In mid September I published an article: “XeroConSouth2016 – The review no-one else will write“. With the help of a response and tweet from Rod Drury, the article “went viral” (well relative my usual readership) and I managed to get a few extra views and likes than usual. A similar article on the biggest player in world SMB accounting tech, is a logical formula for me to follow. My mantra, go beyond the platitudes and compliments and critique the elements of the conference and strategy that warrant more in depth consideration – something I feel no-one else will do.

So for the second year in a row, I jumped a plane to North America to attend the giant of the accounting tech industry, Intuit’s, annual QuickBooks Connect conference in San Jose, California. Whilst I paid for my own flights, this year I managed to score a “VIP” invite, which translated to more access to senior management and more indepth detail on where Intuit are heading. A big thanks to the Australian Intuit team for arranging this!

Across 4 days and 5 nights I really worked hard to gather as many facts as possible. Many a night spent staying up until 5am in the morning, researching, plying, prodding and interrogating key people to get the gritty detail. How do you think I got the stories I broke on Xero & MYOB last week? By being deep under-cover as a drunk Aussie larrikin, no-one would suspect could remember the gossip let alone blog about it – that’s how! 🙂

The after hours talk at #QBConnect among delegates & exhibitors last night: BIG staff changes at $MYO & $XRO neither has formally announced!

— Matt Paff (@mattpaff) October 25, 2016

Anyway, here goes, here’s my takeaways from QB Connect, given the “Matt Paff” perspective:

More for small businesses

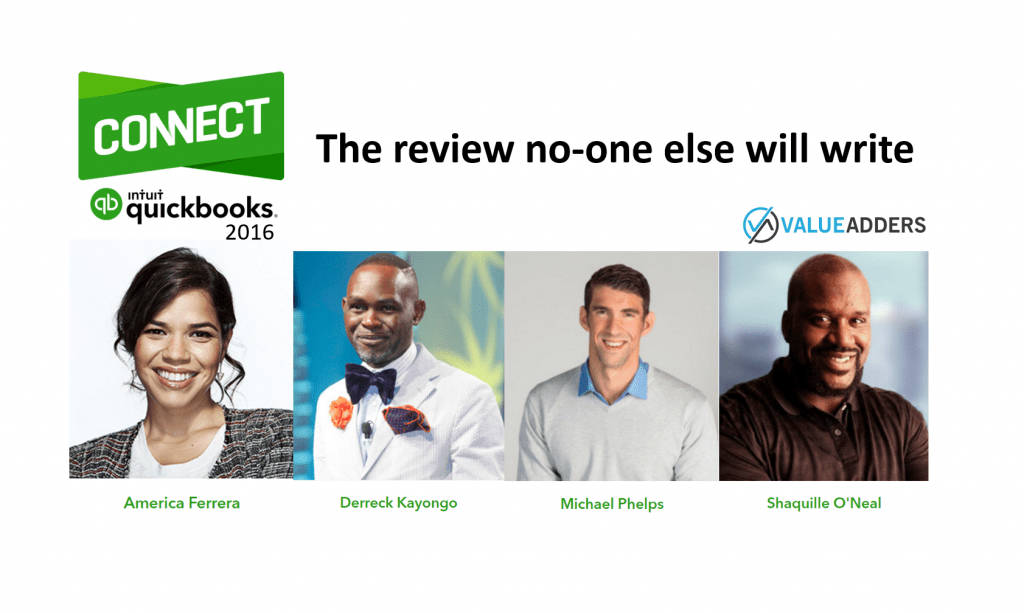

There’s one noticeable difference between Intuit conferences and what we get in Australia (noting QB Connect is on its way down under in May 2017). A significant portion of the attendees are small businesses, drawn by the big ticket, celebrity speakers. Shaq, Michael Phelps, Malcolm Gladwell, Derreck Kayongo, America Ferrer, Tony Hawk, Simone Biles, Christian Siriano, Jillian Michaels, Alli Webb…and many more. All talking about success and how it came from dedication, focus, learning from mistakes and a tonne of hard work.

Its not that there was no content for partners, its just that it was far less about the product and company direction and far more about motivating small business owners.

Intuit get Platform – perhaps a little more than Xero

In my article on Xerocon, I criticised the now departing Andy Lark on Xero’s definition of Platform. My argument was/is that Platform is an overused word and my assessment of a true platform came from what Salesforce, Netsuite and others were doing, not just beautiful, open APIs:

- Single Sign On (SSO)

- Embedded functionality

- Standard User Interface (UI)

- Seamless Customer eXperience (CX)

Intuit had given the aussie market a taste of what they might be thinking with KeyPay – a third party payroll app, neatly embedded in their QBo application. Well, now they have run with this and with TSheet and Bill.com they launched to the world their definition of Platform at the conference: SSO; embedded; single UI, seamless CX! Boom, that is what I call stepping up to the plate and raising the stakes!

