I’ve spent so much time drinking coffee whilst talking about accounting technology that it was only a matter of time before a spurious correlation crept into my blog.

I’ve spent so much time drinking coffee whilst talking about accounting technology that it was only a matter of time before a spurious correlation crept into my blog.

This article is an overview of my presentation at last week’s inaugural Accounting Business Expo: “Why Advisory won’t save you from technology”.

Everywhere you look, it seems the world is telling accountants that compliance work is a non-growth future (at worst a dramatically diminishing business, brought to an end by government policy and technology). The answer, according to pretty much everyone, is operational advisory – helping clients with running better businesses. An entire industry has popped up to coach and help accountants “transition from compliance to advisory”. Technology has popped up everywhere, to systemise advisory, with report packs and standardised approaches for how you monetise the “enormous, under-serviced, advisory opportunity”.

In mid September I published an article: “XeroConSouth2016 – The review no-one else will write“. With the help of a response and tweet from Rod Drury, the article “went viral” (well relative my usual readership) and I managed to get a few extra views and likes than usual. A similar article on the biggest player in world SMB accounting tech, is a logical formula for me to follow. My mantra, go beyond the platitudes and compliments and critique the elements of the conference and strategy that warrant more in depth consideration – something I feel no-one else will do.

Mark September 2016 in your calendars. It was the month when Artificial Intelligence (AI) officially went mainstream in SMB accounting tech. This month saw #XeroCon South in Brisbane and the MYOB Partner Conference Roadshow across AuNZ, both raising the future of “coding free data entry”.

Read more

The accounting software conference season is upon us, with Xerocon, QB Connect, MYOB Partner Conference all hot on the heels of Sage Summit. Apart from the likes of Clayton and Wayne racking up even more frequent flyer miles and social media posts, what can we expect from these events? Much of the same I expect. I don’t see any major announcements being likely.

Read more

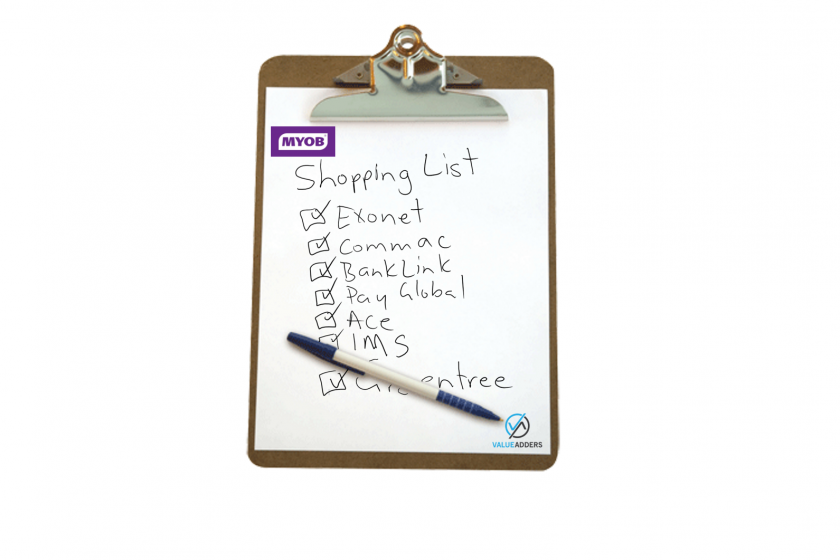

Yesterday’s announcement of MYOB’s acquisition of ERP provider Greentree, won’t be the end of MYOB’s buying spree, according to their CFO Richard Moore. Moore, courtesy of Yolanda Redrup’s AFR article, states:

we do have a list of potential acquisition targets and we’ll keep reviewing that list in the coming months

This got me thinking, who else might be on that list? Based on what we know in the public arena, throw in some gut-feel and some muck-raking, here’s my guess at the MYOB shopping list:

Read more

At the start of 2016 I had a crack at being a futurist, by publishing 16 Predictions For 2016 for the #biztech / #accountingtech industries. Here’s my mid-year update with my current “gut-feel” probability of occurring in 2016, reviewing my predictions with the benefit of 6 months hindsight:

Read more

Assessment of listed (International) AuNZ SMB Accounting Tech

In Part I of Getting SaaSy, I assessed the ASX and NZSE listed SMB accounting tech players competing in the Australian and New Zealand market. For purposes of comparison and relevance, in this installment I’ve assessed the two major international players Intuit and Sage, plus, by popular demand I’ve had a look at Netsuite, whilst not really targeting AuNZ SMBs, they are the longest standing accounting tech SaaS cloud player in the world.

As part of my ongoing mission to contribute to the thinking on the SMB Accounting tech industry for the broader market, I thought I would sit down and provide some analysis and commentary on the relevant, listed players in AuNZ. I start with the ASX and NZSE players MYOB ($MYO), Xero ($XRO), Reckon ($RKN) and JCurve ($JCS) and will publish part 2 next week, for the major international listed entities operating in AuNZ Intuit ($INTU), Netsuite ($N) and Sage ($SGE).

At the recent MYOB Incite, apart from playing semantics around “Disruption vs Transformation”, CEO Tim Reed espoused the line: “Today Defines Tomorrow”. I’d go a step further: I am a firm believer in understanding the past to navigate the future. In this article, I’m going to review from whence we came, so that I can shine a light on where I believe the accounting tech industry is at, and where we are heading.