Connect Sydney arrived, this was a real thing, in the real world.

Intuit’s smart spin on apps, is the provisioning within QBoA, of apps for clients as well as apps for accountants.

The challenge for ecosystem app vendors, Intuit want a sharp price for their channel to market and invariably a clip of the ticket. Margins are already tight for small companies (comparatively) because of the price framing that occurs against the accounting system price. Slicing that further… I’m reminded of a book I read a few years back:

2. QuickBooks Assistant launch

QB Assistance was discussed at QBC 2016 and then demoed last year in San Jose. With Qb Connect Sydney 2018, she was unveiled in the real world via the QB Self Employed app.

One can’t help but be impressed by the slickness of this cool, shiny new thing. Want to know how your business is going, just ask QB. How does that compare to last year? Just ask. Bank balances, who owes you what, who you owe… Just ask!

One can’t help but cast one’s mind forward to where this might head.

Me, I think I see a near future where simple advisory needs no advisor…

Comments were passed by some about it being more “sizzle than sausage” and questions raised about who actually uses Cotana, Siri, Alexa, Bixby, Google Assistant etc etc? Um, me… but apart from that, I think the best response is:

If someone in 2000 told you that people would:

- happily hop into a stranger’s car (Uber);

- stay at a stranger’s house (Air BnB);

- use your credit card on a website…

It probably seemed unrealistic… hindsight..!

3. BAS e-lodgment available via QuickBooks Online

Yay, something new. Something particular relevant to Australia. Something logical.

I think there was some spin about e-lodgement taking the stress and complexity out of accounting and tax… ah no, but nonetheless, it is a useful, handy new function!

Small Business Industry Insights

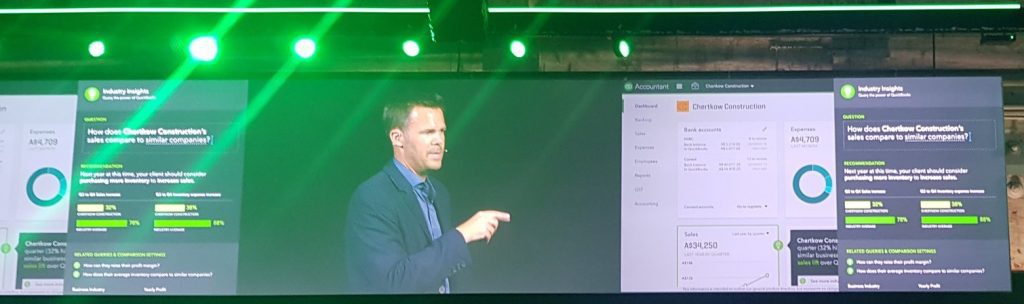

Intuit are about to bring AI to QBoA. Their QBo onboarding process has been neatly categorising customers by industry for years. Their GL accounts have had specific account types and detail types (seemingly without purpose), for years. Now we see exactly what these categorisations allow:

Rich Preece took the audience through QBoA and stressed its target is small firms (bookkeepers primarily plus small accountant’s in practice in Australian terms). The highlight, the automated Insights built around performance and comparative to Industry/Region. Sales are up 20%, but compared other QBo users in that industry who are up 40%, 20% is disappointing… etc etc

My only question is, if QB Assistant is success for the customer (bypassing the advisor), at what point is “advisory insights” for QBoA users superfluous? Just send them direct to the customer… Then what becomes of “advisory”?

Rich Preece – The Chat

I appreciated the opportunity to chat with Rich Preece. There seems to be no pretense with Rich. He’s a charismatic pom. He’s happy to cop the awkward questions (I have many). Here’s the highlight reel:

- On Intuit’s rather stellar Q3 announcement just days earlier: happy, pleasantly pleased. Turbotax obviously big for Intuit in Q3 in the US, but in Rich’s world, QB Self Employed continues to excel with solid numbers, justifying the push into the micro-business space.

- Tax preparation offering for Australian Accountants: they have an announcement pending… a partnership, with someone you can probably guess (mmm, who does tax and is not a competitor..?). A simple, light integration with QBoA has been in Beta for the last few months. #WatchThisSpace

- On South Africa and why they have decided to use a distributor and not go direct with QBo: we were already number 2 brand in market with our desktop product (mmm, that sounds familiar) and 50k desktop customers. We had a distributor of 17 years in market in EasyBiz, who has knowledge of the market, established relationships and a broad reaching existing footprint (mmm, still sounds very familiar…). Just makes logical sense… (So WTF happened with Reckon Rich??? Number 2 in Australia with 350k customers at the time. They had practice management. They had the brand. WHY did you guys not acquire or partner with Reckon??). Before my time Matt… (learnt from your mistake maybe? Or maybe the CEO of EasyBiz isn’t a South African… named Clive…?).

- What happens to KeyPay when you bring your worldwide payroll into QBo in Australia: It’ll be a smooth transition. Its about choice for the customer. No-one will be forced to change… cross that bridge when we come to it…

- India, France, Brazil, South Africa… where to next: Mexico looks promising… Singapore. We are lucky, QBo is used in 202 countries already (with the international edition). We just sit back and see where we get pulled from here. If we see demand building in a new market, we can test it, research it, the market tells us where to go.

The Australian content

Compliments to the coordinating team. The Australian content was solid, more than solid, it was great. Many of the usual suspects, but some great panel discussions and presentations.

I particularly loved Scott Cook’s fly in and “fireside chat” with Melanie from Canva. Two impressive individuals at the (sorry Scott) opposite ends of their careers. Chatting about business and perseverance.

Lehmo, the funniest accountant since John Garrett from the Green Apple podcast.

The Mentor Mark Bouris. The designer Collette Dinnigan. Two legends of Australia and Australian business. Nic from Orange Sky a legend of the future.

And the ever present Lielette Calleja, the Aussie firm of the future winner 2017. On a pedestal and just getting on with business (and leveraging the heck out of brand and social media). A true, modern professional!

In Conclusion

In two years Intuit have definitely built an event worth attending. The networking opportunity is fantastic. The content is great, regardless of which footy team you support (Blue, Purple, Green.. whatever). The ecosystem hall, though light on (compared to say Xerocon), had some big brands (highlighting Intuit’s influence) and some new players. The Intuit staff are friendly and accommodating. The after party, fun. The hangover, a necessary side effect… All in all, its a well run event worth attending for accountants, bookkeepers and small business alike.

___

For more on Accounting, Payroll & HR tech:

Follow On Twitter: https://twitter.com/mattpaff and https://twitter.com/valueadders

Follow our LinkedIn: https://www.linkedin.com/company/value-adders/

Like on Facebook: https://www.facebook.com/valueadders/

Follow on Medium: https://medium.com/@mattpaff