Here goes, my 3rd annual attempt at being an accountable, amateur “futurist” in the Cloud Accounting and general Biztech industry.

2017 proved (for me anyway), more predictable that 2016 (remember 2016 was the year of Trump, Brexit, Cronulla Sharks, Western Bulldogs, Leicester..). By my own marking, my 2017 Biztech predictions saw me score a respectable B upon reflection, after a horrid F for 2016.

So again I saddle up with my futurism skills moving in the right direction and a continued promise to be transparent about my predictions.

This year I have broken my thoughts down into:

- High confidence, somewhat scientific guesses;

- Long odds, outlandish predictions that could happen;

- I don’t think it will happen, but it probably should;

- Some think it will happen, I don’t;

My high confidence, somewhat scientific guesses

1. ACCC to approve MYOBs acquisition of Reckon Accountant’s division

Casting an independent, critical eye over the proposed takeover, from a market and existing client’s perspective, has me concluding the merger should go ahead, so therefore, assuming the ACCC will be logical and thorough in their analysis, they should agree with me…

My key reasons for thinking the acquisition should proceed include:

- In my opinion, clients are no worse off under the proposal (than staying separate businesses);

- The market, whilst limited in competition among the top echelon after the deal, would be better off as:

- There would be more clarity in the future direction of at least the Reckon product suite, than as separate businesses;

- My key belief/reasoning is the merger would, in my opinion, spark increased, more immediate-term, investment in product suites, from competitors on the periphery, as they sense “blood in the water” and aggressively target the Reckon and MYOB client bases with modern, cloud alternatives. Think Xero, Thomson Reuters, Karbon, Jetpack Workflow etc.