We now have (another) key point of differentiation between QBo and Xero. And I think its a game changing, big one. I urge Rod and the Xero team to reconsider their platform definition!

Maybe, the ecosystem kings are being uncrowned?

It is inarguable that Xero reinvented small business accounting by publishing beautiful, open APIs and embracing its ecosystem. A decade after releasing QBo, Intuit finally cottoned on, no doubt learning from Xero’s success and retrofitted an API, not as good, but it was a start.

Now its 2016, the murmur among the ever shared ecosystem is “maybe Xero don’t really love us. After all, they’re wanting to charge those closest to them for API access…And now, Intuit, who have a larger client base (albeit mostly in the US), are outwardly loving us…not charging us, improving and expanding the API to access everything and even allowing us to embed inside their Platform…and offering to take us into big markets like India, Brazil and France…”

Rod and team, you need to talk to your ecosystem…they ain’t all feelin’ the love and they’re being courted by another lover!

Intuit are hypocritical on pricing strategy

As my regular readers will be aware (all 5 of you), I have been critical of Intuit’s pricing and discounting strategy in Australia for some time. I don’t like what it does as far as “price framing” for the ecosystem and the services provided by their partners. I don’t like what it does for the industry when you have a big international player, that can afford to effectively “price-dump” (losing in excess of $20m/year to do so) in a market to change the dynamics of that market. ACCC?

So imagine attending a conference that serves up a significant amount of content on pricing. A conference that rolls out such gurus as Ron Baker and a batch of his “Black Swans” to tell the Accountants and Bookkeepers that their pricing strategy is all wrong and that they need to value themselves more and move to Value Pricing. A conference that has a PhD in pricing (Tim J Smith) explain through mathematical formulas how discounting is not a smart strategy!

And now imagine that the company that delivers that content, is the same as the one offering 10 licences for $10 to Australian partners? Is the same as the one running TV ads with 70% of a retail price that is already half that of the major competitor…

You might say, that this roving reporter was getting a little hot under his collar. So what would you expect took place when I was fortunate enough to sit next to Sasan Goodarzi, EVP & GM Small Business (aka basically The Boss) for lunch? Of course I let Sasan know what I think. His response? “I understand what you say, I do, but there is a bigger strategy at play in Australia and in fact, I’ve asked the team to step it up over there!”.

Do you think I left it at that? Of course I did, I didn’t want lunch to be too awkward. But given the opportunity to question the senior exec. team on stage at the VIP Summit on Thursday, I went again, as evidenced by this tweet from Rachel Fisch:

.@mattpaff challenges @intuit on pricing and discounting strategy and @Rich_Preece answers from the stage #VIPSummit #QBSummit @IntuitAccts pic.twitter.com/AxjOFTZlyz

— Rachel Fisch (@FischBooks) October 29, 2016

This time I was answered by Rich Preece VP Intuit Accountant Segment. Unfortunately, I and others around me, felt I was given lip service. A stock standard company response that didn’t address the concerns about contradicting themselves on pricing. That didn’t address the issue of price framing and the impact on ecosystem and partners. I remain deeply unsatisfied…

Intuit are all-in on mobile

A clear takeaway from the conference is the shift from browser to mobile. All key feature enhancements were shown as mobile app screenshots, rather than a browser window. Sage in their “leapfrogging” attempts are singing from the same hymn book.

Intuit are so convinced on the mobile future, they announced the launch of QB Self Employed in Australia during the conference, in a world first, as a mobile app ONLY, no browser access.

My take, new customers, moving from nothing or “shoebox accounting” – this makes sense. Young, tech savvy self employed…yep it makes perfect sense. Customers moving from desktop accounting systems…I think mobile as an adjunct to browser or a Windows app front end. Intuit need to be careful they don’t build “a bridge too far” for desktop users, by over promoting mobile. It depends on their target audience. Remember Australia and New Zealand have a significantly higher penetration of retail accounting software to the rest of the world (it seems by a factor of like 3). Time will tell how this plays out. Probably well in the micro-business space me thinks.

Intuit coming down whilst Xero goes up

A part from platform and pricing, another MASSIVE strategy gap is opening up between Xero and Intuit. At Xerocon, Rod Drury called out the mid-market, saying that as Xero’s functionality builds out, plus ecosystem partners, they now offer a credible competitive solution for medium-sized businesses.

Intuit spent significant parts of QB Connect, highlighting the worldwide trend towards the “gig” economy. Forecasting the rate of self-employment and microbusinesses to exceed 40% and approach 50% of the workforce over the coming years. Hence the MASSIVE push on QB Self Employed. Hence the mobile-first product design.

Machine Learning down played

It was noticeable that Sasan Goodarzi, dare I say intentionally, skipped over machine learning and auto-coding in his keynote on the 10 big product enhancements. Whilst Rod Drury spent the best part of an hour at Xerocon, building up to his announcement on doing away with GL coding in transactions, Sasan covered off the topic in about 1 minute and then quickly moved on. It left a number in the audience to comment “was that new bank feeds stuff actually about auto-coding?”

