Perspective. It is something I appreciate more as I mature. It is something that hit me hard when I sat down to consider my “review that no-one else would write” for Xerocon Brisbane 2019.

Read more

Perspective. It is something I appreciate more as I mature. It is something that hit me hard when I sat down to consider my “review that no-one else would write” for Xerocon Brisbane 2019.

Read more

Next week, something like 4,000 people will descend on Brisbane for “the Festival of the ABCs”.

All heading to Brisvegas to catch up on the latest and greatest things Xero and industry and let’s be frank, party like no-one is watching!

Read more

Given my professional interest in accounting technology and out of a desire to stay up-to-date, I have been using the 3 most popular browser-based accounting / bookkeeping software systems (Xero, QuckBooks and MYOB Essentials) across 3 different businesses I’m involved with.

Recently I became so frustrated with using MYOB Essentials in my vSure business that I had to end the experiment. Here’s the 7 reasons why I dumped MYOB Essentials:

Read more

I’ve spent some time recently analysing the software landscape for Accountant’s in Australia. Its been interesting, eye-opening and mind-boggling all at the same time.

Read more

In February I made the bold step into the events business. After a couple of years peculating on the idea, I bit the bullet and launched the Apps4 event business, setting up our first event in Sydney in May, Apps4 Wholesalers.

Read more

The end of May marked the third installment of the Australian QuickBooks Connect (QB Connect) event. This was the first year Intuit took their big show to Melbourne, in fact it was the first year the event traveled away from Sydney.

Read more

May is a big month for Accounting Tech investors – we get the “3 big whales” of SME accounting software all reporting within days of each other. Its the one time of year we can assess how much the “rising tide is raising all ships”.

Read more

For us antipodeans, May is a stark reminder that winter is coming. The introduced deciduous trees we have, have given up hope that this year, climate change means they can keep their leaves, and so our streets are littered with the dry, brown, yellow and orange cast offs of these foreigners, as the days shorten, the weather chills and we all await the next episodes of GOT.

Read more

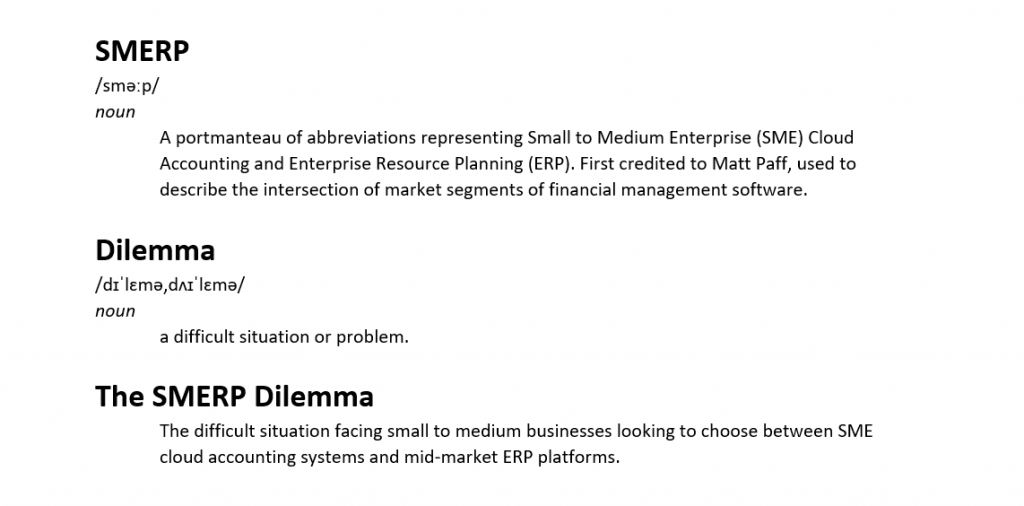

Like never before, larger and growing Small to Medium sized organisations face a common challenge to decide between SME accounting software or invest in a unified, comprehensive ERP system.

Which way do they go?

User-friendly, relatively cheap small business Cloud Accounting software like Xero, MYOB and QuickBooks plus operational specific third party apps ;

OR

A comprehensive, relatively expensive and seemingly less user-friendly Enterprise Cloud Platform like NetSuite, MYOB Advanced (aka Acumatica), Salesforce or Microsoft Dynamics 365 Business Central.

Read more

Over the last few years I’ve tried my hand at predicting the year in cloud accounting and related biztech ahead, publicly critiquing my efforts at the start of the following year. Call me silly, call me brave, call me whatever you like. I do it because I feel too few are willing to back up their guessing with reflection. So rather than complain about it, I do what I think others should.

Read more