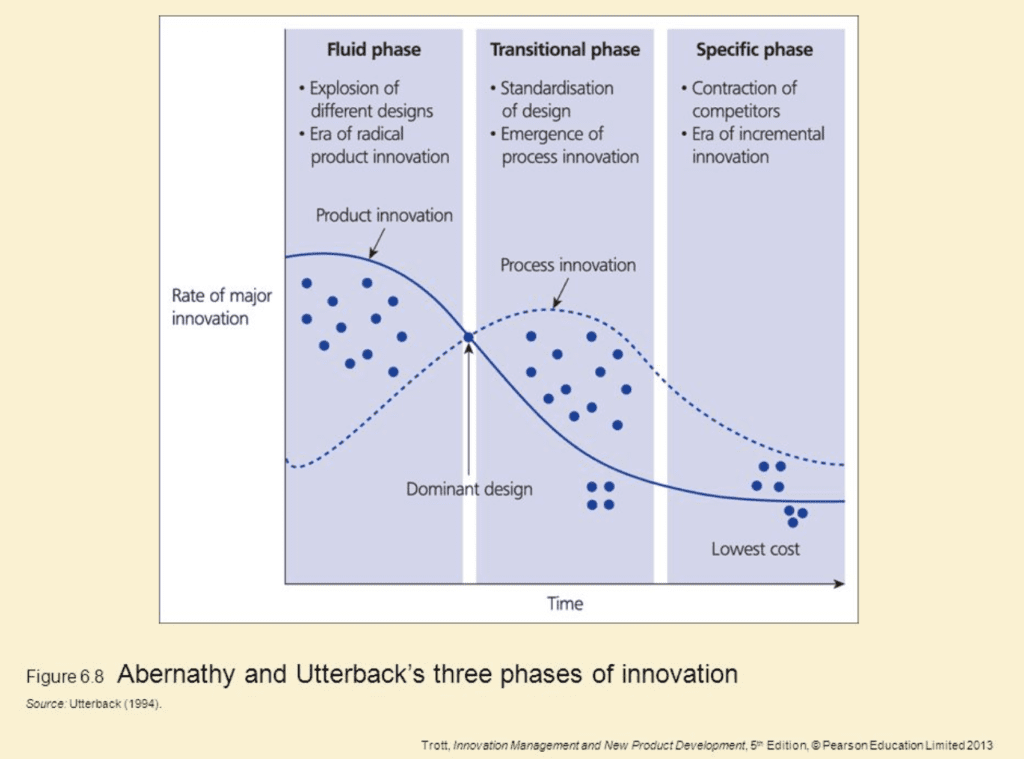

Expanding on this last point, when it comes to accounting practice management software, those familiar with models of innovation, like the one below from Abernathy and Utterback, will probably acknowledge we’ve been stuck in “Specific Phase” for too long (a decade perhaps?). As the graphic highlights, few competitors; low increments of innovation; high margins. Sound familiar? For me, the acquisition will speed up the market’s transition back into the Fluid phase, with cloud, seamless flows of data, APIs, micro-services, new revenue models and user experience design the new paradigms.

2. Reckon to find a home for its Legal Practice division

The legal practice division is not part of the Reckon deal with MYOB. Logically, Reckon will find a buyer for this element of its business, as it doesn’t really fit with the remaining business division. Logical buyers include: CCH Wolters Kluwer; Thomson Reuters; Lexis Nexis; Leap etc etc.

3. Significant consolidation, acquisition and investment activity in Au HR Tech

As my talk at the 2015 Australian Payroll Association conference on The Future Of Payroll highlights, I’ve been expecting for couple of years now, that we would see:

- “significant desegregation” of the HR/Payroll/Rostering/T&A technology market;

- “competition out of previously cooperative relationships”;

- “significant cannibalisation within the Payroll technology eco-system”

- “mergers and acquisitions among technology providers” in the space;

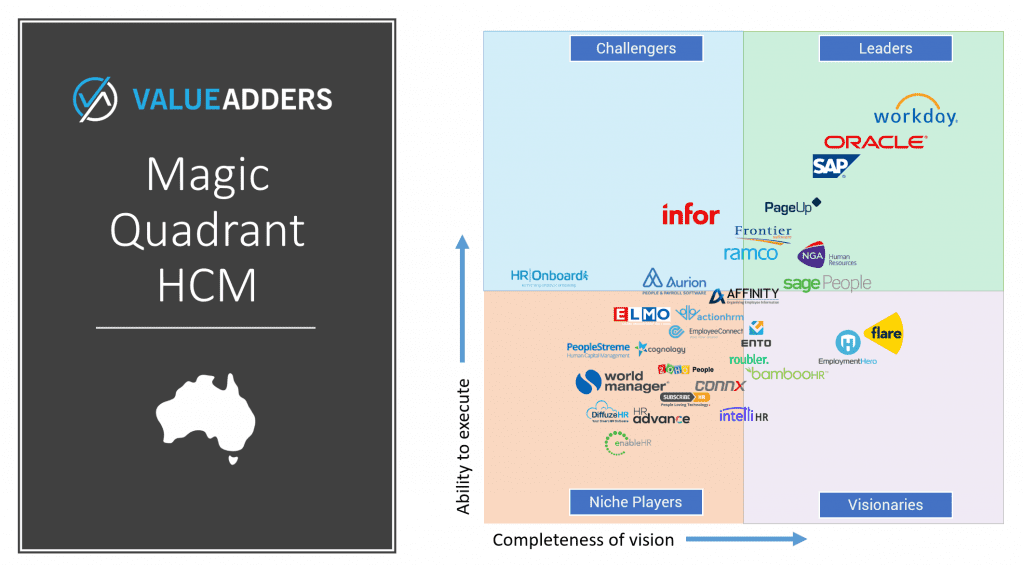

I believe 2018 is the year this 5 year prediction really starts to play out. The HCM, HRIS, HRM or whatever darn acronym you choose to use, industry remains ridiculously disparate, full of small and “legacy players”, low penetration among SMEs and just smells of consolidation and the emergence of heavily backed winners, for mine.

In recent months we’ve started to see key signs of movement with Elmo acquiring Sky Payroll, PageUp receiving a “significant investment” from Battery Ventures, FlareHR raising bucket-loads of ca$h, to name but a few. My prediction is a lot more action in this space in 2018.