With the benefit of a “press roundtable”, and led by the industry’s leading investigative journalist (and for whom I now have an even higher opinion, based on late night antics), Sholto Macpherson, we were lucky enough to confirm, yes with the upcoming release they expect at least 90% of transactions to be auto-coded without bank rules, via machine learning, leaving us to debate, “why was it skipped over”? Is it because they realise that further advancements down that path will scare the daylights out of the traditional accountants and bookkeepers who are wedded to Desktop QB (seemingly the majority of their partners)? After all, their industry IS under threat, in fact, as we found out accounting is near the top of the list of industries most likely to be affected by the rise in Machine Learning (26th of a large number I believe)!

QB Bot: personal assistant & business advisor

A sneak peek of the future was given when a video was played of a lady sitting in the back of a Tesla (with a driver, which leads one to question how futuristic was it really…), talking to her mobile phone, asking the QB bot (Intuit’s equivalent of Apple Siri, Windows Cortana and Amazon Alexa) to perform some transactions and report on her QBo data. THEN (not to be downplayed by the headset wearing accountant that was tokenly introduced to simply say yes) the bot provided Roboadvice on how to improve margin by switching to a new supplier which the bot recommended.

This is a clear indicator for me that any accountant or bookkeeper that thinks they can simply use technology and a change how they charge to “evolve” their business to service their customers, better consider what they’ll be doing that a bot can’t..! How will you humanise your service offering? Lest your strategy be made redundant by technology and market awareness very soon…

Intuit partner with AMEX to reinvent factoring

The talk of Fintech disruption and the death of traditional banking players is well and truly premature. When you see the new, embedded, AMEX small business loans solution against invoices inside QBo, with a 0.5% per month interest charge, you realise the big boys aren’t asleep at the wheel! From 60% of SMBs being declined on small business loans, to more than 70% being accepted! Wow. Sexy. Seriously easy. Game changing for small business – my only question, is it coming or when will it come to Australia? We don’t have QB Financing as yet…

The new #QuickBooks partnership with AMEX Working Capital gives your #smallbiz clients access to faster financing: https://t.co/VbXA0SV68T

— Intuit Accountants (@IntuitAccts) October 31, 2016

Crowdsourcing of data nowhere to be seen

One of my Xerocon highlights was the crowd sourcing of contacts (customers and suppliers) in Xero – eliminating data entry, speeding up processing and improving accuracy. There was no mention of crowdsourcing in the Intuit roadmap…?

Intuit & Google aren’t just neighbours in Silicon Valley

As an Office365 fanboy, I was shocked to hear that 56% of Intuit’s customers use Google Apps! Hence why Intuit have partnered with Google to integrate contacts and Google Calendar. Now you can generate invoices directly from Google Calendar appointments, quickly and easily in QBo. It does look pretty sexy…but given I’m all about Value Pricing – I’m sticking with Outlook. 🙂

Improve SMB survival rates, you reduce Churn & grow LTV

In my review of last year’s QB Connect I wrote:

Like Facebook realising that in order to grow their user base they have to think macro and grow the number of internet users (hence internet.org), Intuit have cottoned-on to the link between SMB survival rates and their success.

It’s obvious when you look at it: improving the survival rate of SMBs decreases Intuit’s churn rate and increases the Average Lifetime Value of an acquired user. They sell it as altruistic, do we care if it is also self-satisfying?

This remains a key strategic pillar for Intuit and was again a prominent theme of this year’s event.

Free accountants tools…except tax. After all, it’s a $500m business for Intuit…

Like Xero HQ and MYOB Dashboard, QB Accountant (QBA) is going to continue to grow as the primary interface for Intuit aligned Accountants to manage their practice. Client portal. Workpapers. Practice Management. And in the US this means converging QBA and their Pro Connect Tax product. All under one hood.

In Australia, this means seeking a partner for tax. If you have a tax product for Australia, in the cloud, and you aren’t an existing competitor, you should probably knock on a few doors at Intuit…just saying.

All of QBA, except tax, will be free for accountants and bookkeepers…Tax is simply too big of a revenue stream for Intuit to replicate in the US. And a partner is Australia will need revenue. Xero can differentiate by giving tax away.

___

I realise this article is getting too long, if you are still skimming, I mean reading, at this point, please contribute your thoughts on Intuit, QB Connect or anything I have written with a comment below.

If you’ve gotten anything out of what I’ve written, a like is appreciated…and you can follow me on any of the platforms below. Thanks for reading!

___

For more commentary by the author on Biztech:

- LinkedIn Company: https://www.linkedin.com/company/value-adders

- Twitter Company: https://twitter.com/ValueAdders

- Me on Twitter: https://twitter.com/mattpaff

- Medium: https://medium.com/@mattpaff