To highlight the disparate market to readers and knowing full-well I will put a few noses out of joint here, here’s my evolving, adapted and localised version of Gartners’ Magic Quadrant for Australian HCM (note does not include specialist payroll, rostering, LMS system etc). Vendors please feel free to contact me and argue your case, ahead of my report’s formal release in March. #watchthisspace

I stress this is a WIP and may change…

4. Single-Touch Payroll to be delayed

Allegedly, Single-Touch Payroll is going live in Australia on July 1 2018, for organisations with 20 or more staff. But, when you hear that a number of payroll technology providers have already told the ATO they will not be ready AND you see articles like this one in AccountantsDaily that states: “Poll finds 90% of accountants’ clients not ready for STP“, add in the memory of SuperStream etc and one doesn’t have to be Nostradamus to predict the ATO will extend the deadline for STP compliance…

5. Growing focus on micro business (the gig economy) tech

Aussie tech start-up success story, Invoice2Go has led the worldwide charge to providing technology solutions to the lower end of the SME market. Intuit have been talking up the opportunity within the growing “gig economy” for the last couple of years, with QuickBooks Self Employed being their (some what premature in the Australian market) play (need I utter the letters GST…?). Reckon, with “validation from Macquarie” (smirk), think this high volume, high churn, low price-point market is their future too. Start-ups like Rounded have been established to specifically go after this market. NAB Venture has invested in freeware provider Wave who is active in the Australian market.

Still, we haven’t seen any big play from the likes of Xero nor MYOB, nor big new player yet...

No-one argues the rise of the gig-economy. More and more people are #sidehustling on AirBNB, Uber, Freelancer.com, Airtasker, Etsy, EBay, Redbubble etc. The #sidehustle and #gigeconomy becomes a new, major consumer group. Blurring the lines between personal income and business. This creates a MASSIVE, attractive market for a multitude of different service provides, whom I believe will try to use tech and apps, to access other revenue opportunities. Think banks, insurance companies, website providers (GoDaddy already has a “GoDaddy Bookkeeping” offering), payments tech (PayPal has some solutions) etc etc.

Late in 2017, Xero announced Xero+C in the US market that really, I think, is a taste of things to come in this space. Xero MUST act in this space. They can’t afford to be “an upgrade” solution – when you outgrow entry level. They need to capture businesses early and keep them. They need a light-weight, low-priced micro-business offering (beyond ledgers).

The same applies to MYOB, who followed up my interview in AccountantsDaily, with their own validation of the need to capture this market the very next day. They have Essentials sure, but have not really targeted this sector.

I could go on, but #watchthisspace. 2018, the year of the #microbusiness #gigeconomy #sidehustle #supplementaryincome tech.

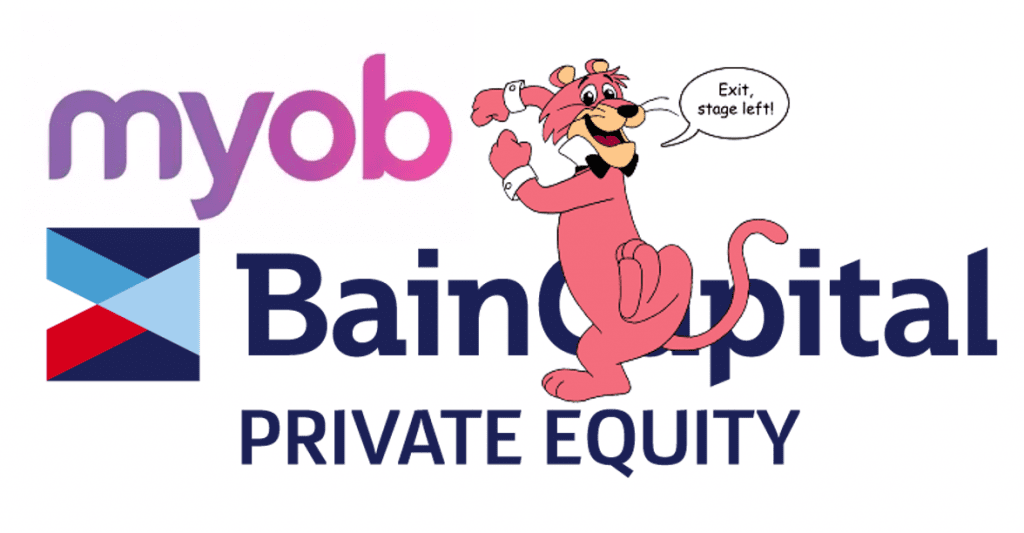

6. Bain to fully exit MYOB

With about 60% of their shares sold in 2017, one might expect that Bain Capital will sell down their remaining 23.1% in MYOB in 2018.

I’ll throw a bonus tip into the prediction and suggest that some members of the senior leadership team at MYOB will also move on around the same time, job done on Bain’s relisting and exit efforts.

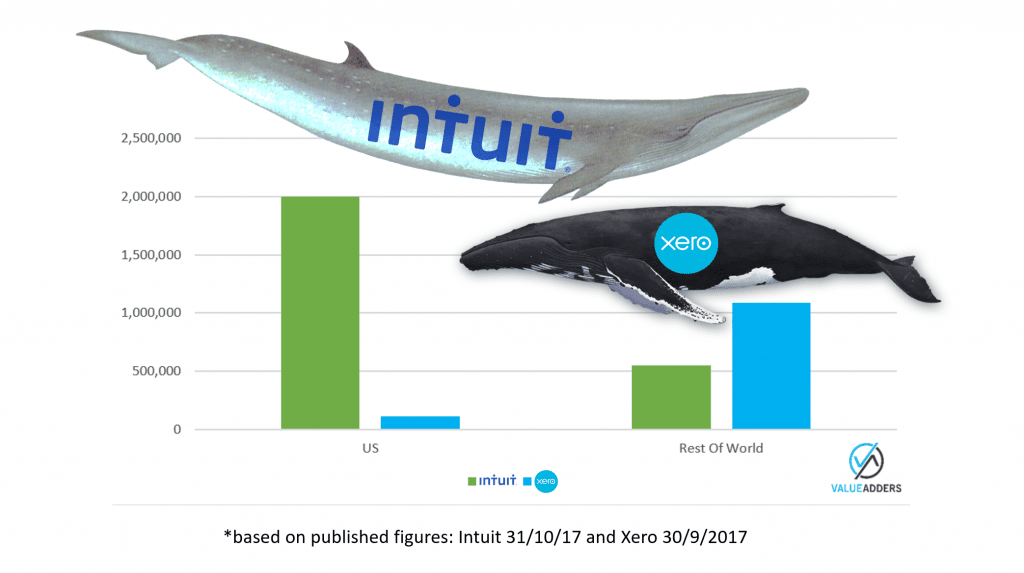

7. Emerging markets to emerge in 2018

To-date, the big whales Intuit and Xero, have fought amongst themselves and with the local incumbents (such as Sage and MYOB) for key accounting technology markets (namely US, Canada, UK and Australia). Emerging markets like South East Asia and South Africa, by my estimation, will become a key battlegrounds in 2018. To-date, these markets have been lumped into the ROW (Rest Of World) piles for the big players and in reality, have not made a blimp on the growth radars. I believe these markets, whilst lagging others in Cloud Accounting adoption, will “come with a bang”, with growth rates exceeding what we have already witnessed in the leading markets.

Factors such as:

- High mobile penetration, seeing markets skip desktop and browser to mobile tech;

- Family business-centric economies where generational change is occurring as baby boomers (tech laggards) retire and Gen Xers and Millennials (tech savvy) take over;

- Quality internet infrastructure driven by the west’s outsourcing demands (in highly populated cities at least);

- Governments driving digital taxation agendas; etc etc

Watch for increased investment and notices in quarterly/half yearly reporting for the likes of Xero and Intuit in particular.

8. Xero to crack 1.5 million customer ahead of 1H19 reporting time

Unlike their US listed rivals Intuit, for whom quarterly reporting and being forthright on guidance is a must, Xero have never been overly forthcoming with forecasts. So I might as well do it for them. I am projecting Xero to announce 1.5m customers ahead of their 1H19 reporting (30 Sept 2018). More specifically, around mid August 2018.

9. Intuit to add more than 1m new QBo subs in FY18

Intuit are providing guidance for QuickBooks Online subscribers of 3.275 million to 3.375 million at the end of FY18 (July 31 18). They started the financial year (August 1 2017) with 2,383m subs. Showing my bullish view of the sector, I think they will beat the upper end guidance and actually exceed 3,383m subs come July 31 2018. Meaning, they will have added an incredible 1m net subscribers in FY2018, which would be an astonishing rate of growth!

10. Cloud-based tax software to be the hot-topic of 2018

If I had a time machine for investment purposes, not only would I have bought Bitcoin 5 years ago (and kept them until probably December 2017), I would have started developing an online tax solution for accounting practices. At some point in the past, the incumbents all looked at their existing desktop tax software code bases, evolved over 20 and 30 years, and said, “meh, that’s in the too hard basket for now, let’s worry about cloudifying something else”.

If practice management software has been stuck in the “Specific Phase” (graphic 1 above) for a decade, Tax software probably tops it as a low competition, low innovation, high margin business!

As Jeff Bezos says:

The reality is, some good devs, a smart person scoping the thing and a bit of investment and it was possible!

But I didn’t and now every major practice management vendor (pretty much outside Xero) is scratching their heads and thinking, “mmm, what do we do about tax in Australia?”.

And then there is “little old” LogdeiT. Practice management vendors: who wants a head start on tax? Yep, thought so, nearly everyone… Alright Andrew, name your price! We’ll start the bidding at… Though I note, Andrew contends he’s not ready to sell!

Nonetheless, #watchthisspace in 2018, I expect lots of announcements, investments, partnerships etc

11. The JCurve / NetSuite relationship to evolve

I’ve made my feelings known that JCurve (the company), promoting and supporting MYOB Advanced, seems at odds with their licence agreement with NetSuite to promote JCurve (the product). NetSuite have a track record of ending agreements unilaterally (those who know the history of NetReturn in Australia will understand). How long will Oracle fulfil their end of the agreement with JCurve the company for JCurve the product, whilst they promote and support a competitor?

If nothing else, given JCurve (the company) is no longer monogamous as far as NetSuite is concerned, why therefore would Oracle continue to allow JCurve the product to be an exclusive licence for one company?

BUT Oracle don’t want to deal in the small business space, so they themselves are unlikely to go direct with a “NetSuite Lite” (a rebrand of the JCurve “cut-down” NetSuite licence). This leaves 2 options for mine:

- Disolve the agreement with JCurve the company and kill off JCurve the product (unlikely, as would be akin to cutting of their nose to spite their face);

- Open up “NetSuite Lite” to other partners (if I were a betting man, I think the most likely option).

My long odds, outlandish predictions

12. Reckon to declare a special dividend and then de-list

There is a long-tail in legacy technology companies. Just ask MYOB and Sage why they’ve made the acquisitions they have over the years. With the cash generated from the sale of the accountant’s division to MYOB, I think there is a lot of sense in Reckon declaring a decent special dividend to return some $$ to shareholders. I also think this could then fund major shareholders (see the list here) specifically founder Greg Wilkinson and CEO Clive Rabie, to lead a buy-out and de-list the remaining entity.

This could be a highly profitable business for years to come, even with little investment in supporting the existing cash cow products (the former QuickBooks desktop products) and a dabble with ReckonOne. ASX compliance would be, in my mind, an unnecessary expense that would reduce profitability. And Rabie and the Board have already shown they are, at times, at odds with other shareholders, with a 70% strike against them in May 2016, angst over the underwriting of and decision to go with secondary UK market with GetBusy, and less than favourable remarks going back the other way from Rabie to shareholders.

13. Sage to invest in MYOB

Despite the ill-blood and court case arising from Sage reneging on a deal to acquire MYOB from Archer, the two companies are very similar (disrupted in home market by Xero; growth through acquisition; belief in the “golden triangle” of Accounting, Payroll & Payments; broad product suite; customer for life strategy…etc). It’s not such a wild suggestion that Sage could step in when Bain step out…?

I don’t think it will happen, but it probably should

14. Intuit should acquire KeyPay

Intuit have already announced they are building their own, worldwide payroll solution. To my knowledge, no-one has ever been able to achieve this to-date, certainly not in the SME market. Most acquire or partner with local providers (as Intuit has done with WebPayroll initially, then KeyPay in Australia to this point). Buying KeyPay, at least just for the Australian (and possibly UK) market(s) would make sense for mine. And I’m sure Rich, Phil et al would be open to the sort of numbers/multiples Intuit recently paid for TSheets… who wouldn’t!?

15. Intuit should acquire remaining assets of Reckon

Intuit were, by proxy, the second biggest player in AuNZ accounting tech, through their distribution agreement with Reckon. To this day, I reckon the majority of Reckon Accounts users refer to their software as QuickBooks.

The inability to get a deal done to buy Reckon in 2012, saw Intuit effectively damage their own, strong brand by confusing the market. The millions they have invested to re-establish the brand as QuickBooks Online only (which is on public record as a foreign entity trading in Australia) easily exceeds the market cap of Reckon, even including the bit MYOB are buying. And they actually could well have used the Practice Management division… And the revenue/profits Reckon have made in the last 6 years. Seriously, US$340m for TSheets, but a smaller number couldn’t be found to acquire Reckon???

Anyway, I think the people who were on the Intuit-side of the negotiating table are no longer there. Egos aside, there is still brand and revenue in the remaining “business division” assets of Reckon. Sure the code-bases (Reckon Accounts vs QuickBooks Desktop) have diverged in the last 6 years, but difficulties aside, acquiring a profitable business that they know how to run and ending the confusion surrounding their brand, makes strong business sense, for mine…

Some think it will happen, I don’t

16. Sage will not acquire Xero

This rumour just won’t go away. I heard it years ago and it came back up again recently. “After buying Intacct, next stop is Xero”…I stake my reputation on this one. It won’t happen. Certainly not in 2018! Multiple already too high. Culture does not fit. Shares too closely held at the top. UK Competition and Markets Authority…etc

17. Rod Drury won’t go the way of Steve Jobs at Apple circa 1985

18. MYOB will not be the next Dick Smith Electronics

Whilst they:

- Will have a truckload of debt (post Reckon deal I’m talking – its pretty big already);

- Do have a mind-boggling number of different, legacy product code-bases;

- Carry an enormous amount of intangible assets in their balance sheet;

- Have been unseated as #1 for the number of paying customers across AuNZ by Xero;

- Have a big US fund exiting the business;

I do not believe MYOB are on the verge of a post Bain collapse like many people keep telling me.

They are:

- A healthy cash generating business, still with the significantly the highest revenue, in market, of the key players;

- In an industry that is recognised as having an incredibly long tail (I reckon that there are a healthy 6 figure number worth of businesses in Australia using MYOB Desktop presently, who, almost regardless of maintenance/upgrade fees, won’t change to Xero or anything else until their key, baby boomer people (Beryl the bookkeeper, Connie the CFO and Adam the accountant) retire. And that will take years!)

- Diversifying and growing well upstream, in the pond with fewer, but bigger fish (with the likes of Greentree, Acumatica, Pay Global etc).

- Having a crack at competing… I’ve certainly not seen signs of them giving up…

Closing

Anyway, there it is, 18 Predictions for 2018. Let’s check back in in July for a half year update and I will publish in early 2019, how I went, so you can hold me to account!

Any predictions of your own?

Any you feel I’ve got wrong?

Please feel free to comment, critique, like or share!

___

Follow On Twitter: https://twitter.com/mattpaff and https://twitter.com/valueadders

Follow on LinkedIn: https://www.linkedin.com/company/value-adders

Like on Facebook: https://www.facebook.com/valueadders/

Follow on Medium: https://medium.com/@mattpaff